- China

- /

- Electronic Equipment and Components

- /

- SZSE:300667

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets experience fluctuations with key indices like the Nasdaq Composite reaching all-time highs and economic indicators showing mixed signals, the Asian tech sector continues to draw attention due to its dynamic growth potential. In this environment, identifying high-growth tech stocks involves looking at companies that can effectively navigate trade challenges and leverage strong demand for innovation in a rapidly evolving market landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 25.38% | 24.34% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 31.69% | 39.80% | ★★★★★★ |

| Gold Circuit Electronics | 26.63% | 32.83% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.08% | ★★★★★★ |

| Naruida Technology | 47.72% | 54.38% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

We'll examine a selection from our screener results.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Vastdata Technology Co., Ltd. specializes in providing database services in China and has a market capitalization of CN¥4.62 billion.

Operations: Vastdata Technology generates revenue primarily from its Software and Information Technology Services segment, totaling CN¥388.84 million. The company focuses on delivering specialized database solutions within China.

Beijing Vastdata Technology, amidst a challenging financial landscape marked by its current unprofitability, is demonstrating significant potential with an expected revenue surge of 37.4% annually. This growth trajectory surpasses the broader Chinese market's average of 12.7%. The company's strategic focus on innovation is evident from its aggressive investment in R&D, aligning with industry shifts towards more sustainable and advanced tech solutions. Despite not yet generating positive free cash flow, forecasts predict a robust annual earnings growth of 105.55%, positioning it for profitability within three years. Recent shareholder meetings underscore a proactive approach to governance and strategic planning, enhancing investor confidence in its future direction.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

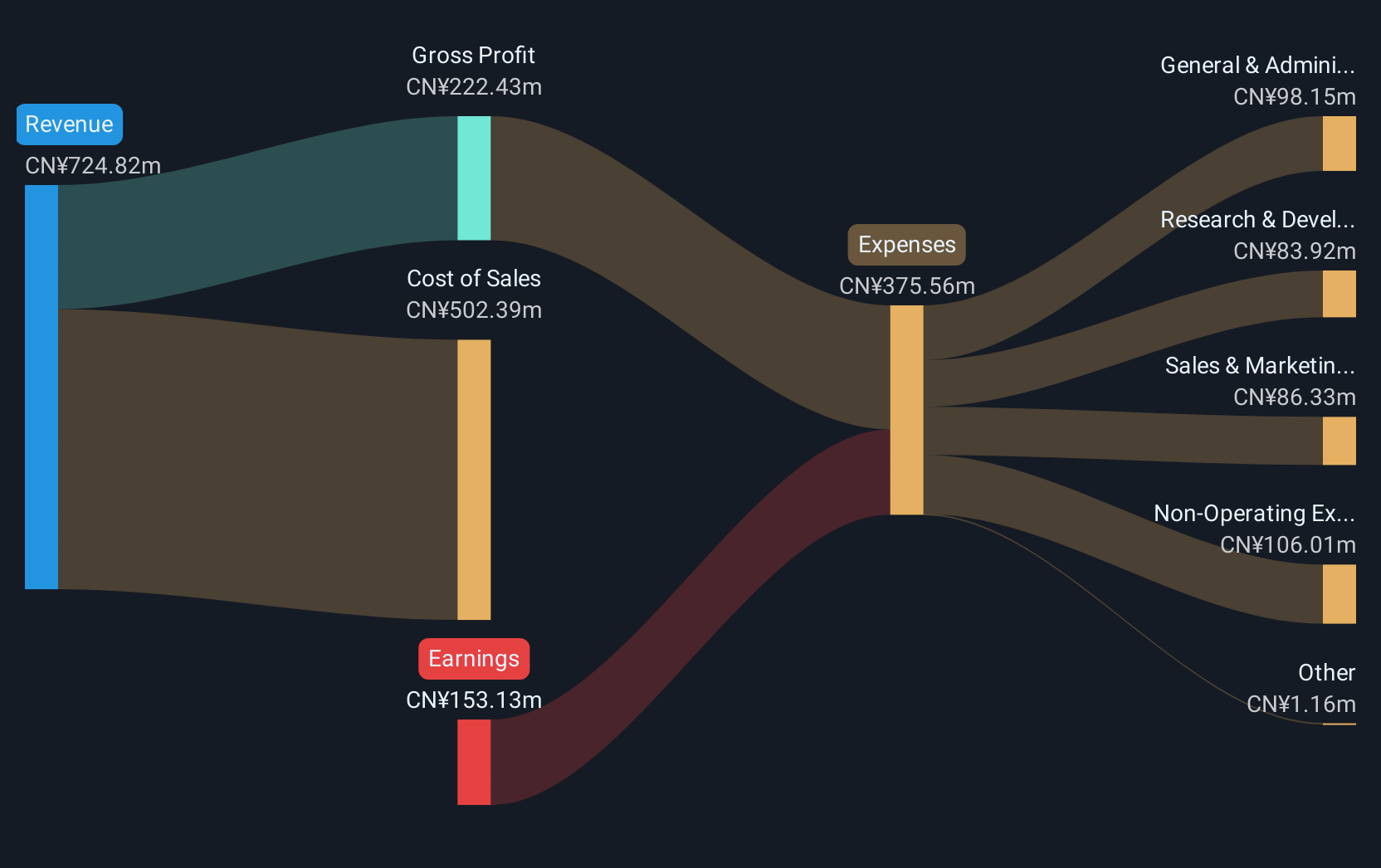

Overview: Beijing Beetech Inc. is engaged in the production and sale of smart sensors and optoelectronic instrument products, with a market capitalization of CN¥3.46 billion.

Operations: The company focuses on the production and sale of smart sensors and optoelectronic instrument products. It operates with a market capitalization of CN¥3.46 billion.

Beijing Beetech is carving out a strong position in the high-growth tech sector in Asia, with an anticipated revenue increase of 15.2% annually. This growth rate notably surpasses the broader Chinese market's average of 12.7%. The company's commitment to innovation is underscored by its substantial R&D spending, which aligns with shifts toward more sophisticated and sustainable technology solutions. Despite current unprofitability, Beijing Beetech is projected to turn a profit within the next three years, supported by an impressive expected annual earnings growth of 98.5%. A recent strategic move included amendments to its articles of association, reflecting proactive governance that could bolster future performance and investor confidence.

Kohoku KogyoLTD (TSE:6524)

Simply Wall St Growth Rating: ★★★★☆☆

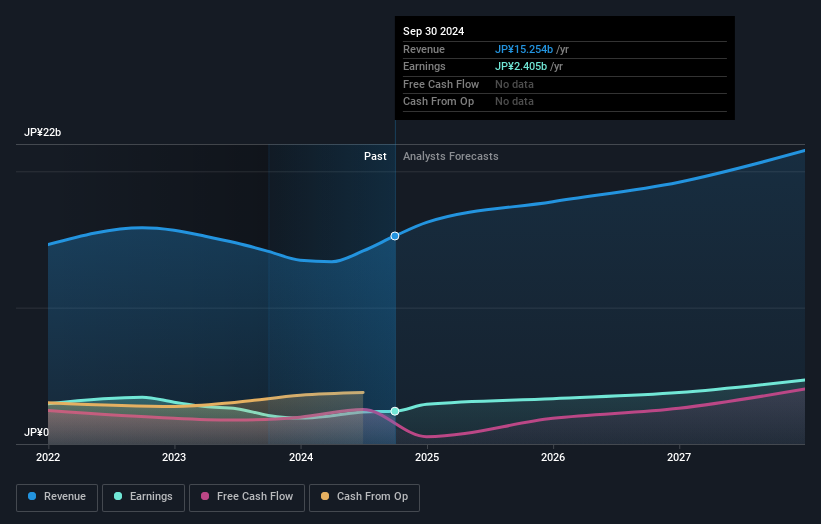

Overview: Kohoku Kogyo Co., Ltd. is engaged in the manufacturing and sale of lead terminals for aluminum electrolytic capacitors, optical components and devices for optical fiber communication networks, and precision components using quartz glass materials across various international markets, with a market capitalization of ¥73.70 billion.

Operations: Kohoku Kogyo focuses on producing lead terminals, optical components for fiber networks, and precision quartz glass parts. The company operates across Japan, China, and other international markets.

Kohoku KogyoLTD, amidst a challenging environment, has shown resilience with a revised annual revenue forecast at JPY 17.36 billion, slightly down from JPY 17.91 billion. The firm's dedication to R&D is evident as it continues to innovate despite recent setbacks, including a significant impairment loss of ¥310 million. With earnings expected to grow by 27.4% annually—outpacing the Japanese market's average of 8.1%—and revenue growth projected at 11.3%, faster than the market's 4.3%, Kohoku KogyoLTD appears poised for recovery and growth in the high-tech sector in Asia.

- Delve into the full analysis health report here for a deeper understanding of Kohoku KogyoLTD.

Assess Kohoku KogyoLTD's past performance with our detailed historical performance reports.

Make It Happen

- Discover the full array of 172 Asian High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Beetech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300667

Beijing Beetech

Produces and sells smart sensors and optoelectronic instrument products.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion