3 Asian Growth Companies With Insider Ownership Expecting Up To 27% Revenue Growth

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape shaped by global economic shifts, investor attention is increasingly drawn to growth companies with strong insider ownership, which can signal confidence in the company's future prospects. In this context, identifying stocks that not only exhibit robust revenue growth potential but also have significant insider stakes can be particularly compelling for those looking to align with management's vested interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's uncover some gems from our specialized screener.

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

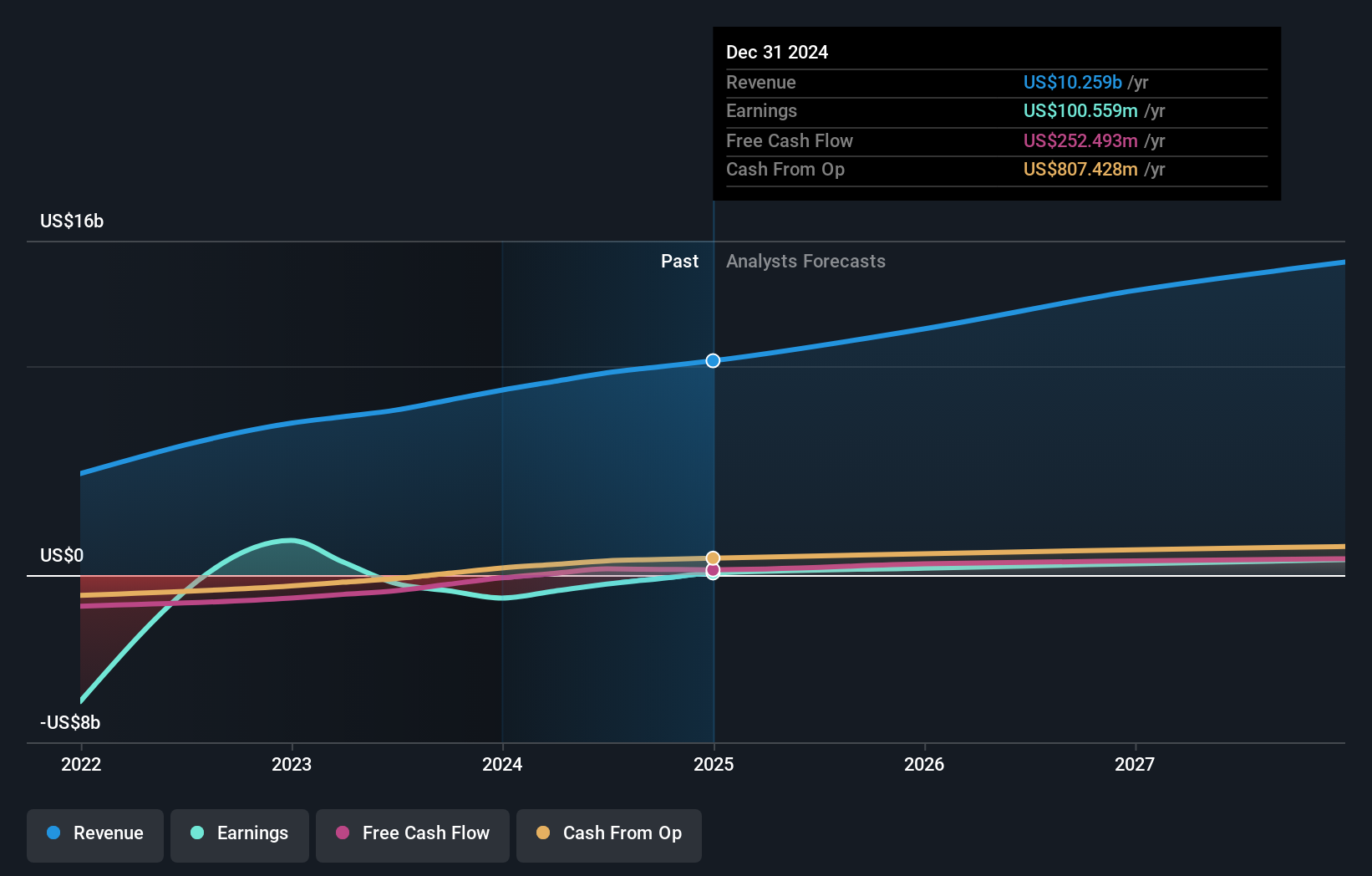

Overview: J&T Global Express Limited is an investment holding company providing integrated express delivery services across several countries, including China and Indonesia, with a market cap of HK$88.86 billion.

Operations: The company's revenue from transportation - air freight amounts to $10.90 billion.

Insider Ownership: 18.9%

Revenue Growth Forecast: 13.4% p.a.

J&T Global Express has demonstrated strong growth potential, with earnings forecasted to increase significantly at 35.9% annually, outpacing the Hong Kong market's average. Despite its removal from the Hang Seng China Enterprises Index, recent share buybacks aim to enhance shareholder value by increasing net asset value and earnings per share. The company's revenue growth of 13.4% annually exceeds the local market rate, supported by substantial insider ownership which aligns management interests with shareholders'.

- Delve into the full analysis future growth report here for a deeper understanding of J&T Global Express.

- The analysis detailed in our J&T Global Express valuation report hints at an inflated share price compared to its estimated value.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

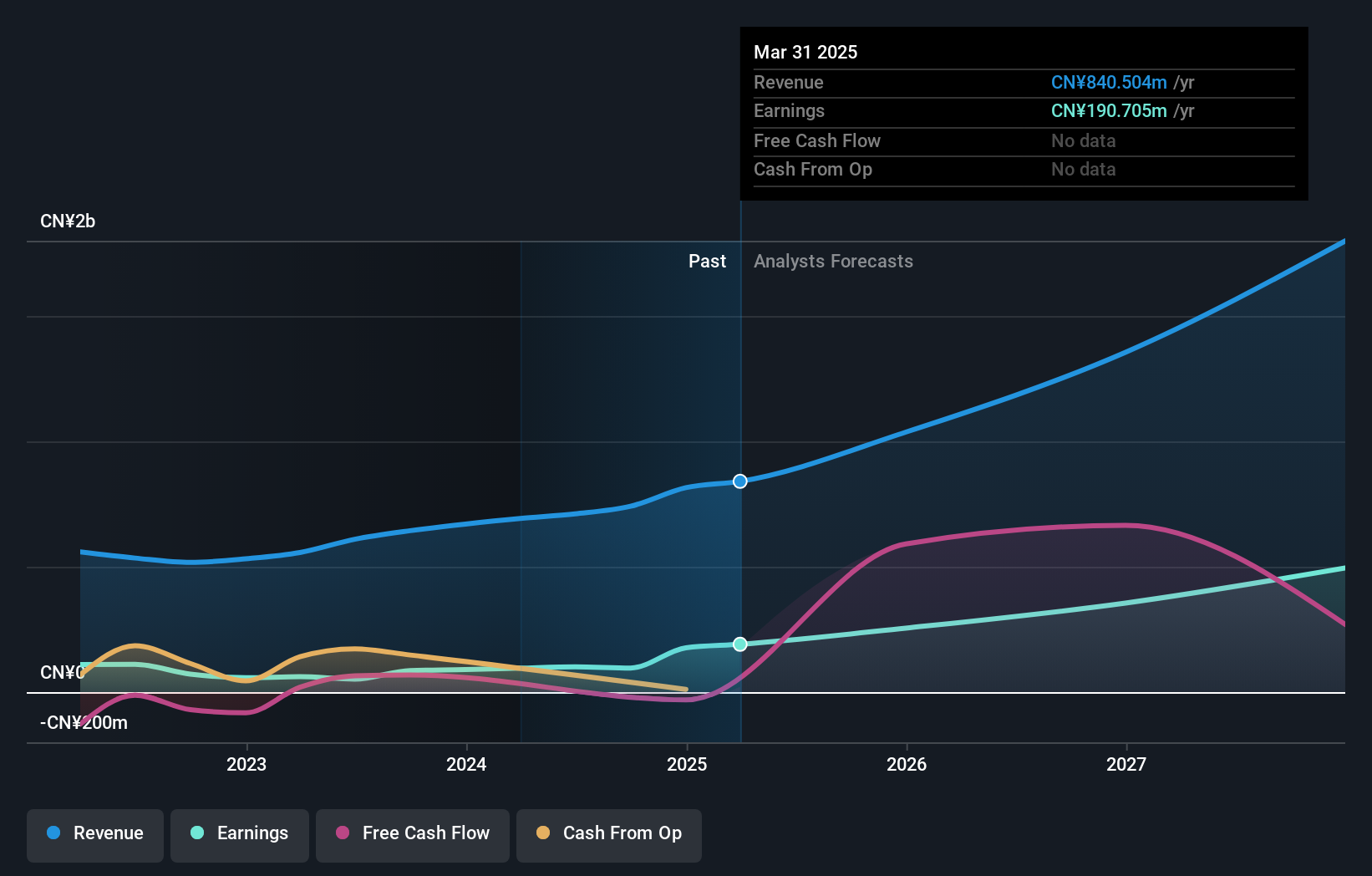

Overview: ArcSoft Corporation Limited is a global algorithm and software solution provider in the computer vision industry, with a market cap of CN¥25.03 billion.

Operations: ArcSoft Corporation Limited derives its revenue from providing algorithm and software solutions within the computer vision sector globally.

Insider Ownership: 32.5%

Revenue Growth Forecast: 27.4% p.a.

ArcSoft's revenue and earnings are forecast to grow significantly, with annual growth rates of 27.4% and 33.9%, respectively, surpassing the Chinese market averages. Recent results show a rise in net income to CNY 88.54 million for H1 2025 from CNY 61.46 million a year prior, indicating robust performance. Despite unstable dividends and low future return on equity projections at 12.4%, strong insider ownership aligns management with shareholder interests, supporting its growth trajectory in Asia's tech sector.

- Dive into the specifics of ArcSoft here with our thorough growth forecast report.

- Our valuation report here indicates ArcSoft may be overvalued.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan with a market cap of ¥211.39 billion.

Operations: Revenue Segments (in millions of ¥): The company generates revenue through its cloud-based accounting and HR software solutions in Japan.

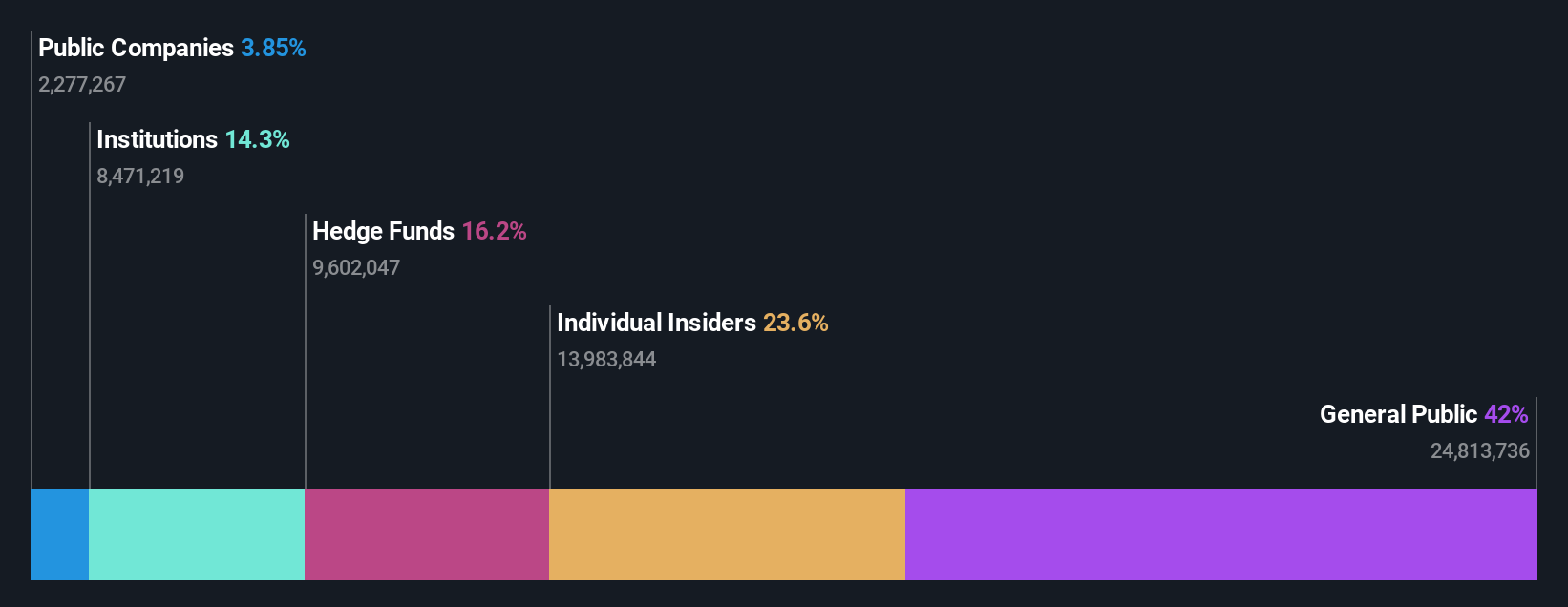

Insider Ownership: 21.9%

Revenue Growth Forecast: 16.7% p.a.

freee K.K. is trading significantly below its estimated fair value, indicating potential upside for investors. Its earnings are projected to grow substantially at 37.1% annually over the next three years, outperforming the Japanese market average of 8.2%. The company recently became profitable and expects net sales between ¥40.93 billion and ¥41.59 billion by June 2026, driven by SaaS business expansion and enhanced customer value propositions, despite recent share price volatility.

- Unlock comprehensive insights into our analysis of freee K.K stock in this growth report.

- Our comprehensive valuation report raises the possibility that freee K.K is priced lower than what may be justified by its financials.

Next Steps

- Gain an insight into the universe of 617 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Curious About Other Options? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if freee K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4478

freee K.K

Engages in the provision of cloud-based accounting and HR software solutions in Japan.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives