Revenues Working Against Zhongtong Guomai Communication Co., Ltd.'s (SHSE:603559) Share Price Following 26% Dive

Unfortunately for some shareholders, the Zhongtong Guomai Communication Co., Ltd. (SHSE:603559) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

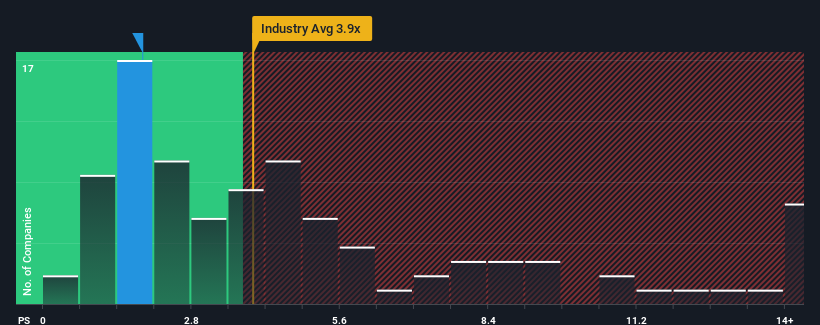

Since its price has dipped substantially, Zhongtong Guomai Communication may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.9x, since almost half of all companies in the IT industry in China have P/S ratios greater than 3.9x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Zhongtong Guomai Communication

What Does Zhongtong Guomai Communication's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Zhongtong Guomai Communication over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Zhongtong Guomai Communication will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhongtong Guomai Communication's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Zhongtong Guomai Communication?

The only time you'd be truly comfortable seeing a P/S as depressed as Zhongtong Guomai Communication's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 56% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 43% shows it's an unpleasant look.

With this in mind, we understand why Zhongtong Guomai Communication's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Having almost fallen off a cliff, Zhongtong Guomai Communication's share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Zhongtong Guomai Communication revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Zhongtong Guomai Communication (1 is potentially serious!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Zhongtong Guomai Communication, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhongtong Guomai Communication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603559

Zhongtong Guomai Communication

Provides communication engineering construction services to telecommunication operators in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives