Top Growth Companies With High Insider Ownership January 2025

Reviewed by Simply Wall St

As global markets navigate choppy waters, with U.S. equities experiencing declines amid inflation concerns and political uncertainties, investors are increasingly focused on growth companies that demonstrate resilience through high insider ownership. In such volatile times, stocks with significant insider stakes can offer a sense of stability and alignment of interests between management and shareholders, making them attractive options for those seeking growth potential in an uncertain economic landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's explore several standout options from the results in the screener.

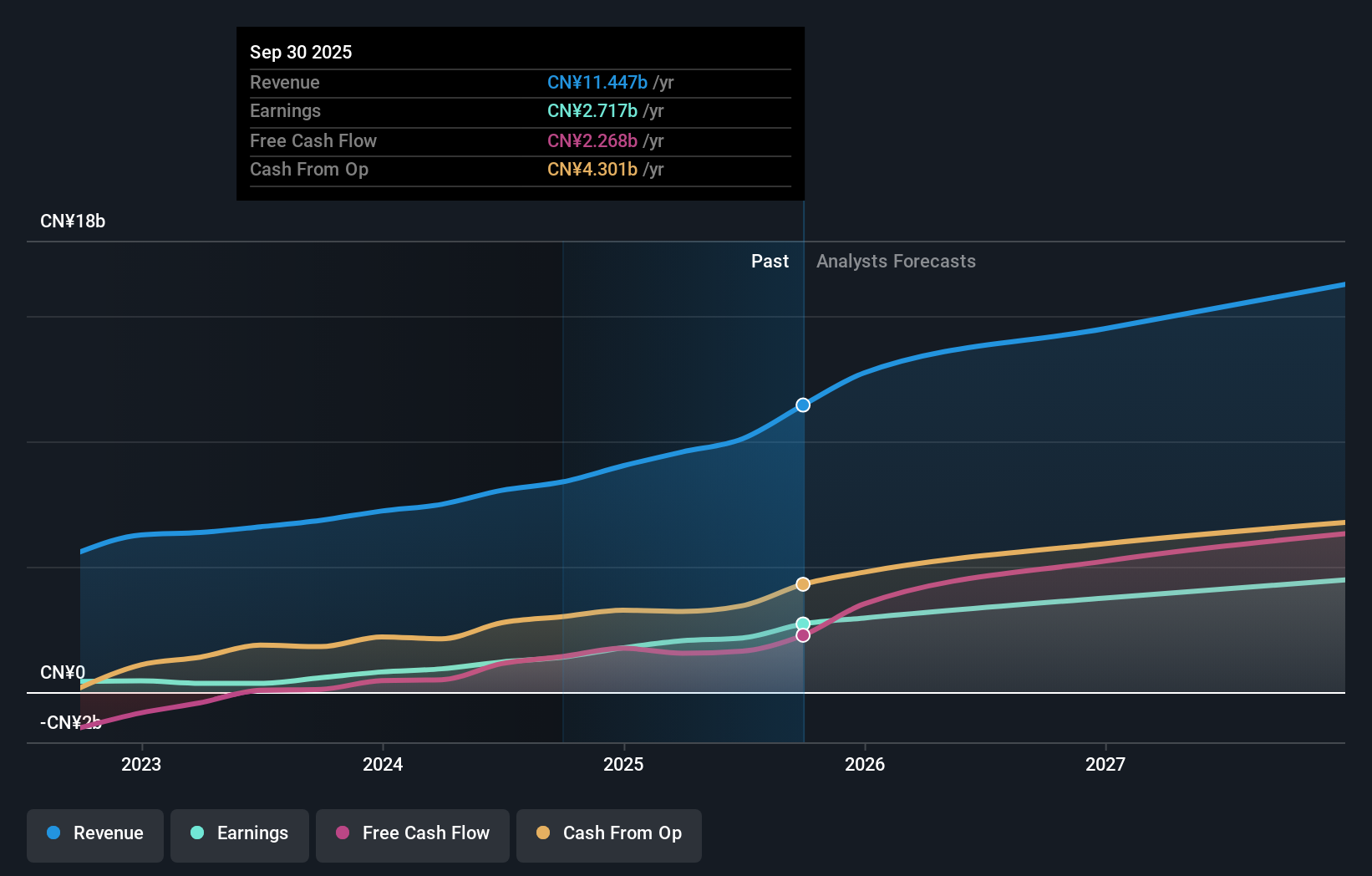

Chifeng Jilong Gold MiningLtd (SHSE:600988)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chifeng Jilong Gold Mining Co., Ltd. is a company engaged in the mining of gold and non-ferrous metals, with a market capitalization of approximately CN¥26.84 billion.

Operations: The company's revenue is derived from its operations in gold and non-ferrous metal mining.

Insider Ownership: 16.1%

Chifeng Jilong Gold Mining Ltd. shows potential as a growth company with high insider ownership, despite recent removal from major indices like the SSE 180 Index. The company reported strong financial performance for the nine months ending September 2024, with sales reaching CNY 6.22 billion and net income more than doubling to CNY 1.11 billion compared to the previous year. Analysts forecast revenue growth of 14.9% annually, outpacing the CN market average, while earnings are expected to grow significantly over the next three years, although slightly below market expectations. Despite no substantial insider trading activity recently, Chifeng Jilong is perceived as undervalued by analysts and offers good relative value in its industry.

- Click here and access our complete growth analysis report to understand the dynamics of Chifeng Jilong Gold MiningLtd.

- According our valuation report, there's an indication that Chifeng Jilong Gold MiningLtd's share price might be on the cheaper side.

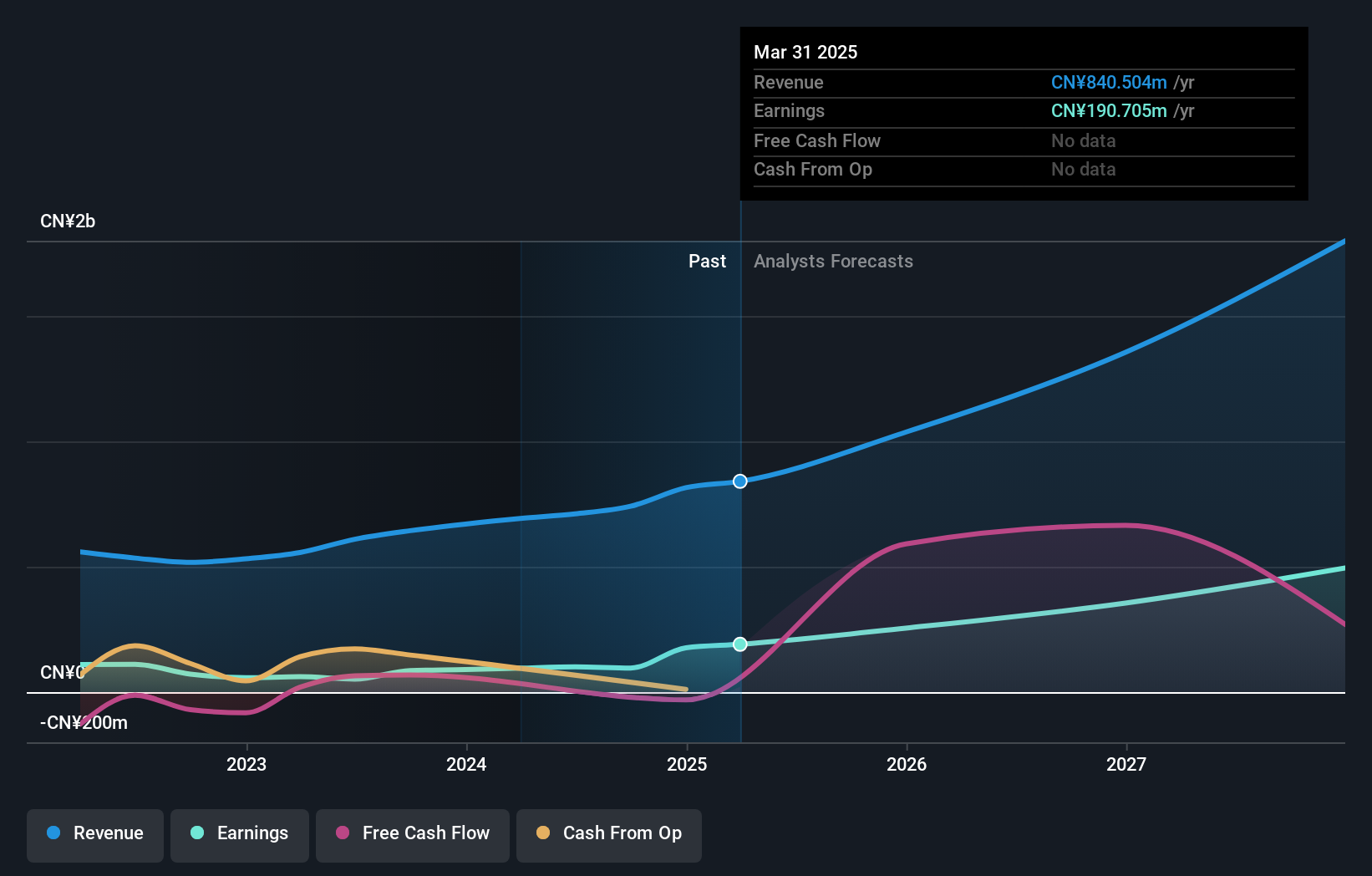

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market cap of CN¥14.67 billion.

Operations: ArcSoft Corporation Limited generates revenue primarily from its algorithm and software solutions in the computer vision sector globally.

Insider Ownership: 34.5%

ArcSoft demonstrates potential for growth with high insider ownership, reporting sales of CNY 573.68 million and net income of CNY 88.29 million for the nine months ending September 2024. Earnings are forecast to grow significantly at 43.4% annually, surpassing market expectations, while revenue is expected to increase by 30.7% per year, outpacing the Chinese market average. Despite a low return on equity forecast and an unstable dividend track record, ArcSoft's growth prospects remain strong without recent insider trading activity influencing performance perceptions.

- Unlock comprehensive insights into our analysis of ArcSoft stock in this growth report.

- The analysis detailed in our ArcSoft valuation report hints at an inflated share price compared to its estimated value.

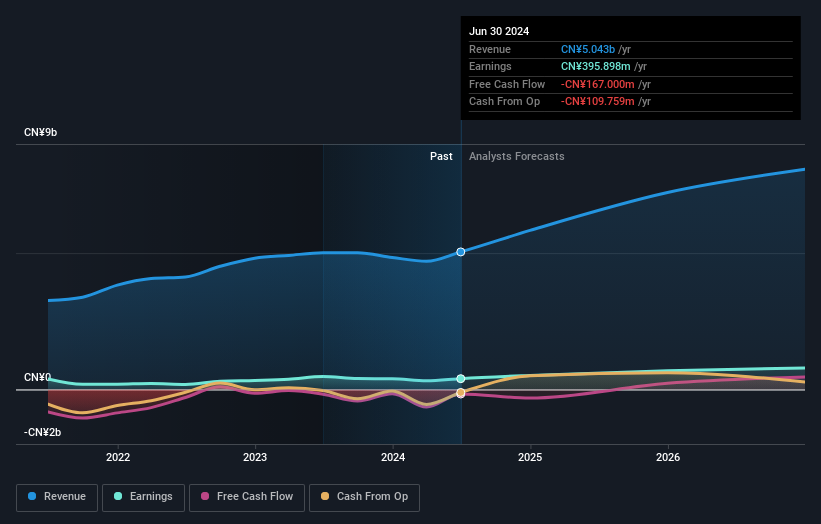

Bozhon Precision Industry TechnologyLtd (SHSE:688097)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bozhon Precision Industry Technology Co., Ltd. (ticker: SHSE:688097) operates in the precision manufacturing sector and has a market cap of CN¥11.17 billion.

Operations: The company generates revenue primarily from its Industrial Automation & Controls segment, amounting to CN¥4.87 billion.

Insider Ownership: 29.4%

Bozhon Precision Industry Technology Ltd. shows promising growth prospects, with earnings forecast to grow at 27% annually and revenue expected to rise by 20.9% per year, both surpassing the Chinese market averages. Recent earnings for the nine months ending September 2024 reported sales of CNY 3.27 billion and net income of CNY 253.84 million, reflecting modest growth from the previous year. The recent acquisition of a 5.43% stake by Tianjin Xinke Hongchuang underscores investor confidence despite no significant insider trading activity recently noted.

- Dive into the specifics of Bozhon Precision Industry TechnologyLtd here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Bozhon Precision Industry TechnologyLtd is trading beyond its estimated value.

Where To Now?

- Discover the full array of 1442 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bozhon Precision Industry TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688097

Bozhon Precision Industry TechnologyLtd

Bozhon Precision Industry Technology Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives