Hillstone NetworksLtd (SHSE:688030) adds CN¥274m to market cap in the past 7 days, though investors from five years ago are still down 73%

Hillstone Networks Co.,Ltd. (SHSE:688030) shareholders should be happy to see the share price up 16% in the last month. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 74% in that time. The recent bounce might mean the long decline is over, but we are not confident. The real question is whether the business can leave its past behind and improve itself over the years ahead.

While the last five years has been tough for Hillstone NetworksLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Hillstone NetworksLtd

Hillstone NetworksLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Hillstone NetworksLtd saw its revenue increase by 6.0% per year. That's a pretty good rate for a long time period. So the stock price fall of 12% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

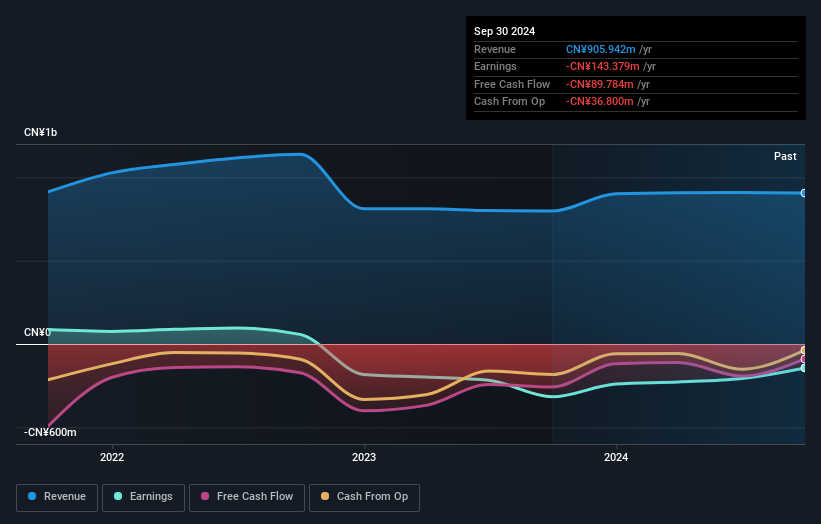

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Hillstone NetworksLtd's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Hillstone NetworksLtd shareholders have received a total shareholder return of 46% over the last year. That certainly beats the loss of about 12% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Hillstone NetworksLtd (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hillstone NetworksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688030

Hillstone NetworksLtd

Provides an infrastructure protection solutions to enterprises and service providers.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives