Pinming Technology Leads 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of economic indicators and investor sentiment, small-cap stocks have shown resilience, with the Russell 2000 Index posting a notable rise amid hopes for an interest rate cut from the Federal Reserve. In this environment, identifying promising companies requires a keen eye on those that not only withstand macroeconomic pressures but also demonstrate innovation and adaptability.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Gem-Year IndustrialLtd | NA | -3.47% | -34.40% | ★★★★★★ |

| SEC Electric Machinery | NA | -5.40% | -44.23% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| House of Investments | 18.23% | 14.46% | 47.47% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Pizu Group Holdings | 45.21% | -1.54% | -3.14% | ★★★★☆☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Pinming Technology (SHSE:688109)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinming Technology Co., Ltd. focuses on the research, development, sale, and technical service of Internet of Things software and hardware systems and related products, with a market cap of approximately CN¥12.87 billion.

Operations: Pinming Technology generates revenue primarily from its Software & Programming segment, which contributed CN¥457.84 million. The company's market cap stands at approximately CN¥12.87 billion, indicating its significant presence in the sector.

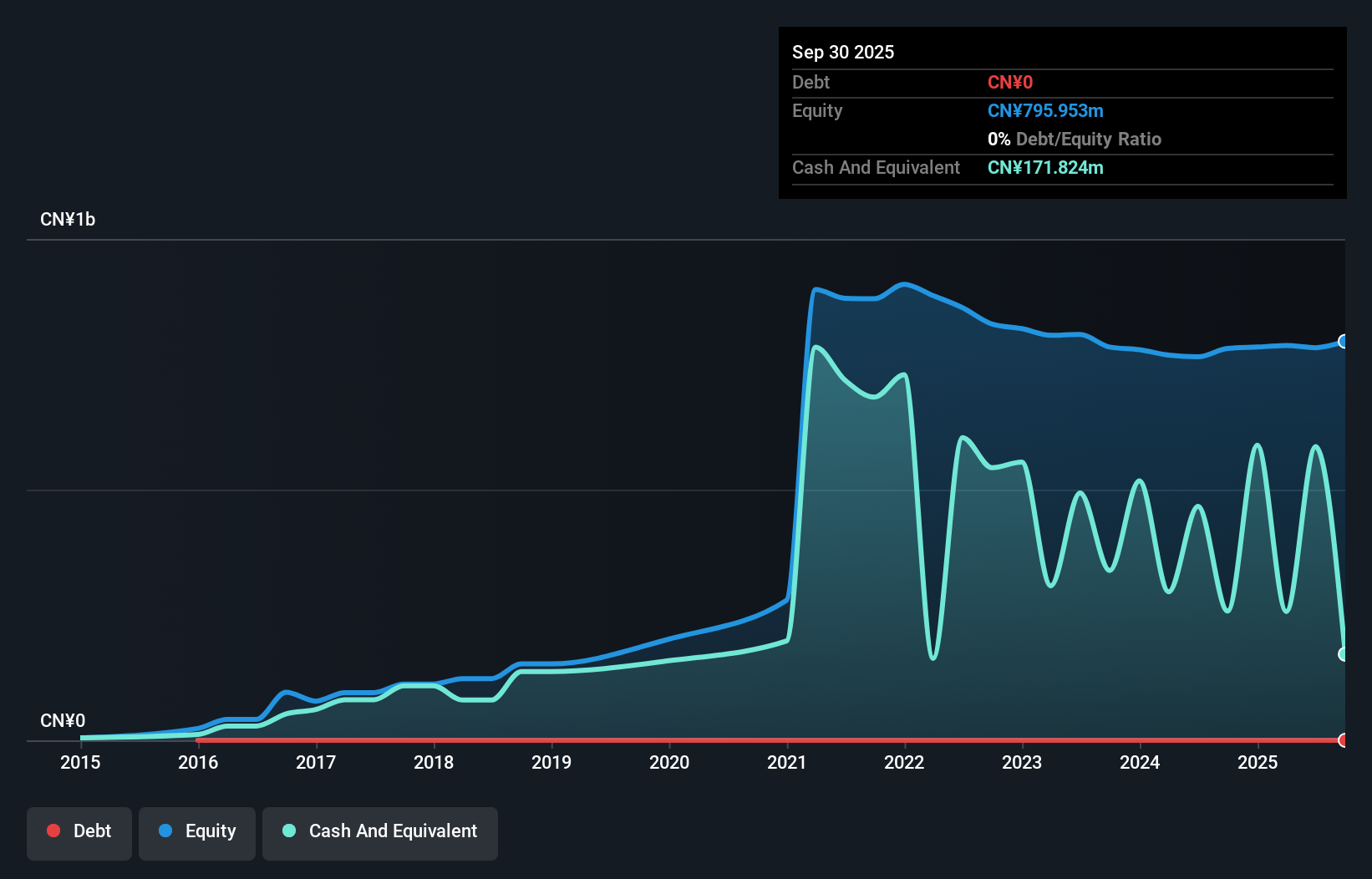

Pinming Technology showcases a robust financial profile, with earnings surging 65.7% over the past year, outpacing the Software industry's modest 0.4% growth. The company is debt-free and enjoys high-quality earnings, although a significant one-off gain of CN¥32.3 million has influenced recent results. For the nine months ending September 2025, net income reached CN¥48.43 million compared to CN¥13.18 million in the previous year, with basic EPS climbing from CN¥0.17 to CN¥0.61 per share. Despite its profitability and positive cash flow position, Pinming's share price has been highly volatile recently, reflecting market uncertainties or investor sentiment shifts.

Wuxi Online Offline Communication Information Technology (SZSE:300959)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Online Offline Communication Information Technology Co., Ltd. operates in the technology sector with a market cap of CN¥9.17 billion.

Operations: Wuxi Online Offline Communication Information Technology Co., Ltd. generates revenue through its technology sector operations, contributing to its market capitalization of CN¥9.17 billion.

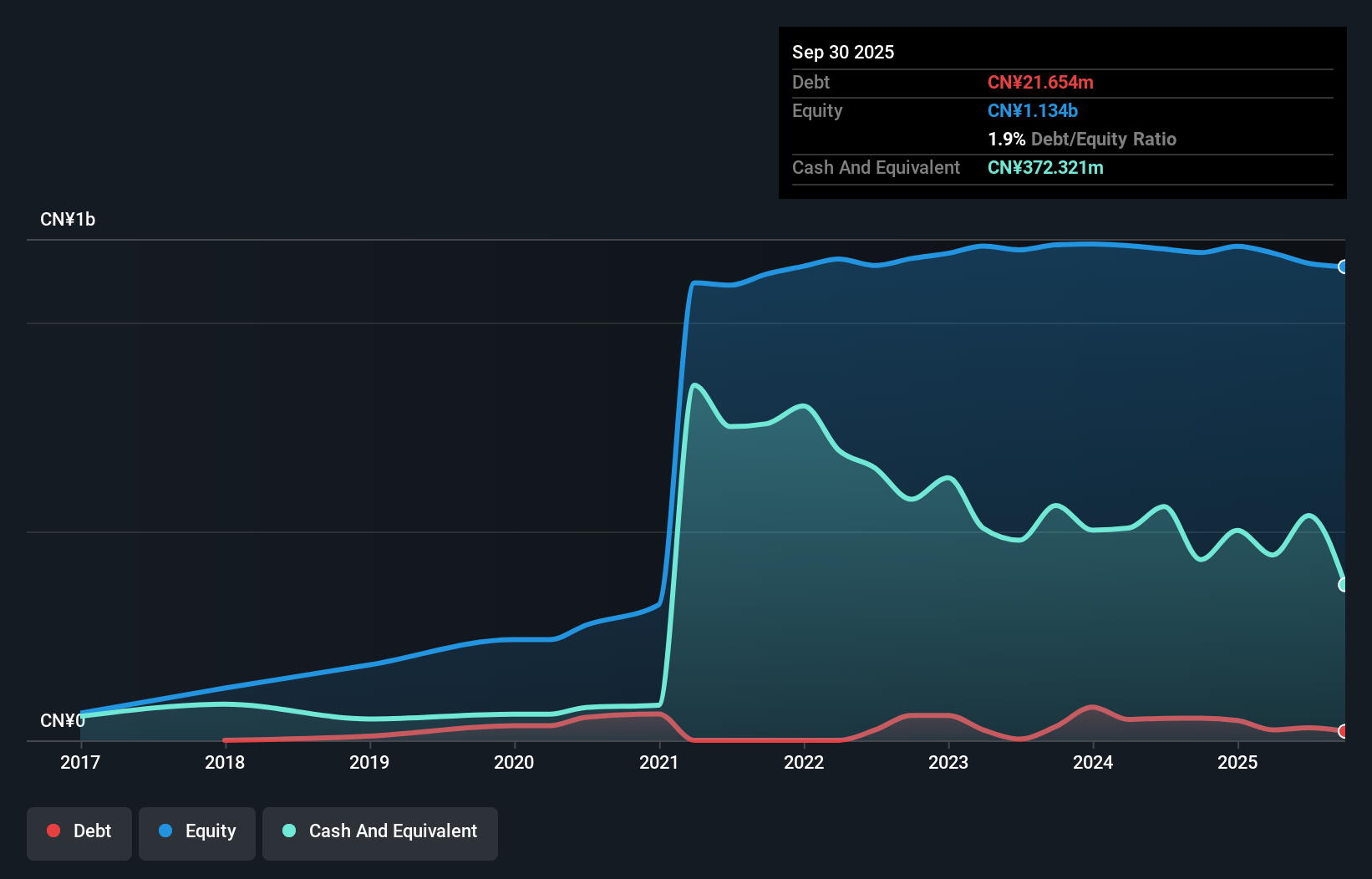

Wuxi Online Offline Communication Information Technology, a small cap entity, has experienced a significant earnings growth of 116% over the past year, notably outpacing the Wireless Telecom industry’s 9.2%. Despite this impressive growth, recent financials show sales at CN¥469.76 million for nine months ending September 2025 compared to CN¥883.62 million in the previous year, with net income dropping to CN¥3.51 million from CN¥12.55 million. The company’s debt management appears strong as its debt-to-equity ratio improved from 19.7% to 1.8% over five years and it holds more cash than total debt on hand.

Sanhe Tongfei Refrigeration (SZSE:300990)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanhe Tongfei Refrigeration Co., Ltd. specializes in manufacturing and selling industrial temperature control products in China, with a market cap of CN¥12.54 billion.

Operations: Sanhe Tongfei generates revenue primarily from the sale of industrial temperature control products. The company's financial performance is influenced by its cost structure and market demand in China.

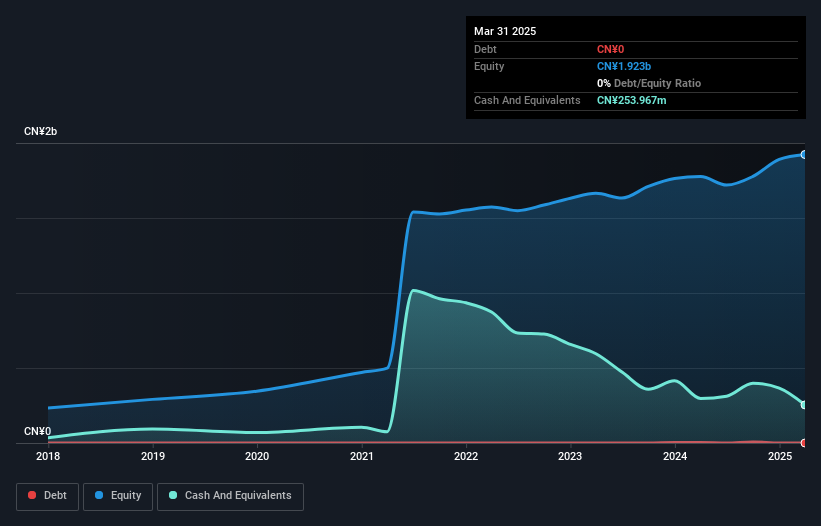

Sanhe Tongfei Refrigeration, a nimble player in the machinery sector, has shown impressive financial performance with earnings growth of 136.9% over the past year, outpacing the industry average of 6.1%. The company reported a net income of CNY 180.46 million for the first nine months of 2025, up from CNY 69.92 million in the previous year, while sales reached CNY 2.08 billion compared to last year's CNY 1.37 billion. Despite its high volatility recently, Sanhe Tongfei remains debt-free which enhances its financial flexibility and positions it well for future growth opportunities within its industry context.

Seize The Opportunity

- Navigate through the entire inventory of 3010 Global Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300990

Sanhe Tongfei Refrigeration

Manufactures and sells industrial temperature control products in China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026