As global markets navigate a landscape marked by the European Central Bank's rate cuts and steady U.S. Federal Reserve policies, technology stocks in particular have faced volatility due to competitive pressures from emerging AI developers like China's DeepSeek. Despite these challenges, identifying high growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability in response to shifting market dynamics and economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 1233 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

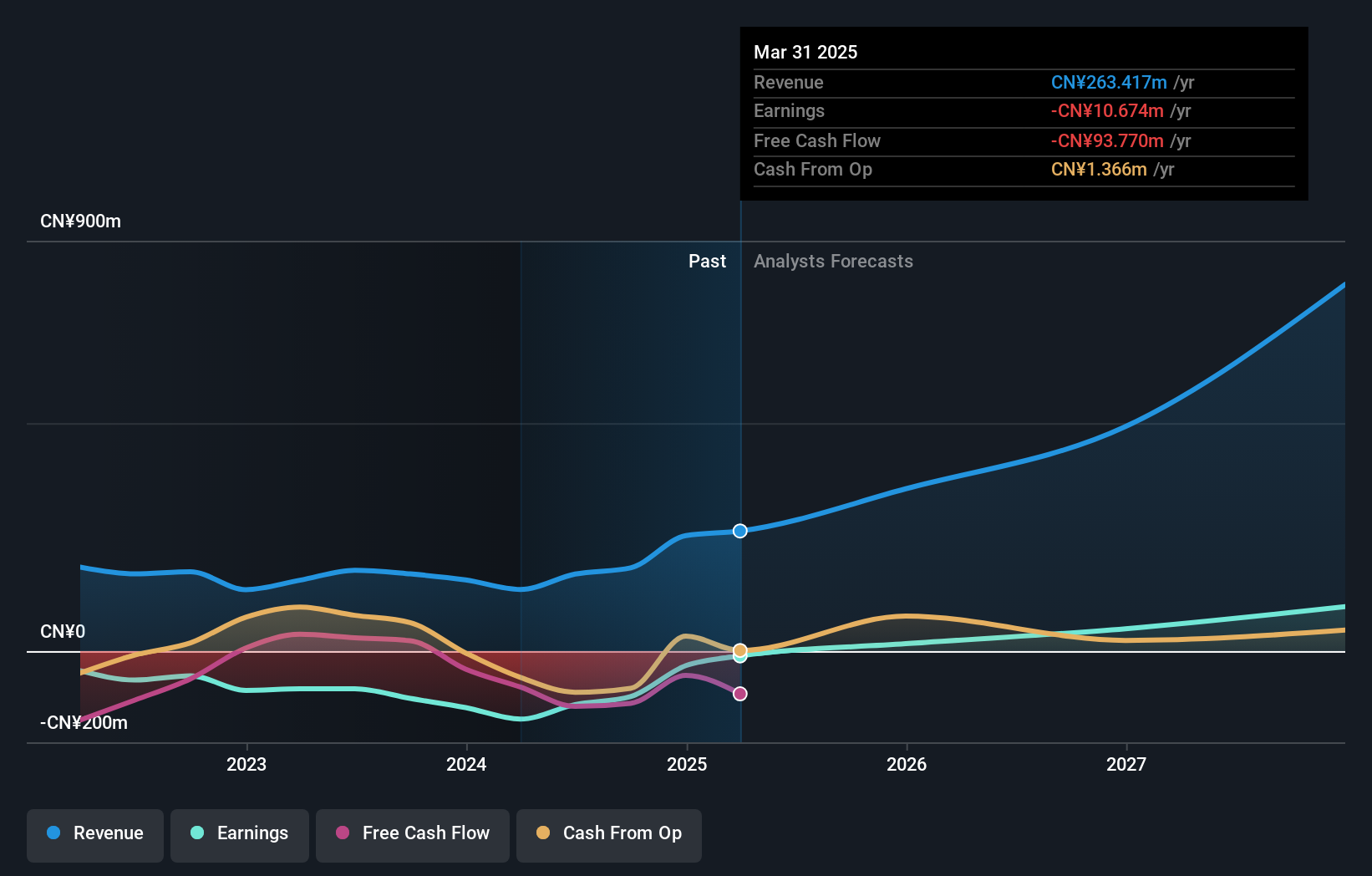

Appotronics (SHSE:688007)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Appotronics Corporation Limited focuses on the research, development, production, sale, and leasing of laser display devices and machines in China with a market capitalization of CN¥6.41 billion.

Operations: Appotronics Corporation Limited specializes in laser display technology, offering products through research, development, production, sales, and leasing activities. The company operates primarily within China and has a market capitalization of approximately CN¥6.41 billion.

Appotronics, demonstrating robust growth in the tech sector, is poised to capitalize on its recent strategic partnership with Ceres Holographics aimed at revolutionizing in-car display solutions. With an impressive annual revenue growth forecast at 21.5% and earnings expected to surge by 90.1% per year, the company's commitment to innovation is evident through substantial R&D investments amounting to CN¥3.5M last year. Despite a slight dip in profit margins from 6.8% to 0.8%, this collaboration could enhance Appotronics' market position by integrating advanced ALPD® technology with Ceres' HoloFlext™ manufacturing for next-gen vehicle displays, potentially boosting future profitability and market share in a high-growth industry.

- Click here and access our complete health analysis report to understand the dynamics of Appotronics.

Assess Appotronics' past performance with our detailed historical performance reports.

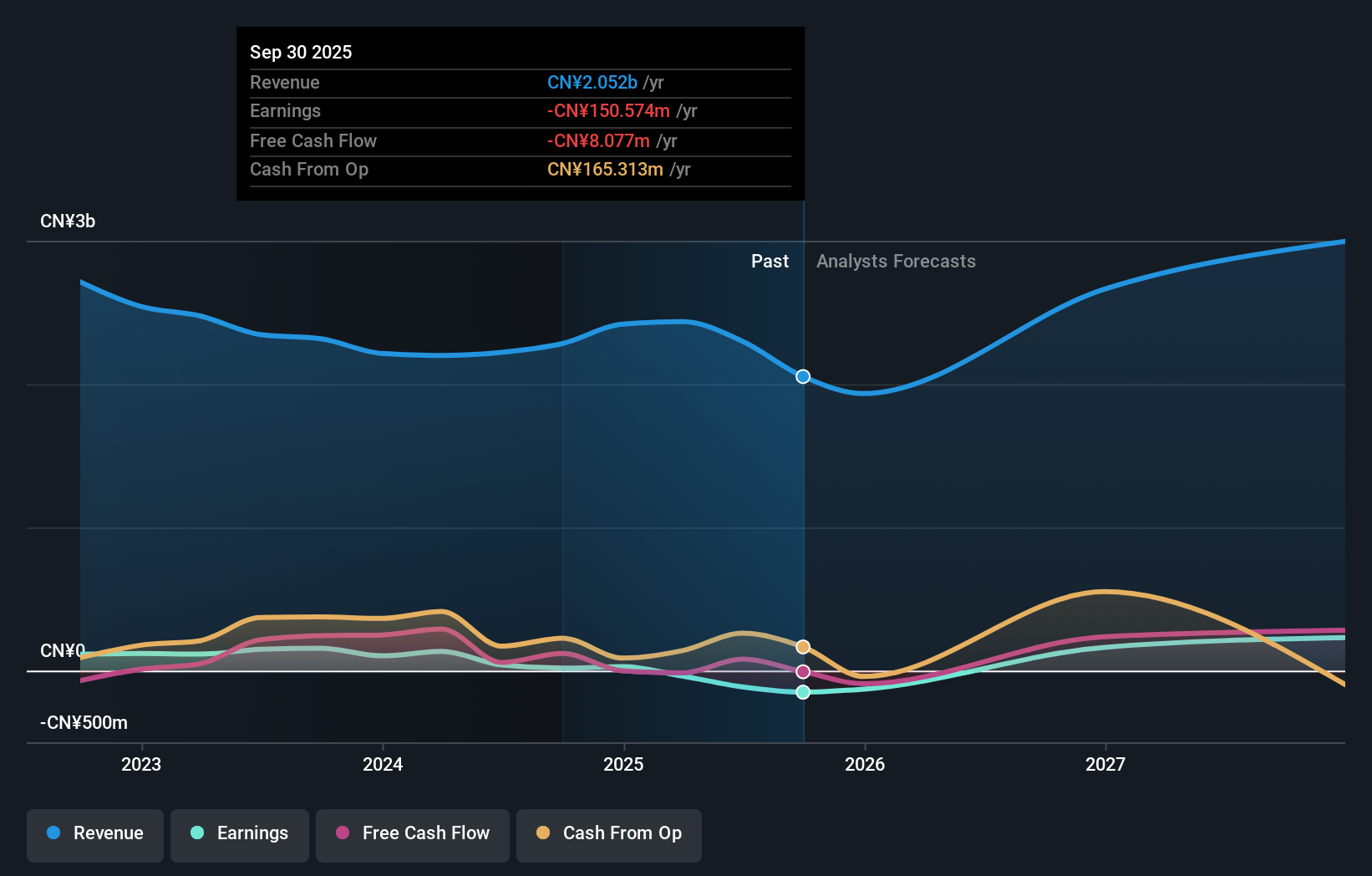

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. specializes in manufacturing quantum information technology-enabled security products and services for the information and communication technology sector in China, with a market cap of CN¥20.95 billion.

Operations: The company focuses on producing quantum information technology-based security solutions for China's ICT sector. With a market capitalization of CN¥20.95 billion, it leverages advanced quantum technologies to enhance data protection and secure communication networks.

QuantumCTek is navigating a transformative phase with anticipated revenue growth of 24.3% annually, outpacing the Chinese market's average of 13.3%. This growth trajectory is supported by an expected surge in earnings, projected at an annual increase of 106.5%. However, the company's current unprofitability and highly volatile share price present challenges. The recent special shareholders meeting could signal strategic shifts aiming to stabilize and capitalize on these robust growth forecasts. QuantumCTek's commitment to becoming profitable within three years showcases its potential to leverage emerging tech trends effectively despite existing financial hurdles.

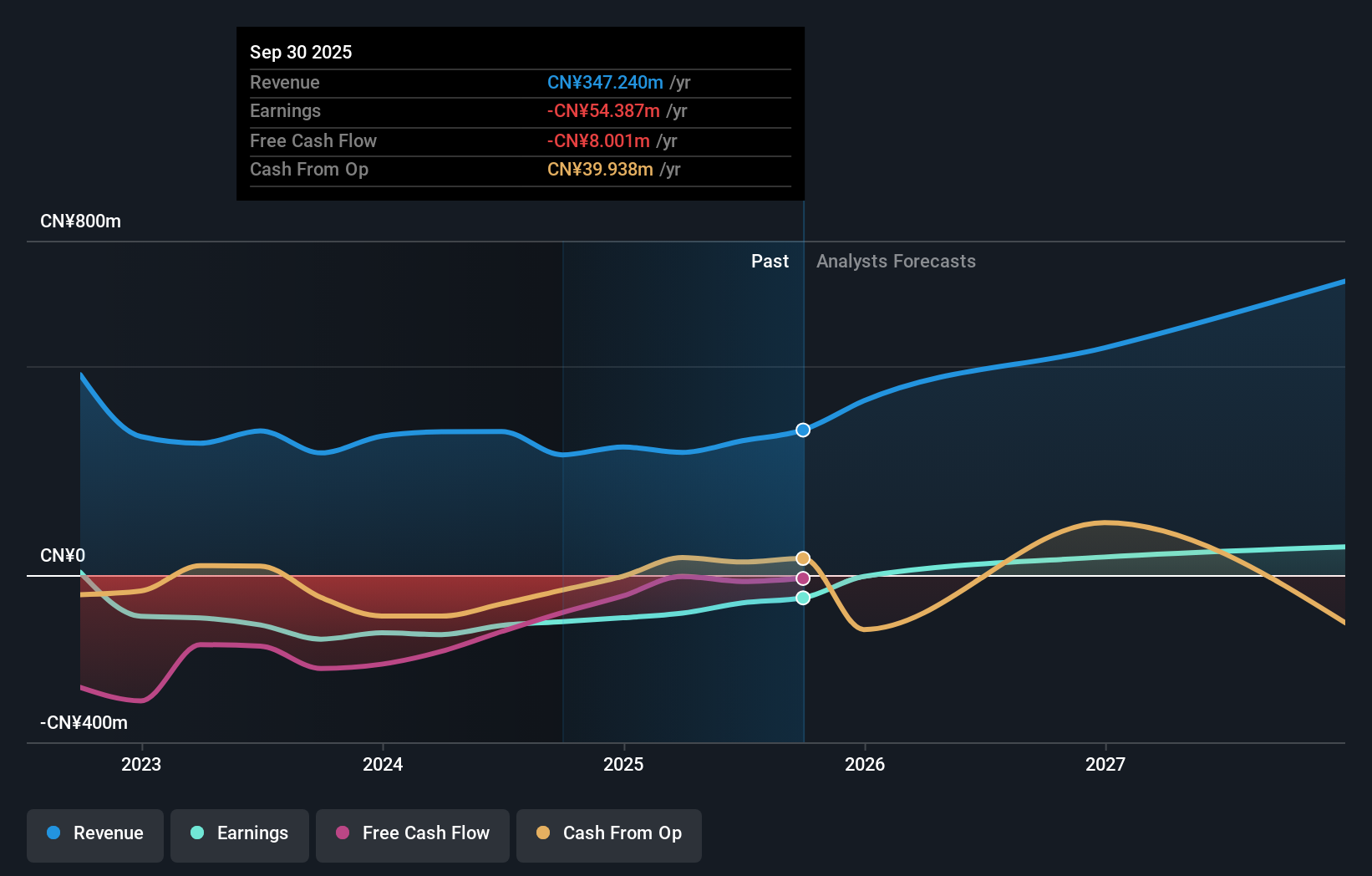

Hangzhou Arcvideo Technology (SHSE:688039)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Arcvideo Technology Co., Ltd. offers smart and secure video solutions along with video cloud services for media platforms, with a market cap of CN¥3.02 billion.

Operations: Arcvideo Technology focuses on delivering advanced video solutions and cloud services tailored for media platforms. The company operates with a market capitalization of CN¥3.02 billion, reflecting its position in the technology sector.

Hangzhou Arcvideo Technology, with a forecasted annual revenue growth of 27.9%, is outperforming the Chinese market average of 13.3%. This robust expansion is supported by an anticipated earnings surge of 124.1% per year, positioning the firm well above typical market growth rates. Despite its current lack of profitability and a highly volatile share price, Arcvideo's aggressive investment in R&D—evidenced by substantial expenditures that align closely with its revenue spikes—signals a clear strategy to harness cutting-edge tech advancements and secure a competitive edge in the software industry. The company's recent earnings call highlighted these points, suggesting potential strategic shifts to stabilize and leverage future growth opportunities effectively.

Summing It All Up

- Click here to access our complete index of 1233 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Arcvideo Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688039

Hangzhou Arcvideo Technology

Provides smart and secure video solutions and video cloud services for media platforms.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives