As global markets navigate a choppy start to 2025, characterized by inflation concerns and political uncertainties, investors are keenly observing the impact of economic data on stock performance. In such a volatile environment, growth companies with high insider ownership can be particularly appealing due to the potential alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 35.8% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Apex Software Co., LTD is a professional platform software and information service provider in China with a market cap of CN¥7.13 billion.

Operations: The company generates revenue from its Application Software Service Industry segment, totaling CN¥707.34 million.

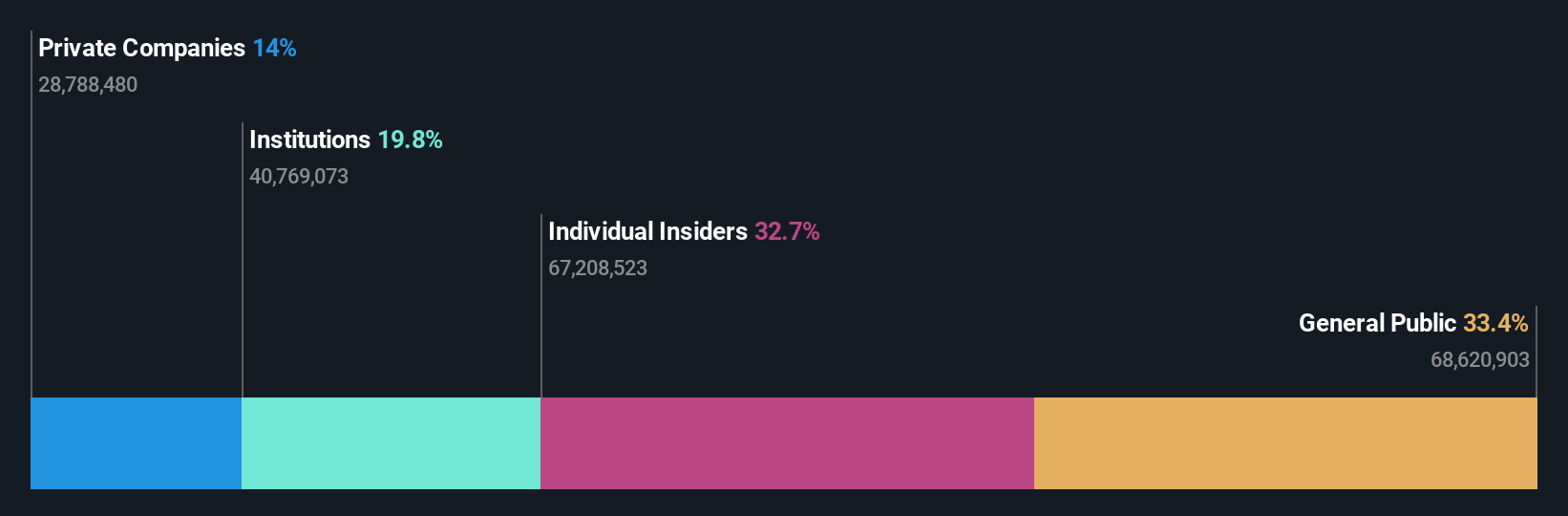

Insider Ownership: 32.7%

Earnings Growth Forecast: 22.6% p.a.

Fujian Apex SoftwareLTD exhibits promising growth prospects, with earnings expected to grow at 22.61% annually, although slightly below the market average. Despite a decline in recent sales and net income—CNY 420.63 million and CNY 101.24 million respectively—the company's price-to-earnings ratio of 33.2x suggests it is undervalued compared to industry peers. While dividends are not well-covered by earnings, substantial insider ownership could align management interests with shareholders for long-term growth potential.

- Delve into the full analysis future growth report here for a deeper understanding of Fujian Apex SoftwareLTD.

- In light of our recent valuation report, it seems possible that Fujian Apex SoftwareLTD is trading behind its estimated value.

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Fangbang Electronics Co., Ltd is involved in the research, development, production, sale, and service of electronic materials in China with a market cap of CN¥2.73 billion.

Operations: Guangzhou Fangbang Electronics Co., Ltd generates its revenue through the research, development, production, sale, and service of electronic materials in China.

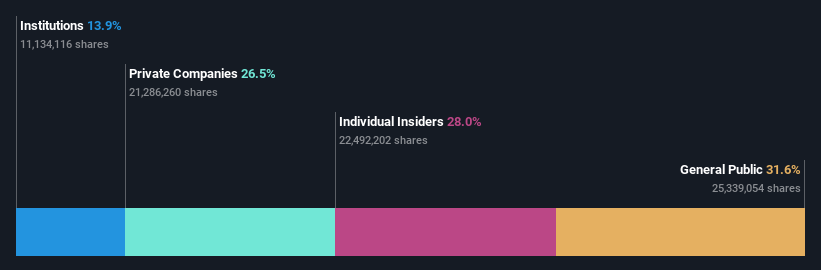

Insider Ownership: 28.2%

Earnings Growth Forecast: 237.8% p.a.

Guangzhou Fangbang Electronics Ltd. is poised for significant growth, with revenue expected to rise 60.9% annually, outpacing the Chinese market average. Despite a recent net loss of CNY 39.63 million for nine months ending September 2024, the company is projected to achieve profitability within three years, surpassing average market growth rates. Trading at a substantial discount to its estimated fair value suggests potential upside as insider ownership aligns management and shareholder interests.

- Click here to discover the nuances of Guangzhou Fangbang ElectronicsLtd with our detailed analytical future growth report.

- The analysis detailed in our Guangzhou Fangbang ElectronicsLtd valuation report hints at an inflated share price compared to its estimated value.

Shenzhen WOTE Advanced MaterialsLtd (SZSE:002886)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen WOTE Advanced Materials Co., Ltd is involved in the research, development, production, and sale of polymer materials and engineering plastic products both in China and internationally, with a market cap of CN¥4.13 billion.

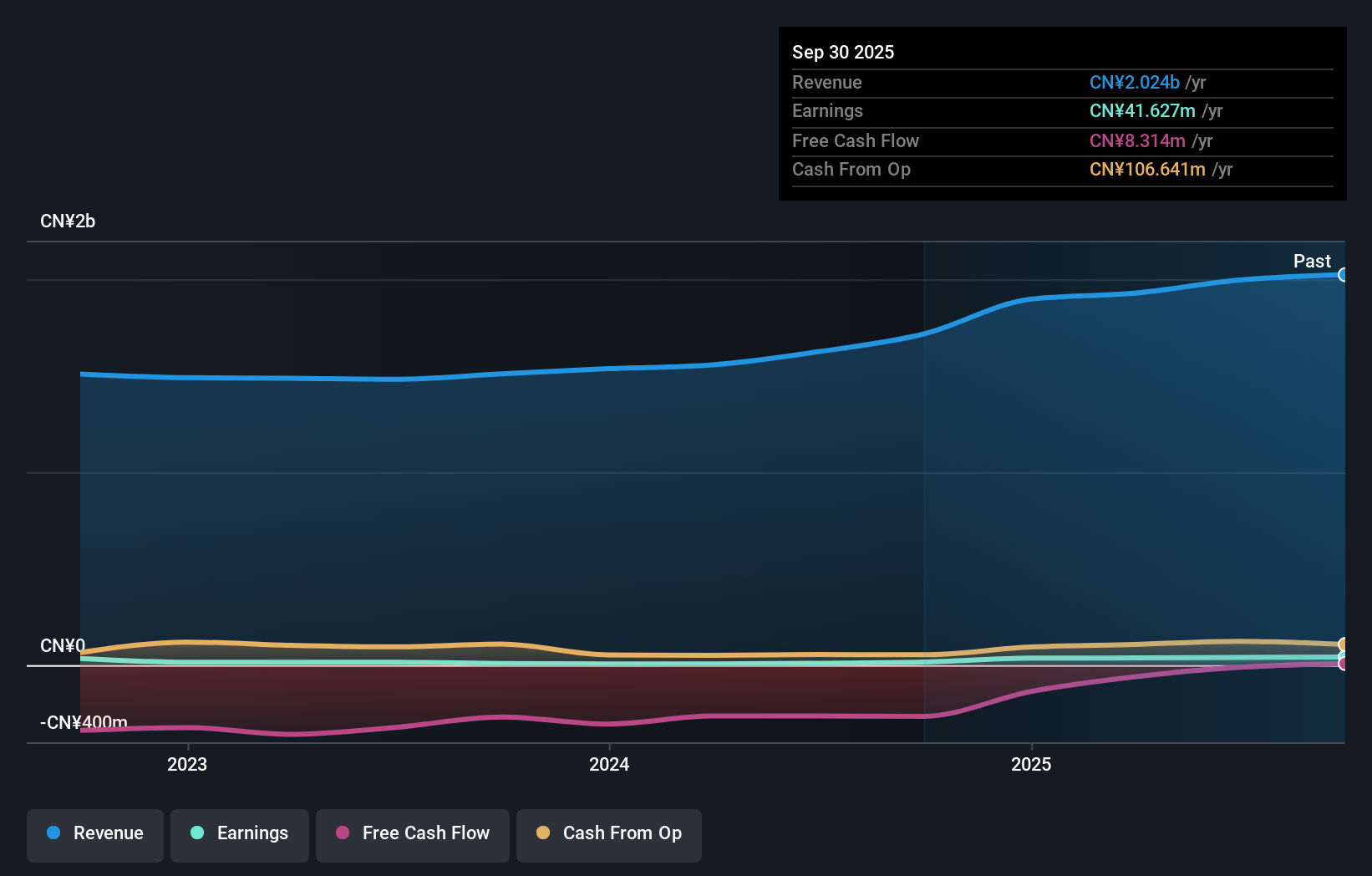

Operations: The company generates revenue from the New Material Industry segment, amounting to CN¥1.72 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 90.9% p.a.

Shenzhen WOTE Advanced Materials Ltd. has shown robust revenue growth, reporting CNY 1,287.4 million for the first nine months of 2024, up from CNY 1,107.04 million the previous year. Earnings are forecast to grow significantly at 90.92% annually, outpacing market averages. However, interest payments remain inadequately covered by earnings and large one-off items impact financial results. Despite low future return on equity forecasts and no recent insider trading activity reported, high insider ownership supports alignment with shareholders' interests.

- Navigate through the intricacies of Shenzhen WOTE Advanced MaterialsLtd with our comprehensive analyst estimates report here.

- Our valuation report here indicates Shenzhen WOTE Advanced MaterialsLtd may be overvalued.

Summing It All Up

- Embark on your investment journey to our 1438 Fast Growing Companies With High Insider Ownership selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002886

Shenzhen WOTE Advanced MaterialsLtd

Engages in the research, development, production, sale, of polymer materials and engineering plastic products in China and internationally.

Acceptable track record with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion