As we step into January 2025, global markets are navigating a mixed landscape, with key indices like the S&P 500 and Nasdaq Composite closing out another strong year despite recent economic challenges such as the decline in the Chicago PMI and revised GDP forecasts. Amidst this backdrop, high-growth tech stocks continue to capture investor interest due to their potential for innovation and resilience in adapting to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

BeijingABT NetworksLtd (SHSE:688168)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BeijingABT Networks Co., Ltd. specializes in developing and providing visualized network security technology solutions in China, with a market capitalization of approximately CN¥2.77 billion.

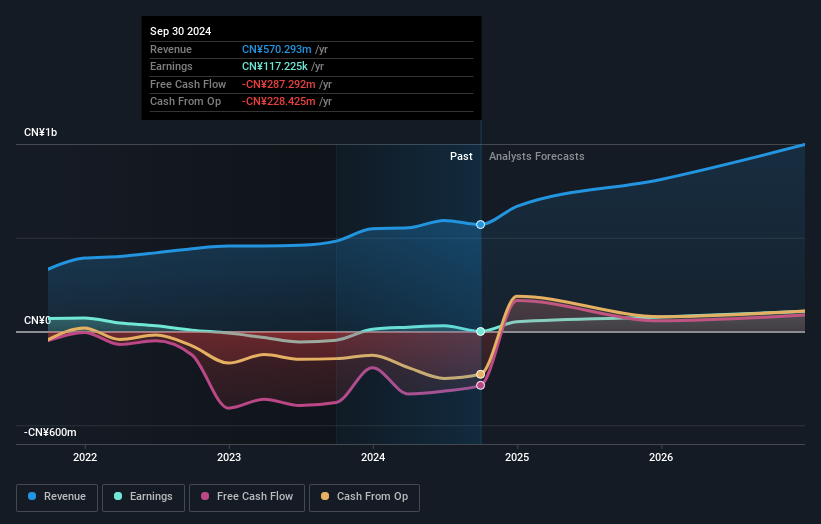

Operations: The company focuses on visualized network security technology solutions, generating revenue primarily from its Network Security segment, which amounts to approximately CN¥570.29 million.

BeijingABT NetworksLtd, amidst a volatile market, has shown promising growth with a projected annual revenue increase of 23.6% and earnings expected to surge by 69.1% per year, outpacing the Chinese market's average. This growth trajectory is bolstered by significant investments in R&D, aligning with industry trends towards enhanced digital infrastructure capabilities. Despite recent setbacks resulting in a net loss reported in September 2024, the firm's aggressive expansion in high-demand sectors positions it well for potential future recovery and profitability.

- Unlock comprehensive insights into our analysis of BeijingABT NetworksLtd stock in this health report.

Explore historical data to track BeijingABT NetworksLtd's performance over time in our Past section.

Talant Optronics (Suzhou) (SZSE:301045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Talant Optronics (Suzhou) Co., Ltd. focuses on the research, development, production, and sale of photoelectric light guide plates and related components both in China and internationally, with a market cap of CN¥2.33 billion.

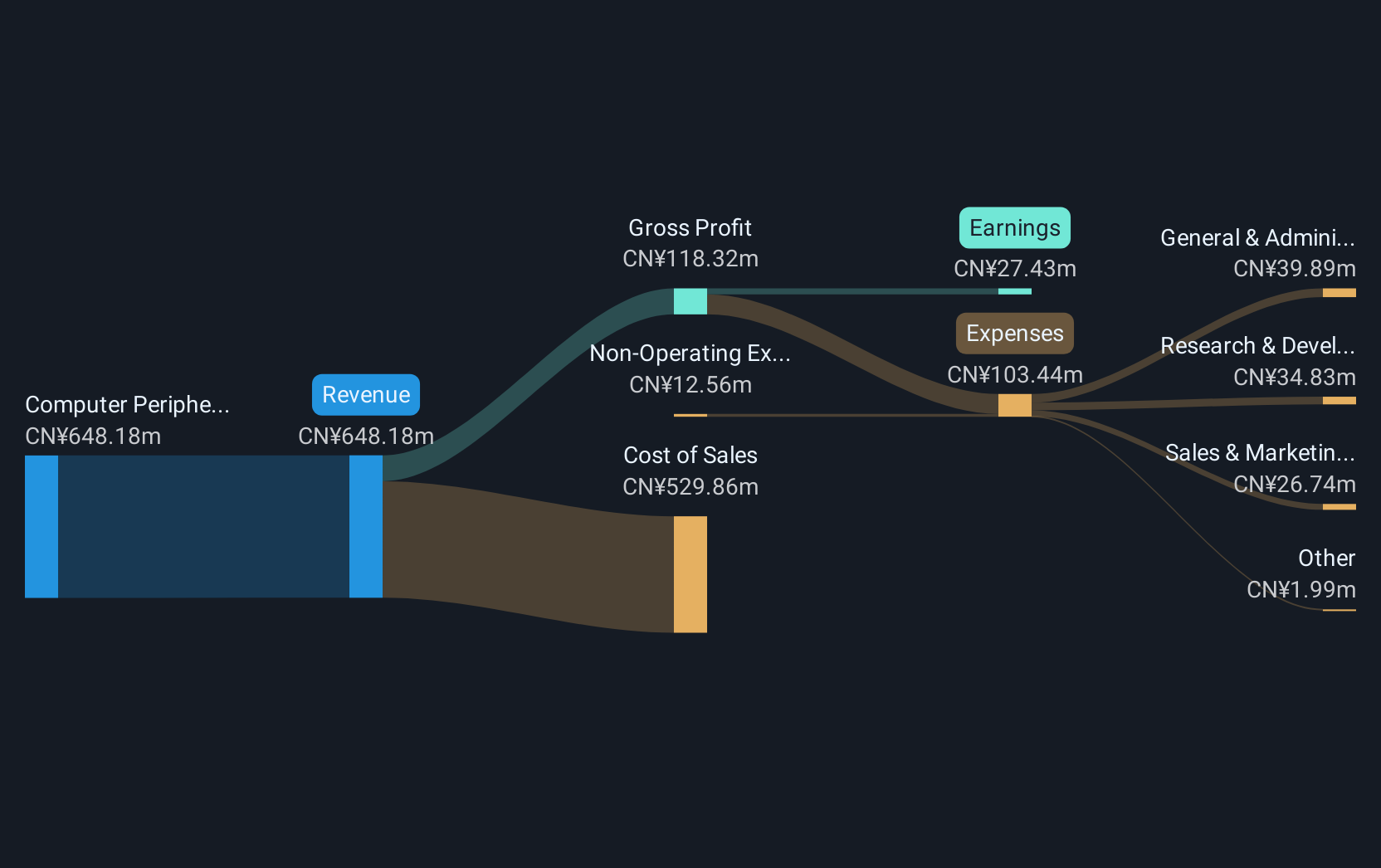

Operations: Talant Optronics (Suzhou) Co., Ltd. derives its revenue primarily from the sale of computer peripherals, amounting to CN¥642.10 million. The company's operations span both domestic and international markets, focusing on photoelectric light guide plates and related components.

Talant Optronics (Suzhou) has demonstrated robust financial performance, with revenue increasing to CNY 496.21 million and net income rising to CNY 19.97 million as of September 2024. This represents a significant growth in earnings by 866.5% over the past year, outstripping broader industry averages significantly. The firm's commitment to innovation is evident from its strategic R&D investments, which are crucial for maintaining its competitive edge in the fast-evolving tech landscape. Recent corporate activities, including a notable stake acquisition by Shanghai Fortune Asset Management and Fengchi Hengfeng No.1 Private Equity Investment Fund for CNY 99.5 million, underscore investor confidence and potential for future growth amidst dynamic market conditions.

- Click here to discover the nuances of Talant Optronics (Suzhou) with our detailed analytical health report.

Gain insights into Talant Optronics (Suzhou)'s past trends and performance with our Past report.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software solutions for supply chain operations across the United States, Europe, Asia, and Canada with a market capitalization of CA$4.89 billion.

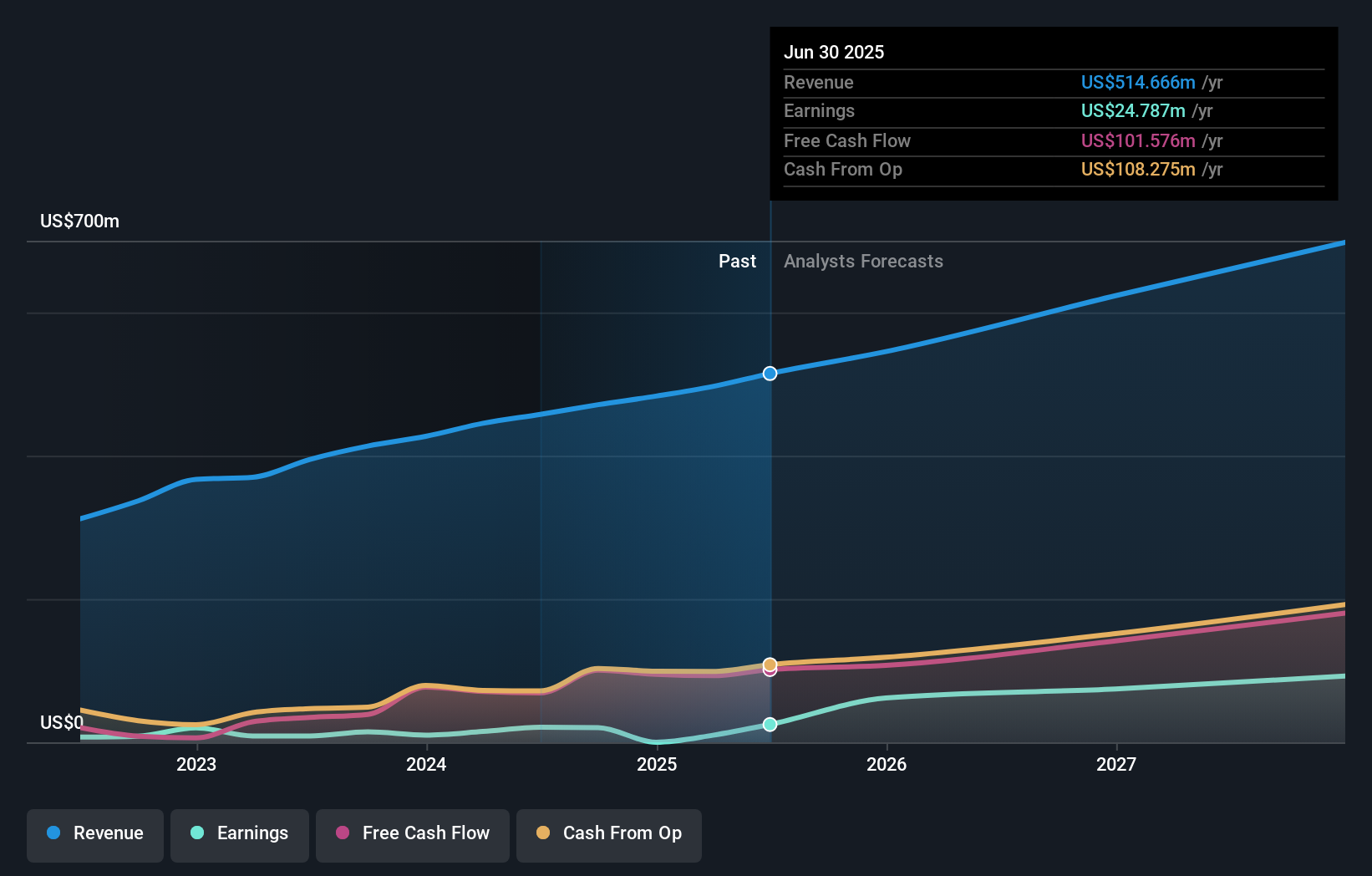

Operations: Kinaxis generates revenue primarily from its software and programming segment, amounting to $471.17 million, by providing cloud-based solutions for supply chain operations. The company focuses on subscription-based models to deliver its services across multiple regions including the United States, Europe, Asia, and Canada.

Kinaxis, a leader in supply chain management solutions, is reinforcing its market position through strategic partnerships and board enhancements. With the recent appointments like Lynn Loewen to the Board and partnerships with NTT DATA Japan and Octapharma, Kinaxis is poised to deepen its influence in global supply chains. Notably, its revenue growth at 12.9% annually outpaces the Canadian market average of 7.1%, while earnings have surged by an impressive 42.9% per year, showcasing robust financial health and innovation-driven growth. The company's commitment to R&D is evident from significant investments aimed at enhancing its AI-powered Maestro platform, crucial for maintaining competitive advantage in the dynamic tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Kinaxis.

Evaluate Kinaxis' historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 1266 High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeijingABT NetworksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688168

BeijingABT NetworksLtd

Develops and provides visualized network security technology solutions in China.

High growth potential and good value.