- China

- /

- Entertainment

- /

- SZSE:300031

Exploring 3 High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by government shutdowns and fluctuating economic indicators, the technology sector in Asia is drawing attention for its potential to thrive amidst these challenges. In such an environment, stocks that demonstrate robust growth prospects and resilience in the face of economic uncertainties can be particularly appealing to investors seeking opportunities in high-growth tech sectors.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.73% | 30.71% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

ROBOTIS (KOSDAQ:A108490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ROBOTIS Co., Ltd. offers robotic solutions in South Korea and has a market cap of ₩2.05 trillion.

Operations: The company generates revenue primarily through the development, manufacturing, and sale of personal robots, amounting to ₩31.71 billion.

ROBOTIS has recently pivoted from a challenging past, marked by losses, to post a significant net income of KRW 1.27 billion in the first half of 2025, contrasting sharply with a net loss of KRW 3.12 billion in the same period last year. This turnaround is underscored by an impressive annual revenue growth rate of 42.4%, outpacing the South Korean market's average of 7.6%. Additionally, its earnings are expected to surge by 83.3% annually over the next three years, reflecting robust growth prospects and operational efficiency improvements. The company's commitment to innovation is evident from its recent follow-on equity offering aimed at raising KRW 100 billion, likely funding further research and development which currently stands at {rd_expense_string}. These strategic moves could enhance ROBOTIS's competitive edge in Asia’s high-tech industry landscape.

- Click to explore a detailed breakdown of our findings in ROBOTIS' health report.

Review our historical performance report to gain insights into ROBOTIS''s past performance.

Integrity Technology Group (SHSE:688244)

Simply Wall St Growth Rating: ★★★★★☆

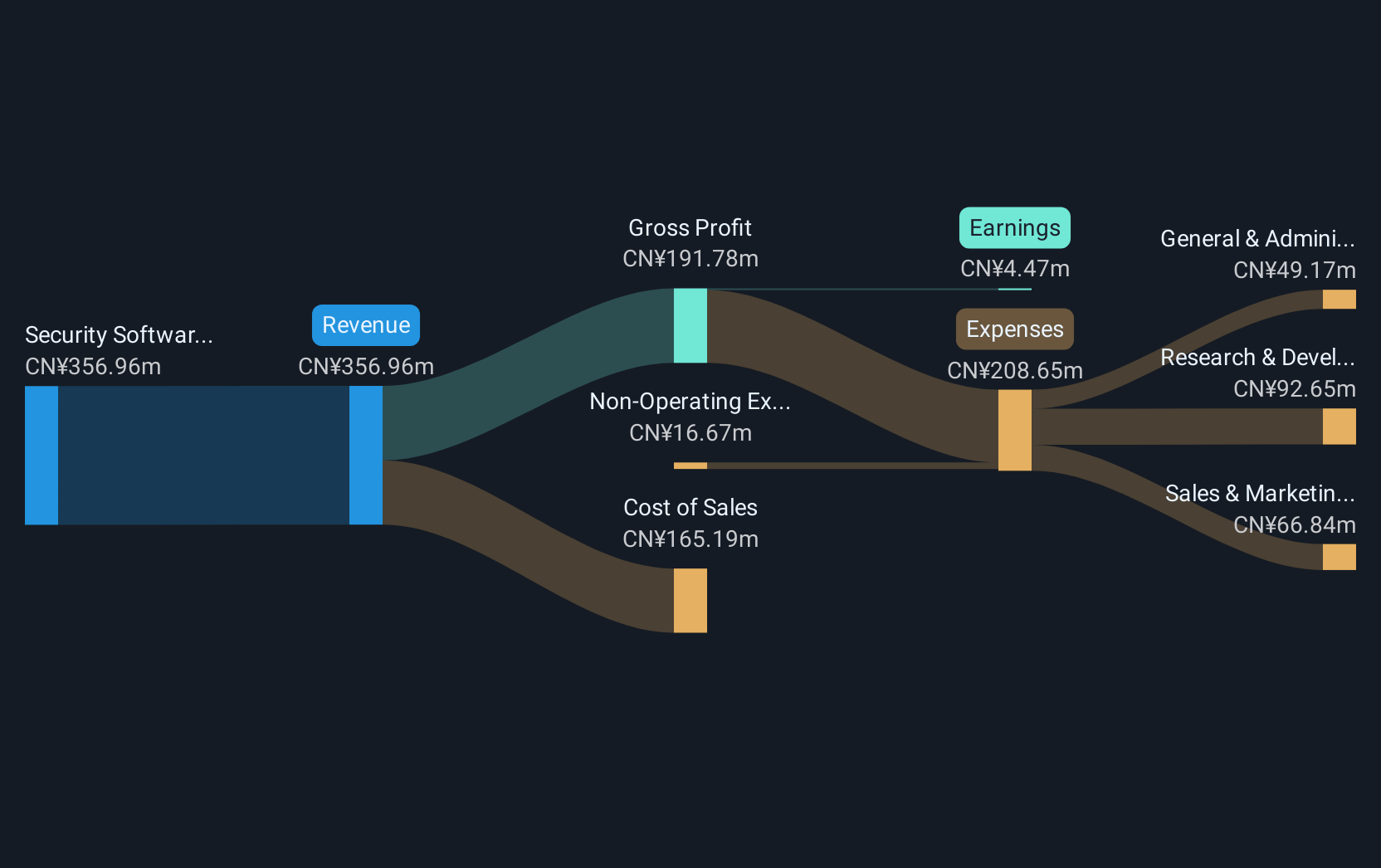

Overview: Integrity Technology Group Inc., with a market cap of CN¥3.44 billion, is a network security enterprise offering network security solutions in China.

Operations: The company generates revenue primarily through its Security Software & Services segment, which accounts for CN¥341.45 million.

Despite a challenging half-year with revenues dropping to CNY 85.28 million from CNY 100.16 million, Integrity Technology Group's strategic focus on R&D could herald a turnaround, evidenced by its robust projected annual earnings growth of 65.7%. The company's commitment to innovation is crucial as it navigates through current losses, aiming for profitability within three years—a pace well above the market average. This trajectory is supported by an anticipated revenue climb of 22% annually, significantly outstripping the broader Chinese market's growth rate of 14.1%.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

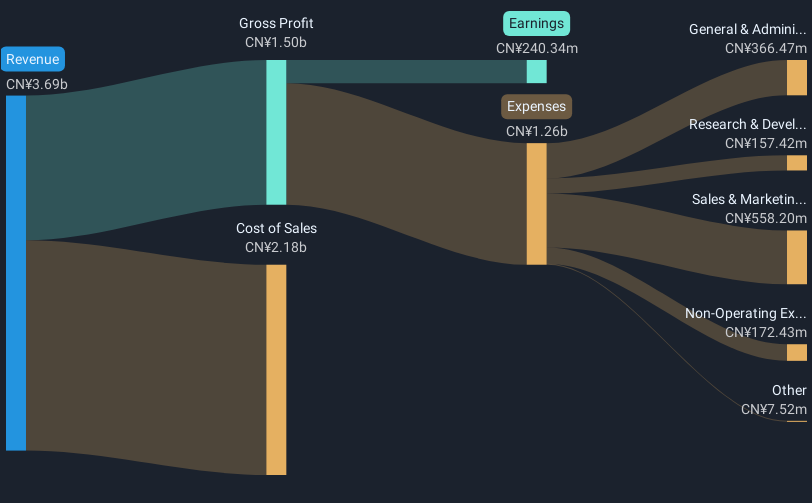

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both within China and internationally, with a market cap of CN¥10.31 billion.

Operations: The company focuses on industrial bulk material handling and mobile Internet services, generating revenue from both domestic and international markets. Its business model leverages these two key sectors to drive growth, with a market capitalization of CN¥10.31 billion indicating its significant presence in the industry.

Wuxi Boton Technology, amidst a backdrop of regulatory changes and governance adjustments, has shown resilience with a significant revenue of CNY 1.6 billion, albeit a decrease from the previous year’s CNY 1.7 billion. Despite this dip, the company's net income stands robust at CNY 139.74 million. Notably, its commitment to innovation is reflected in its R&D strategy which is crucial as it navigates through market shifts and aims for sustained growth in an increasingly competitive tech landscape in Asia. This focus on R&D could be pivotal for Wuxi Boton as it strives to outpace the average market growth rate and adapt to evolving industry demands.

Where To Now?

- Explore the 185 names from our Asian High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Boton Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300031

Wuxi Boton Technology

Engages in the industrial bulk material handling and mobile Internet businesses in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives