There's Reason For Concern Over Beijing Baolande Software Corporation's (SHSE:688058) Massive 35% Price Jump

Beijing Baolande Software Corporation (SHSE:688058) shareholders are no doubt pleased to see that the share price has bounced 35% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

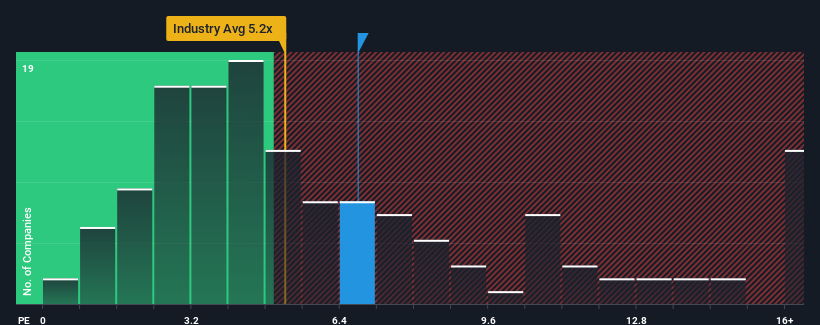

Following the firm bounce in price, when almost half of the companies in China's Software industry have price-to-sales ratios (or "P/S") below 5.2x, you may consider Beijing Baolande Software as a stock probably not worth researching with its 6.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Beijing Baolande Software

How Beijing Baolande Software Has Been Performing

The revenue growth achieved at Beijing Baolande Software over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing Baolande Software's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Beijing Baolande Software's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. The strong recent performance means it was also able to grow revenue by 67% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 33% shows it's noticeably less attractive.

With this in mind, we find it worrying that Beijing Baolande Software's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Beijing Baolande Software shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Beijing Baolande Software currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Beijing Baolande Software that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Baolande Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688058

Beijing Baolande Software

Engages in the research and development, and sale of enterprise-level middleware and other infrastructure software products.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives