360 Security Technology Inc. (SHSE:601360) Stock Rockets 40% As Investors Are Less Pessimistic Than Expected

The 360 Security Technology Inc. (SHSE:601360) share price has done very well over the last month, posting an excellent gain of 40%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.9% in the last twelve months.

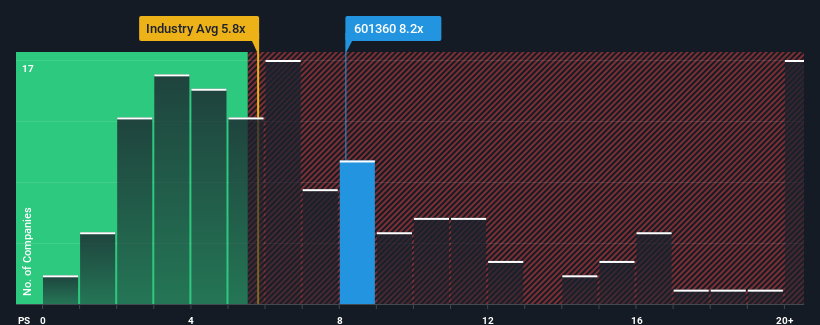

Since its price has surged higher, you could be forgiven for thinking 360 Security Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 8.2x, considering almost half the companies in China's Software industry have P/S ratios below 5.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for 360 Security Technology

What Does 360 Security Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, 360 Security Technology's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on 360 Security Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

360 Security Technology's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 12% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

With this information, we find it concerning that 360 Security Technology is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does 360 Security Technology's P/S Mean For Investors?

360 Security Technology's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see 360 Security Technology trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - 360 Security Technology has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on 360 Security Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if 360 Security Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601360

360 Security Technology

An internet security company, provides Internet and security service products in China.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives