As we enter January 2025, global markets have been experiencing a mix of gains and declines, with the technology-heavy Nasdaq Composite recently leading the charge before seeing a slight pullback. Amidst this backdrop of fluctuating consumer confidence and economic indicators, identifying high-growth tech stocks involves looking for companies that are well-positioned to capitalize on innovation and market demand despite current economic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ZwsoftLtd (SHSE:688083)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zwsoft Co., Ltd. develops and sells CAD/CAM/CAE software solutions in China, with a market cap of CN¥10.34 billion.

Operations: Zwsoft Co., Ltd. generates revenue primarily through the development and sale of CAD/CAM/CAE software solutions in China. The company's market cap stands at approximately CN¥10.34 billion, reflecting its position within the industry.

ZwsoftLtd's financial trajectory has shown impressive growth, with earnings surging by 133.1% over the past year, significantly outpacing the software industry's decline of 11.2%. This robust performance is underpinned by a substantial one-off gain of CN¥134.5M, which skews the earnings figure but still highlights potential operational strengths or strategic maneuvers that could have long-term benefits. Despite a forecasted revenue growth rate of 17% per year, which lags behind the ideal high-growth benchmark of 20%, ZwsoftLtd remains ahead of the broader CN market growth expectation of 13.6%. The company also actively engages in shareholder value activities, as evidenced by its recent share buyback program where it repurchased shares for CNY 2.92 million. While its Return on Equity is projected to be modest at 5.5% in three years, these figures collectively suggest that ZwsoftLtd is navigating its market with strategic agility—balancing between immediate financial gains and steady market expansion.

- Click to explore a detailed breakdown of our findings in ZwsoftLtd's health report.

Examine ZwsoftLtd's past performance report to understand how it has performed in the past.

Sinocelltech Group (SHSE:688520)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sinocelltech Group Limited is a biotech company focused on the R&D and industrialization of recombinant proteins, monoclonal antibodies, and vaccines in China, with a market cap of approximately CN¥16.13 billion.

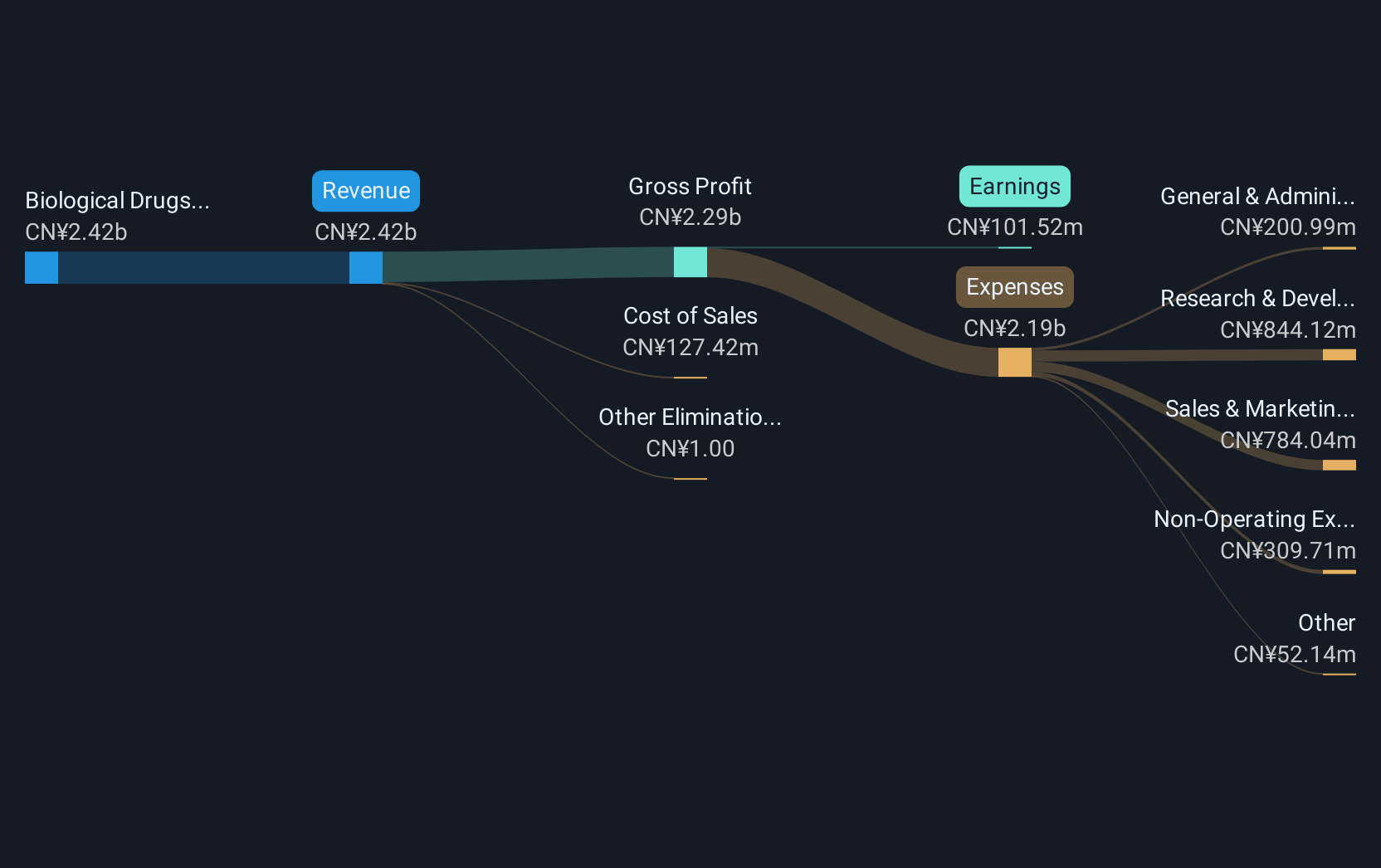

Operations: Sinocelltech Group generates revenue primarily from its biological drugs segment, which includes drugs and vaccines, totaling approximately CN¥2.45 billion. The company is involved in the research and development of recombinant proteins, monoclonal antibodies, and vaccines within China.

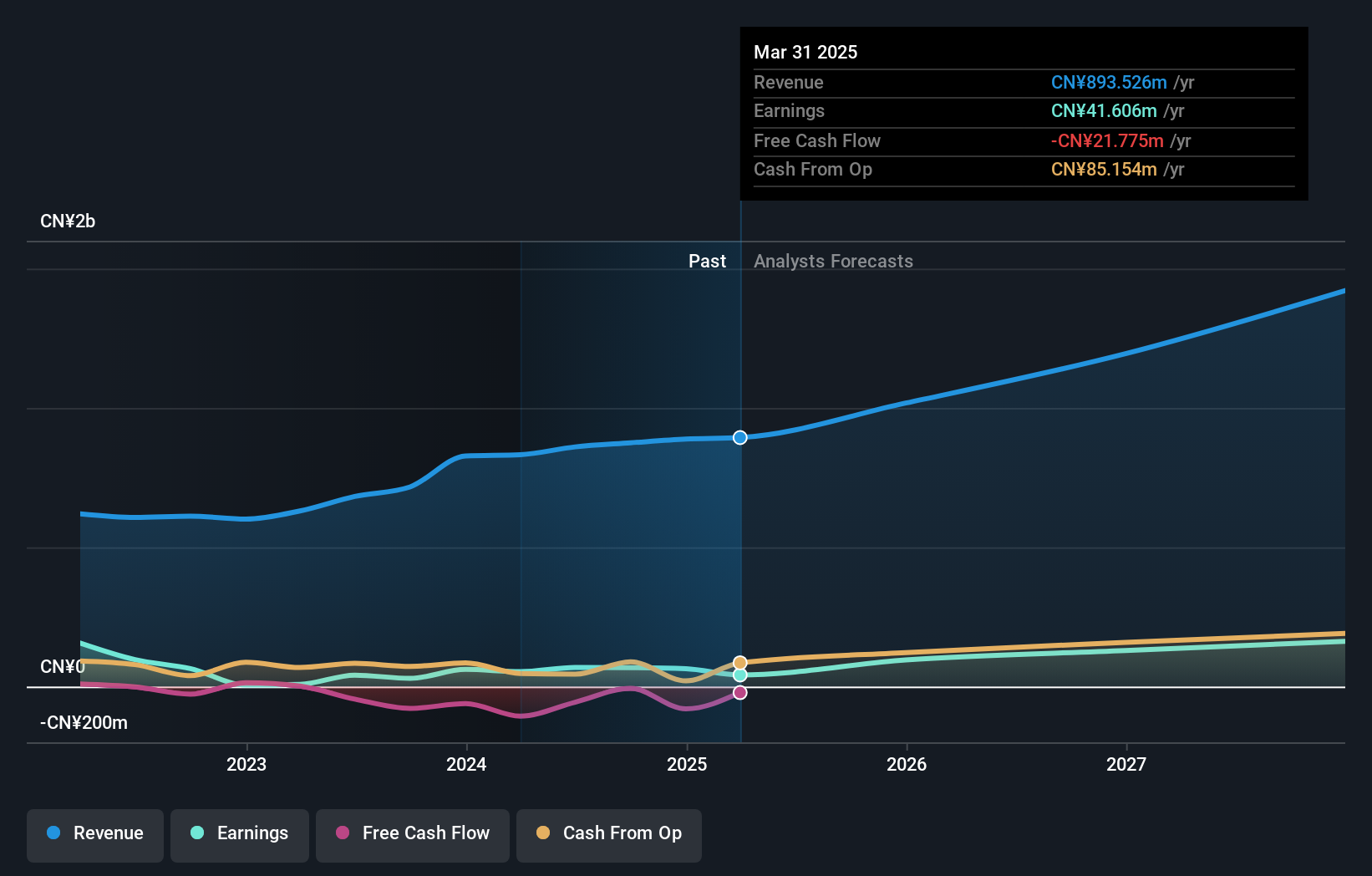

Sinocelltech Group has demonstrated a remarkable turnaround, evidenced by its latest earnings report showing net income of CN¥149.95 million, a significant rebound from the previous year's net loss of CN¥219.96 million. This financial recovery is propelled by a robust annual revenue growth rate of 28%, surpassing the broader Chinese market's expectation of 13.6%. Moreover, the company's commitment to innovation is underscored by its substantial R&D investments, which have strategically positioned it for sustained growth in biotechnology—a sector where rapid advancements are critical for maintaining competitive edge and meeting evolving healthcare demands.

- Dive into the specifics of Sinocelltech Group here with our thorough health report.

Understand Sinocelltech Group's track record by examining our Past report.

Wenzhou Yihua Connector (SZSE:002897)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wenzhou Yihua Connector Co., Ltd. focuses on the research, development, manufacture, and sale of communication connectors and components in China, with a market capitalization of approximately CN¥8.02 billion.

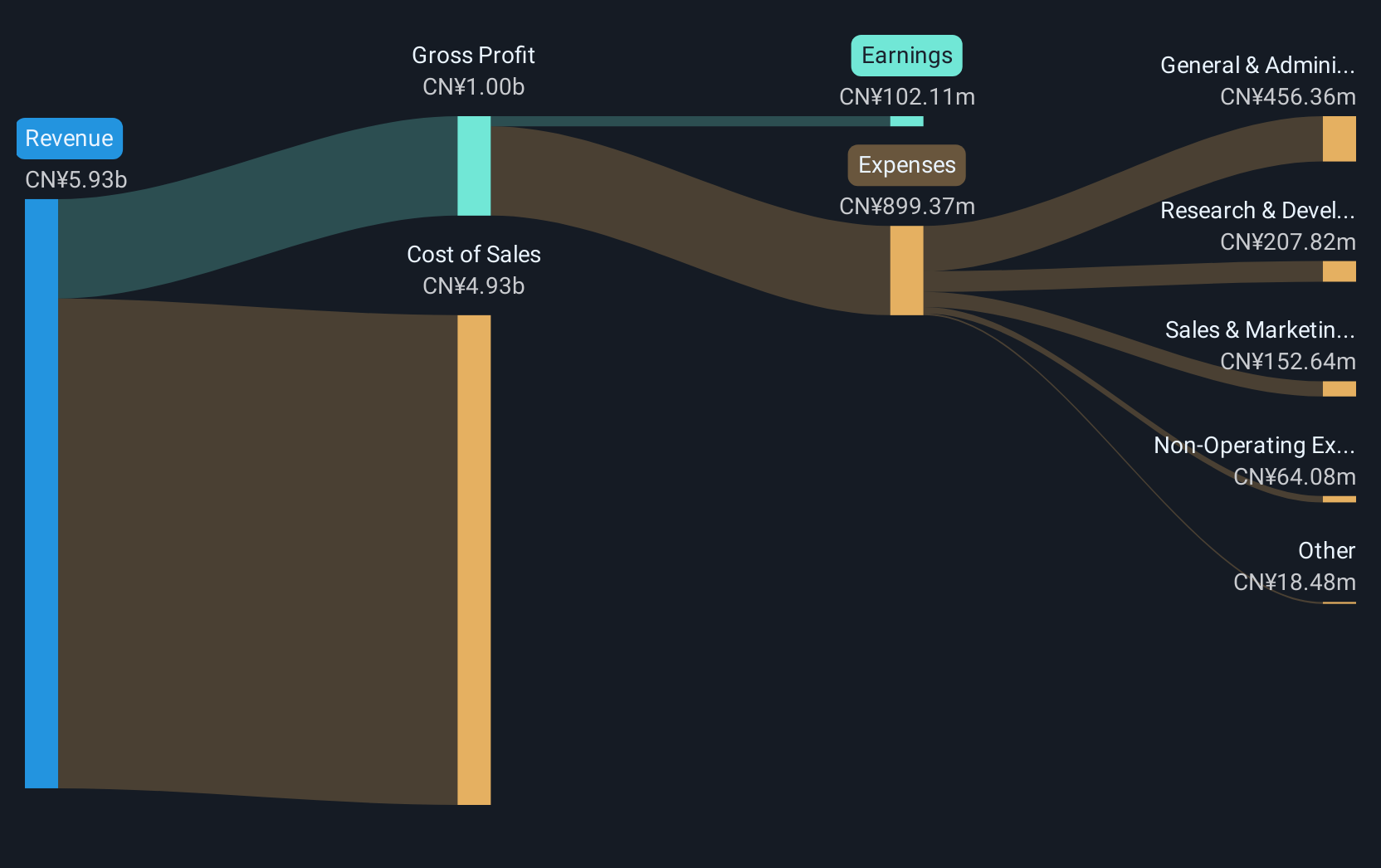

Operations: The company generates revenue primarily through its Connector and Stents for Solar Power segments, with the latter contributing a larger share at CN¥3.70 billion compared to CN¥2.10 billion from connectors.

Wenzhou Yihua Connector is poised for robust growth, with its earnings projected to surge by 30.6% annually, outpacing the broader Chinese market's average of 25.2%. This growth trajectory is underpinned by a solid revenue increase of 19.7% per year, significantly ahead of the market expectation of 13.6%. Recent governance enhancements and strategic leadership appointments signal a strengthened corporate framework, likely bolstering future performance in the competitive electronics sector where innovation and agile management are crucial for success.

- Click here to discover the nuances of Wenzhou Yihua Connector with our detailed analytical health report.

Assess Wenzhou Yihua Connector's past performance with our detailed historical performance reports.

Make It Happen

- Discover the full array of 1266 High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688520

Sinocelltech Group

A biotech company, engages in the research and development, and industrialization of recombinant proteins, monoclonal antibodies, and innovative vaccines in China.

High growth potential low.

Market Insights

Community Narratives