Revenues Not Telling The Story For Zhongtong Guomai Communication Co., Ltd. (SHSE:603559) After Shares Rise 28%

Zhongtong Guomai Communication Co., Ltd. (SHSE:603559) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

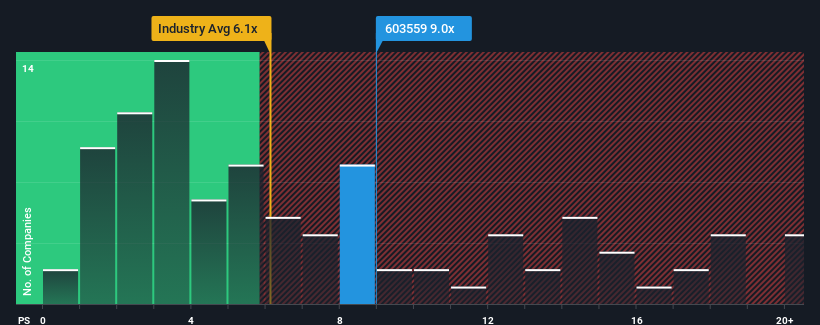

Following the firm bounce in price, Zhongtong Guomai Communication's price-to-sales (or "P/S") ratio of 9x might make it look like a sell right now compared to the wider IT industry in China, where around half of the companies have P/S ratios below 6.1x and even P/S below 3x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Zhongtong Guomai Communication

What Does Zhongtong Guomai Communication's P/S Mean For Shareholders?

The revenue growth achieved at Zhongtong Guomai Communication over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Zhongtong Guomai Communication, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Zhongtong Guomai Communication's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 26% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 17% shows it's an unpleasant look.

In light of this, it's alarming that Zhongtong Guomai Communication's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Zhongtong Guomai Communication's P/S Mean For Investors?

Zhongtong Guomai Communication shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhongtong Guomai Communication currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Zhongtong Guomai Communication that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhongtong Guomai Communication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603559

Zhongtong Guomai Communication

Provides communication engineering construction services to telecommunication operators in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives