Even With A 26% Surge, Cautious Investors Are Not Rewarding DBAPPSecurity Co., Ltd.'s (SHSE:688023) Performance Completely

DBAPPSecurity Co., Ltd. (SHSE:688023) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 66% share price drop in the last twelve months.

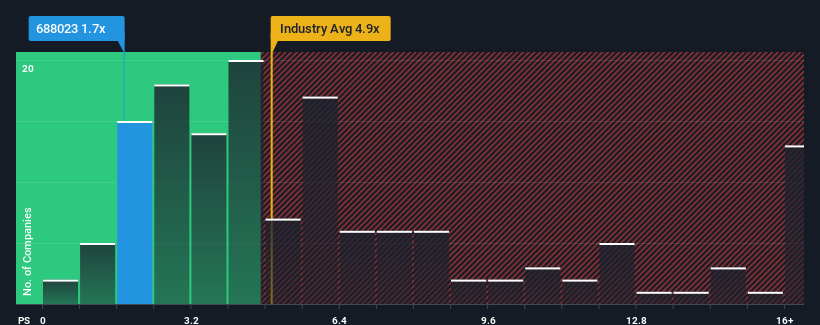

In spite of the firm bounce in price, DBAPPSecurity may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.7x, since almost half of all companies in the Software industry in China have P/S ratios greater than 4.9x and even P/S higher than 8x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for DBAPPSecurity

What Does DBAPPSecurity's Recent Performance Look Like?

There hasn't been much to differentiate DBAPPSecurity's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DBAPPSecurity.How Is DBAPPSecurity's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like DBAPPSecurity's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 48% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 22% each year over the next three years. That's shaping up to be similar to the 21% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that DBAPPSecurity's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

DBAPPSecurity's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that DBAPPSecurity currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for DBAPPSecurity with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688023

DBAPPSecurity

Engages in the research and development, manufacture, and sale of cybersecurity products in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives