- China

- /

- Communications

- /

- SZSE:300136

Top 3 High Growth Tech Stocks in China to Watch

Reviewed by Simply Wall St

Recent stimulus measures announced by China have injected optimism into global markets, lifting key indices and boosting investor sentiment. As technology stocks outperform due to these positive developments, it’s an opportune moment to explore high-growth tech stocks in China that are poised to benefit from this favorable economic backdrop. A good stock in this context typically exhibits strong fundamentals, innovative capabilities, and the potential for substantial market share expansion.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.61% | 31.78% | ★★★★★★ |

| Zhongji Innolight | 32.37% | 31.70% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| Wanma Technology | 35.58% | 47.75% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market capitalization of CN¥13.50 billion.

Operations: ArcSoft Corporation Limited specializes in providing algorithms and software solutions for the computer vision industry on a global scale. The company generates revenue through its advanced technological offerings, catering to various sectors requiring computer vision applications.

ArcSoft, a player in China's tech landscape, has demonstrated robust growth with a 94.1% increase in earnings over the past year, outpacing the software industry’s average decline of 13.6%. This growth is underpinned by significant investment in innovation, as reflected in its R&D expenses which are strategically aligned to foster advancements in AI and software solutions. With revenue rising by 23% annually and projected earnings growth of 34.1% per year, ArcSoft is setting a brisk pace compared to the broader Chinese market's expectations. Despite challenges common in high-growth environments, ArcSoft’s recent financial performance signals strong operational execution; half-year reports show revenues up from CNY 340.19 million to CNY 380.92 million and net income increasing from CNY 50.04 million to CNY 61.46 million year-over-year. The company's commitment to reinvesting in technology development could well position it for sustained influence within China’s competitive tech sector, promising an intriguing trajectory ahead as they continue expanding their technological footprint.

- Click here and access our complete health analysis report to understand the dynamics of ArcSoft.

Gain insights into ArcSoft's historical performance by reviewing our past performance report.

Beijing Shiji Information Technology (SZSE:002153)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Shiji Information Technology Co., Ltd. operates in the technology sector, focusing on computer applications and services as well as commodity wholesale and trade, with a market cap of CN¥20 billion.

Operations: The company generates revenue primarily from the Computer Application and Service Industry (CN¥2.31 billion) and the Commodity Wholesale and Trade Industry (CN¥655.73 million). The net profit margin stands at 15%.

Beijing Shiji Information Technology has shown a promising trajectory with its recent earnings report indicating a revenue increase to CNY 1.38 billion, up from CNY 1.20 billion the previous year, reflecting a growth of 16.5%. This performance is bolstered by an R&D commitment that remains robust, aligning with the firm's strategic focus on technological innovation in hospitality solutions and data management systems. Furthermore, earnings are expected to surge by approximately 91% annually, showcasing potential in an increasingly competitive sector. The company's ability to scale operations and enhance service offerings could be pivotal as it navigates the complexities of China's tech industry landscape.

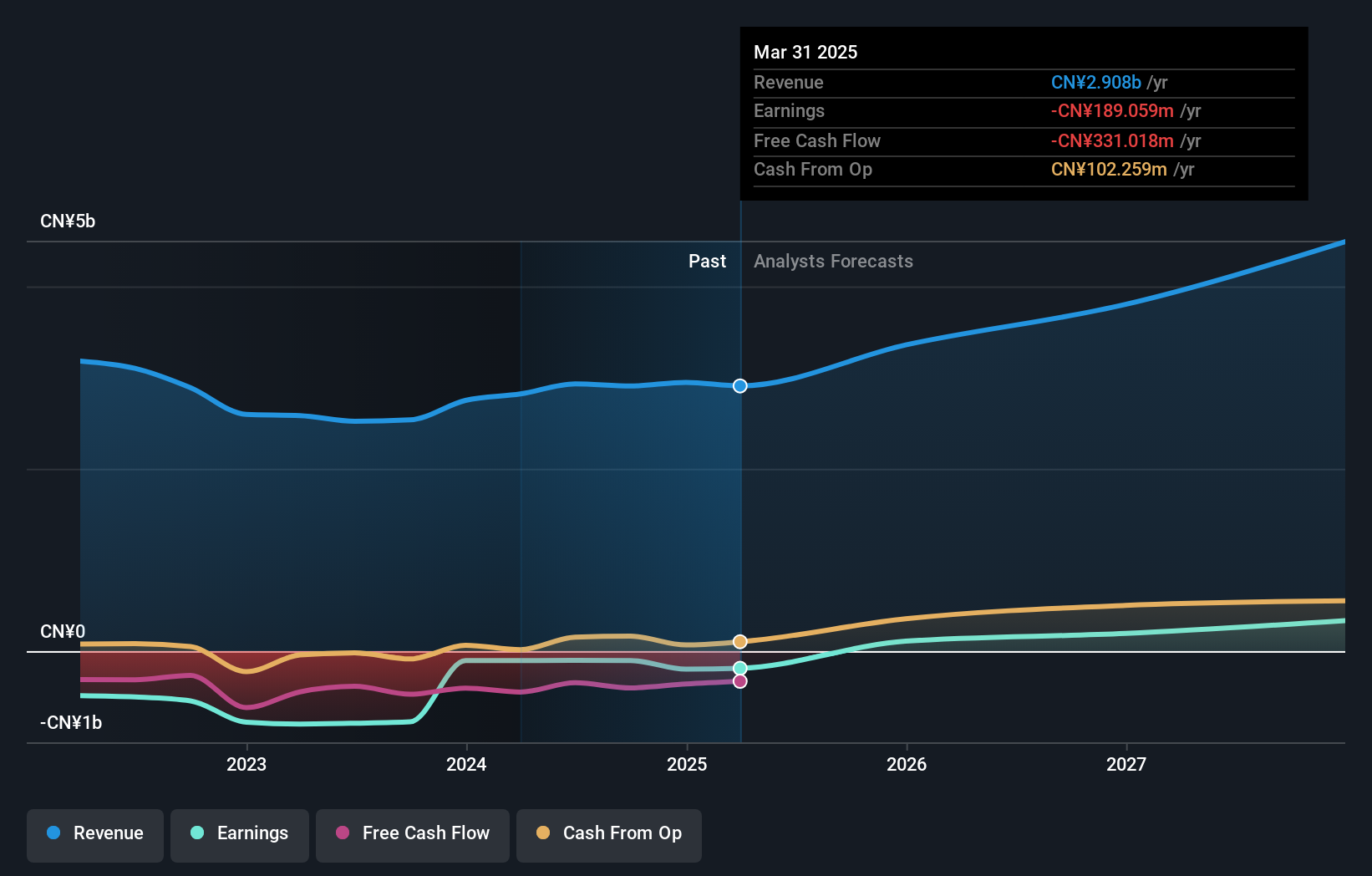

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunway Communication Co., Ltd. focuses on the research, development, manufacture, and sale of various communication components such as antennas and wireless charging modules both in China and internationally, with a market cap of CN¥22.45 billion.

Operations: Sunway Communication generates revenue primarily from its electronic component segment, amounting to CN¥7.95 billion. The company's product offerings include antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions for both domestic and international markets.

Shenzhen Sunway Communication has demonstrated resilience and strategic foresight in its operations, evidenced by a robust half-year sales increase to CNY 3.69 billion, up from CNY 3.30 billion the previous year. This growth is underpinned by significant R&D investments, aligning with an 18.4% annual revenue growth forecast, slightly below the sector's top performers but still ahead of the broader Chinese market average of 13.2%. Moreover, the company's proactive approach in shareholder value is reflected through a recent share repurchase program valued at CNY 400 million and plans for employee stock ownership that could enhance long-term commitment and performance within its teams. With earnings expected to surge by approximately 30.6% annually, Shenzhen Sunway Communication is positioning itself as a competitive player in China’s high-tech communications sector despite some market volatility and past negative earnings growth trends.

- Dive into the specifics of Shenzhen Sunway Communication here with our thorough health report.

Gain insights into Shenzhen Sunway Communication's past trends and performance with our Past report.

Key Takeaways

- Click this link to deep-dive into the 255 companies within our Chinese High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300136

Shenzhen Sunway Communication

Engages in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions in China and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives