- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:700

Exploring 3 High Growth Tech Stocks with Strong Potential

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record levels, investors are closely watching how domestic policies and geopolitical factors might influence future market dynamics. In this environment, high-growth tech stocks stand out for their potential to thrive by leveraging innovation and adapting swiftly to changing economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 22.02% | 28.64% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services both in China and internationally, with a market capitalization of approximately HK$3.71 trillion.

Operations: Tencent generates revenue primarily through Value-Added Services (CN¥309.23 billion), Fintech and Business Services (CN¥210.21 billion), and Marketing Services (CN¥116.16 billion). The company operates extensively in China and internationally, leveraging its diverse portfolio to drive growth across various sectors.

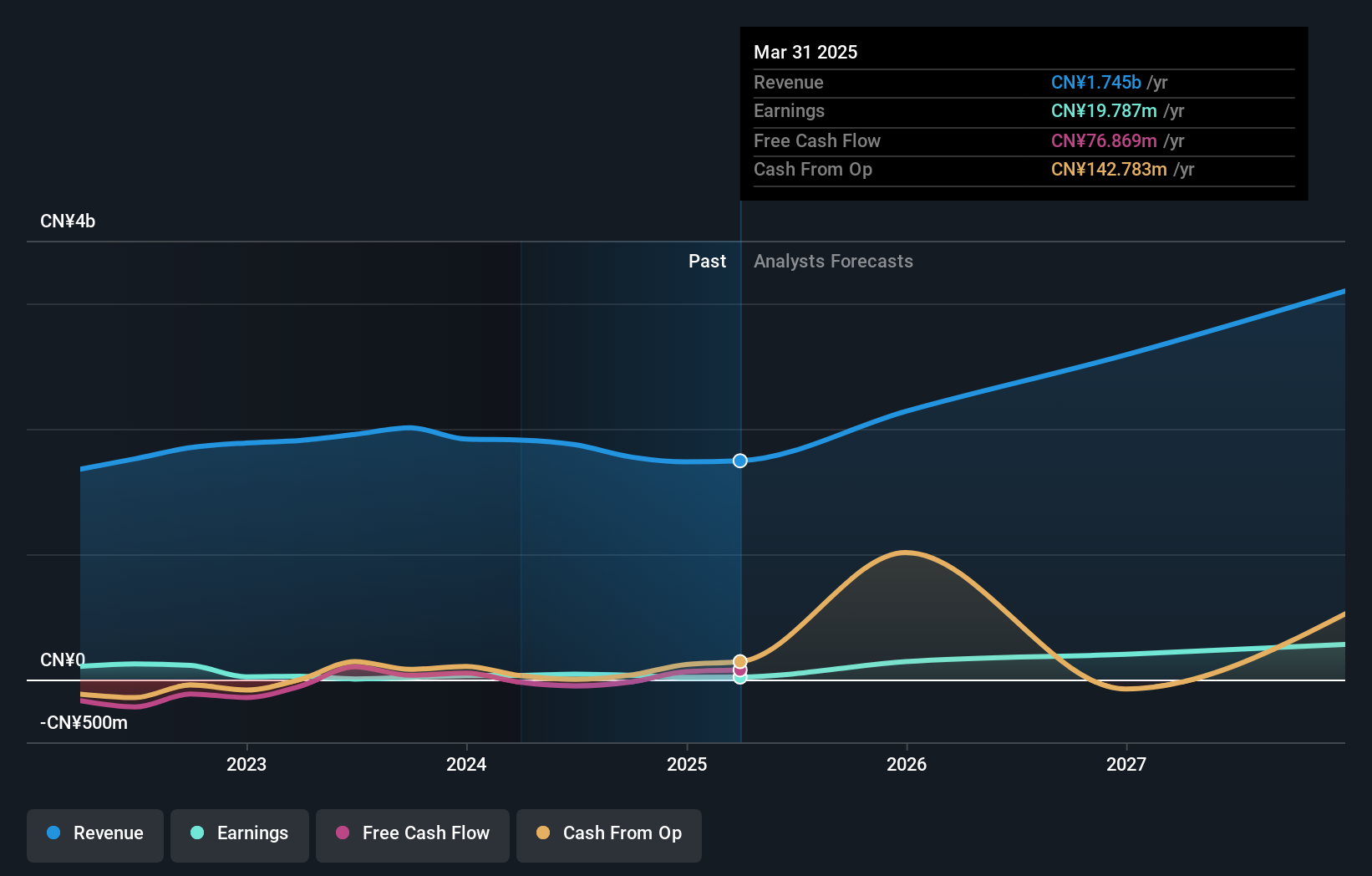

Tencent Holdings has demonstrated a robust commitment to innovation, particularly through its recent launch of the CarbonX Program 2.0, aiming to accelerate global decarbonization technologies. This initiative not only underscores Tencent's dedication to sustainability but also aligns with its strategic growth in diverse tech sectors. Financially, the company reported a significant year-over-year increase in Q3 revenue to CNY 167.19 billion and net income of CNY 53.23 billion, reflecting an earnings surge from CNY 3.83 to CNY 5.76 per share. These figures highlight Tencent's ability to leverage its R&D investments effectively—evident from an R&D expense ratio that has consistently enhanced its innovative capacity and market competitiveness within the tech industry.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Apex Software Co., LTD is a professional platform software and information service provider company in China with a market capitalization of CN¥9.02 billion.

Operations: Apex Software generates revenue primarily from its application software service industry, amounting to CN¥707.34 million. The company focuses on providing specialized software and information services in China.

Fujian Apex Software Co., LTD, despite a slight revenue dip to CNY 420.63 million from CNY 457.21 million year-over-year, continues to innovate with a robust R&D focus. The company's commitment is reflected in its substantial investment in research and development, crucial for maintaining competitiveness in the fast-evolving tech landscape. With earnings forecasted to grow by an impressive 24.5% annually, Fujian Apex is strategically positioning itself within the software industry where technological advancements are paramount. Moreover, their recent dividend announcement underscores a commitment to shareholder returns amidst challenging market conditions.

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sunline Tech Co., Ltd. offers banking software and technology services to global banking and finance clients, with a market cap of CN¥13.52 billion.

Operations: Sunline Tech specializes in providing software and technology services tailored for the banking and finance sectors globally. The company's revenue model is primarily driven by its suite of banking software solutions, which cater to various financial institutions worldwide.

Shenzhen Sunline Tech has demonstrated notable growth, with a revenue increase to CNY 1,035.42 million and net income rising to CNY 3.98 million from the previous year's CNY 1.64 million. This financial uplift is part of a broader trend where its earnings are expected to surge by 56.6% annually, outpacing the industry average significantly. Moreover, the company's strategic amendments in corporate governance and substantial R&D spending underscore its commitment to innovation and market adaptability in a competitive tech landscape.

- Get an in-depth perspective on Shenzhen Sunline Tech's performance by reading our health report here.

Understand Shenzhen Sunline Tech's track record by examining our Past report.

Seize The Opportunity

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1279 more companies for you to explore.Click here to unveil our expertly curated list of 1282 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:700

Tencent Holdings

An investment holding company, provides value-added services, marketing services, fintech, and business services in Mainland China and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives