Tencent Holdings Alibaba Group And Baidu Among China's High Growth Tech Stocks

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and mixed performance in major indices, Chinese equities have also faced challenges, with the Shanghai Composite Index and the blue-chip CSI 300 both experiencing declines. Despite this volatility, high-growth tech stocks like Tencent Holdings, Alibaba Group, and Baidu continue to capture investor interest due to their potential for innovation and market leadership in China's rapidly evolving digital landscape.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 33.08% | 31.98% | ★★★★★★ |

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Zhongji Innolight | 32.38% | 31.76% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.63% | 28.58% | ★★★★★★ |

| Eoptolink Technology | 44.12% | 41.49% | ★★★★★★ |

| Wanma Technology | 35.58% | 47.75% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Linewell Software (SHSE:603636)

Simply Wall St Growth Rating: ★★★★★☆

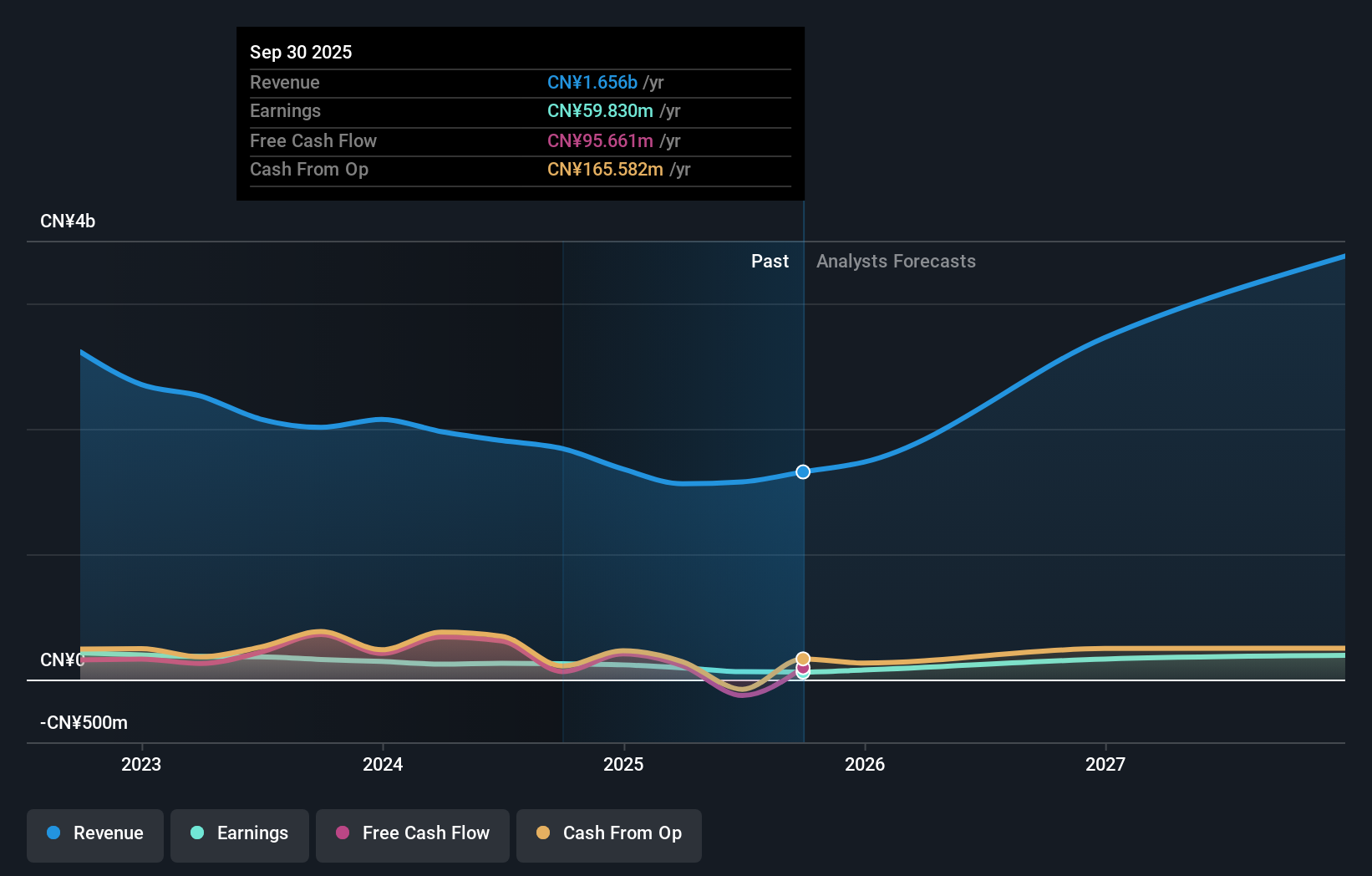

Overview: Linewell Software Co., Ltd. engages in software development and system integration services in China, with a market cap of CN¥5 billion.

Operations: Linewell Software Co., Ltd. focuses on software development and system integration services in China. The company generates revenue from these core activities, leveraging its expertise in the tech sector to serve various clients.

Linewell Software's revenue is projected to grow at 22.4% annually, outpacing the broader Chinese market's 13.3%. Despite a net loss of ¥114.77 million for the first half of 2024, earnings are expected to increase by 62.1% per year, indicating robust future growth potential. The company's R&D expenses reflect its commitment to innovation and development in AI and software solutions, essential for maintaining competitive advantage in a rapidly evolving tech landscape.

- Take a closer look at Linewell Software's potential here in our health report.

Assess Linewell Software's past performance with our detailed historical performance reports.

Anhui XDLK Microsystem (SHSE:688582)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui XDLK Microsystem Corporation Limited engages in the research and development, production, and sale of sensors in China with a market cap of CN¥13.52 billion.

Operations: The company generates revenue primarily from its Electronic Test & Measurement Instruments segment, amounting to CN¥357.73 million. Gross profit margin for this segment is 45%.

Anhui XDLK Microsystem's revenue is forecast to grow at 38.3% annually, significantly outpacing the broader Chinese market's 13.3%. The company's earnings are expected to increase by 35.6% per year, showcasing strong growth potential compared to the CN market's 23.2%. For the first half of 2024, sales reached ¥137.32 million, up from ¥96.68 million a year ago, while net income rose to ¥56.45 million from ¥40.89 million in the same period last year—reflecting robust performance and efficient operations. Investments in R&D are pivotal for Anhui XDLK Microsystem; their commitment is evident with substantial expenditure aimed at advancing AI and software innovations crucial for staying competitive in a rapidly evolving tech landscape. With projected annual revenue growth of over 20%, Anhui XDLK stands poised to capitalize on emerging opportunities within China's high-growth tech sector while navigating industry challenges effectively.

- Get an in-depth perspective on Anhui XDLK Microsystem's performance by reading our health report here.

Evaluate Anhui XDLK Microsystem's historical performance by accessing our past performance report.

Shenzhen Phoenix Telecom TechnologyLtd (SZSE:301191)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Phoenix Telecom Technology Co., Ltd. (ticker: SZSE:301191) operates in the telecommunications technology sector and has a market cap of CN¥4.50 billion.

Operations: Phoenix Telecom generates revenue primarily from the sale of telecommunications equipment and related services. The company focuses on providing advanced technology solutions for network infrastructure, with significant investments in R&D to enhance product offerings.

Shenzhen Phoenix Telecom Technology Ltd. has seen a revenue growth forecast of 26.7% annually, significantly outpacing the broader Chinese market's 13.3%. Despite a recent 7.3% decline in net income for the half year ended June 30, 2024, R&D expenses have been a focal point, with substantial investments driving innovation in AI and software sectors—key to maintaining competitive advantage. Earnings are projected to grow at an impressive rate of 34.9% per year, reflecting strong future potential amidst industry challenges.

- Navigate through the intricacies of Shenzhen Phoenix Telecom TechnologyLtd with our comprehensive health report here.

Understand Shenzhen Phoenix Telecom TechnologyLtd's track record by examining our Past report.

Taking Advantage

- Unlock our comprehensive list of 256 Chinese High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603636

Linewell Software

Provides artificial intelligence and data services in China.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion