- China

- /

- Communications

- /

- SZSE:300098

3 Growth Companies With High Insider Ownership Growing Revenues Up To 34%

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are keenly observing the performance of major indices like the S&P 500, which recently experienced a slight decline amid these challenges. Despite this backdrop, growth companies with high insider ownership have garnered attention for their potential to outperform through strategic alignment and vested interests in driving revenue growth. In today's market conditions, a strong alignment between company insiders and shareholders can be particularly appealing. This is because high insider ownership often indicates confidence in the company's future prospects and can lead to more prudent decision-making aimed at sustainable growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's dive into some prime choices out of the screener.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global algorithm and software solution provider in the computer vision industry with a market cap of CN¥21.74 billion.

Operations: ArcSoft Corporation Limited generates revenue from its role as a provider of algorithms and software solutions within the global computer vision sector.

Insider Ownership: 34.5%

Revenue Growth Forecast: 30.6% p.a.

ArcSoft's anticipated revenue growth of 30.6% annually positions it as a strong contender in the growth sector, outpacing the broader Chinese market. Despite volatile share prices and a low forecasted return on equity of 9.5%, its earnings are projected to rise significantly at 43.48% per year, surpassing market expectations. The company recently announced an extraordinary shareholders meeting, potentially indicating strategic developments ahead.

- Navigate through the intricacies of ArcSoft with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, ArcSoft's share price might be too optimistic.

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gosuncn Technology Group Co., Ltd. offers IoT products and services both in China and internationally, with a market cap of CN¥10.25 billion.

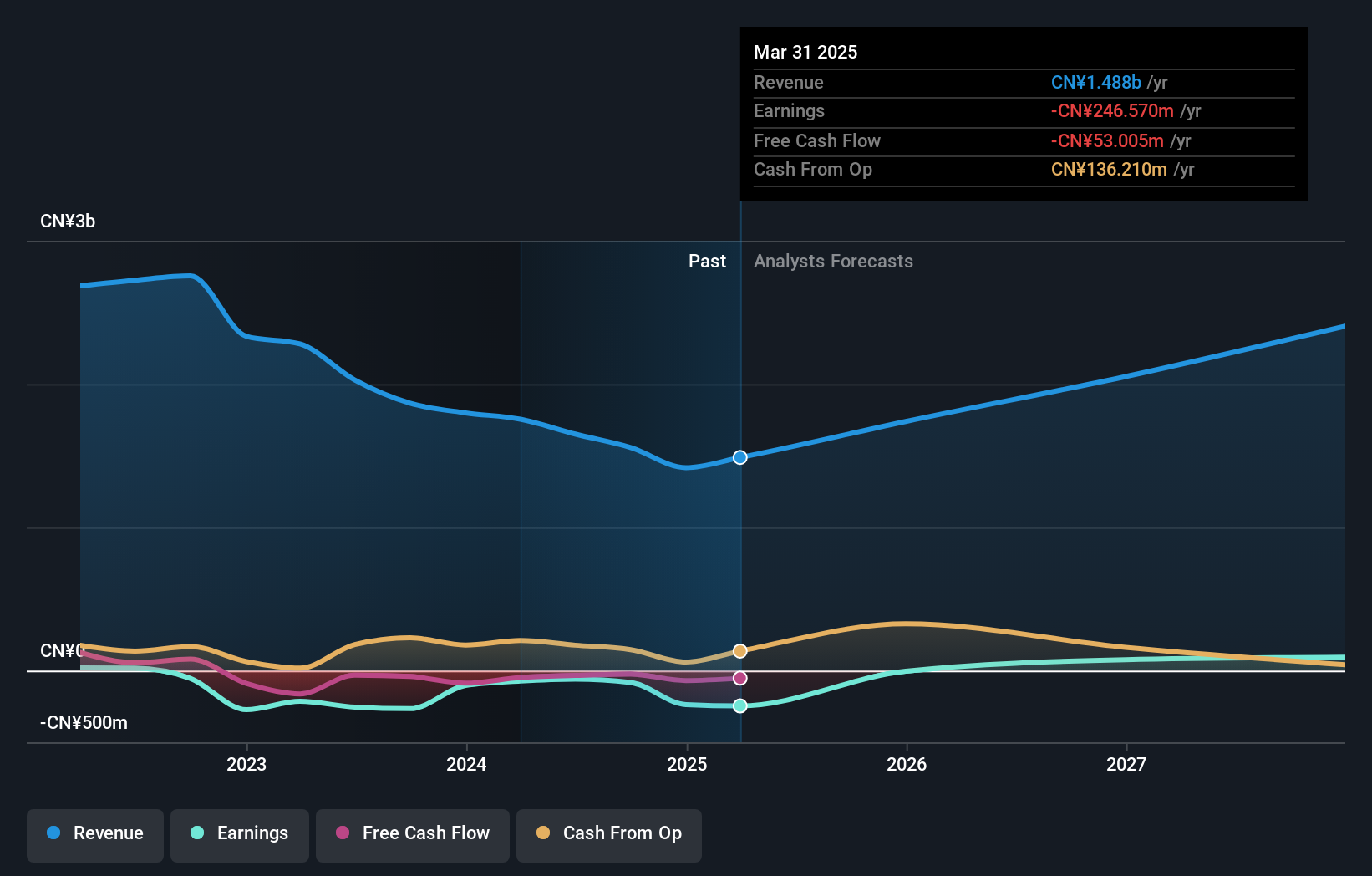

Operations: Gosuncn Technology Group Co., Ltd. generates revenue from its IoT products and services across domestic and international markets.

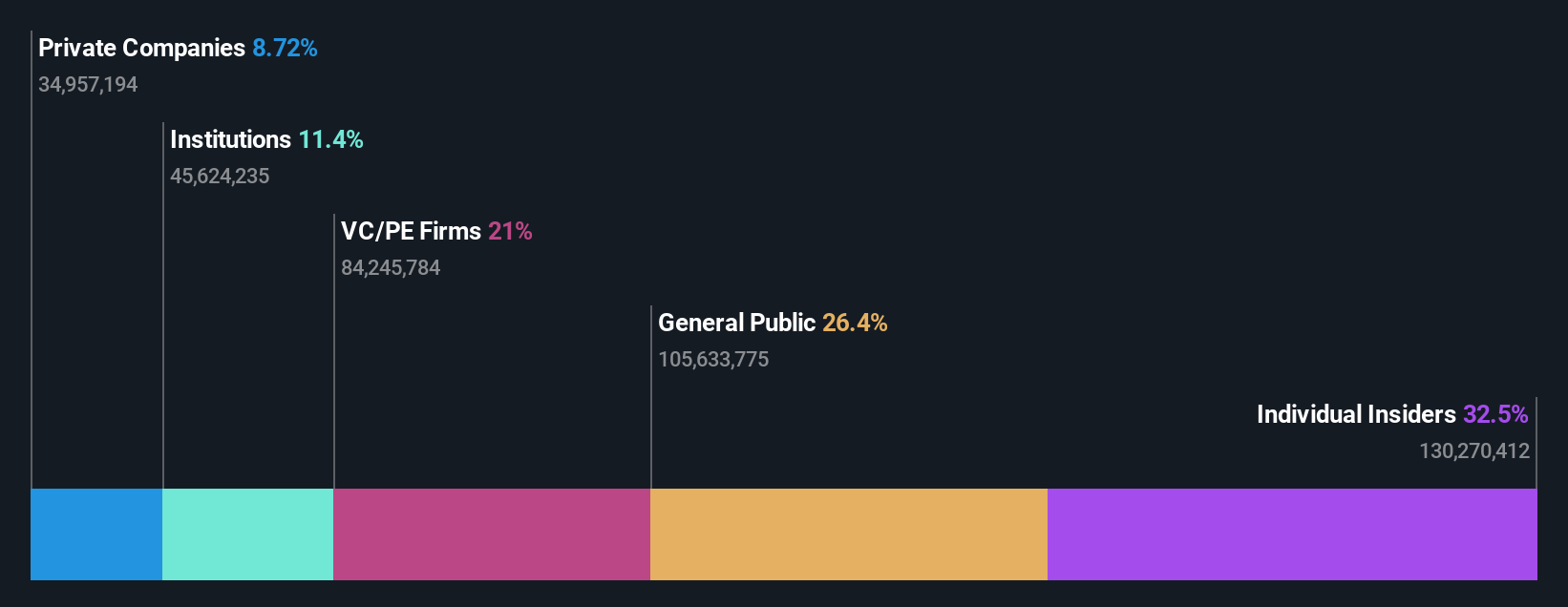

Insider Ownership: 19.1%

Revenue Growth Forecast: 14.3% p.a.

Gosuncn Technology Group is forecast to achieve profitability within three years, with earnings expected to grow at 100.72% annually, outpacing the broader market. Its revenue growth of 14.3% per year is slightly above the Chinese market average but below 20%. Despite a highly volatile share price recently and a low projected return on equity of 4.3%, these growth forecasts highlight potential for future expansion in its sector.

- Take a closer look at Gosuncn Technology Group's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Gosuncn Technology Group's current price could be inflated.

Semitronix (SZSE:301095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Semitronix Corporation offers characterization and yield improvement solutions for the semiconductor industry both in China and globally, with a market cap of CN¥10.93 billion.

Operations: Revenue segments for SZSE:301095 are not provided in the text.

Insider Ownership: 34.1%

Revenue Growth Forecast: 34.5% p.a.

Semitronix is projected to experience strong growth, with earnings expected to rise 46.06% annually over the next three years, outpacing the Chinese market's 25.4% growth rate. Revenue is forecasted to grow at 34.5% per year, significantly exceeding the market average of 13.5%. However, profit margins have declined from last year's 32% to 16.8%, and return on equity is expected to remain low at 7.6%. The recent buyback completed for CNY139.65 million may impact future strategies positively.

- Click here and access our complete growth analysis report to understand the dynamics of Semitronix.

- Our comprehensive valuation report raises the possibility that Semitronix is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1439 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300098

Gosuncn Technology Group

Provides IoT products and services in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives