- Taiwan

- /

- Communications

- /

- TWSE:2345

High Growth Tech Stocks Innovent Biologics And 2 Other Promising Picks

Reviewed by Simply Wall St

Global markets have recently shown mixed performances, with the S&P 500 and Nasdaq Composite both closing out a strong year despite some volatility and profit-taking towards year-end. In this environment, where economic indicators like the Chicago PMI signal contraction while unemployment claims remain low, high-growth tech stocks can stand out by demonstrating robust innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.23% | 56.37% | ★★★★★★ |

| TG Therapeutics | 29.99% | 44.07% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1254 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China with a market cap of HK$57.57 billion.

Operations: Innovent Biologics focuses on developing and commercializing monoclonal antibodies for various diseases in China. The company generates revenue primarily from its biotechnology segment, amounting to CN¥7.46 billion.

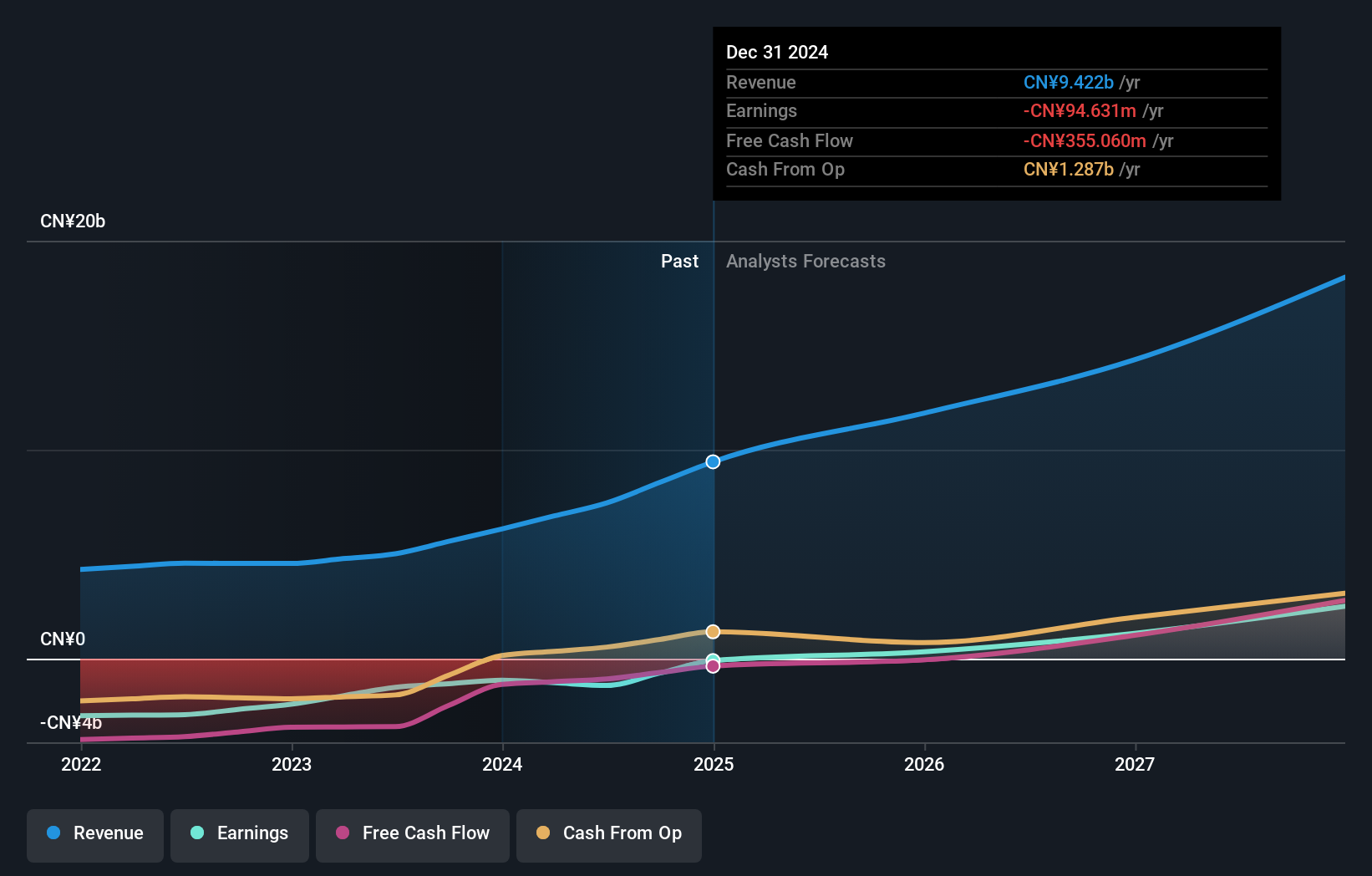

Innovent Biologics is making significant strides in the biotech sector, evidenced by its robust annual revenue growth of 19.7% and an impressive forecast of earnings growth at 45.04% per year. The company's commitment to innovation is highlighted by its recent approval of DOVBLERON for ROS1-positive NSCLC, a market with high unmet medical needs, particularly in managing brain metastases which affect up to 55% of patients post-initial treatment. This approval not only expands Innovent's oncology portfolio but also underscores its potential in addressing critical care challenges through advanced therapies. Furthermore, their strategic alliance with Roche on IBI3009 reinforces their capability to develop targeted treatments that could revolutionize care standards in oncology, positioning them well for future profitability and market leadership within the biotech industry.

- Click to explore a detailed breakdown of our findings in Innovent Biologics' health report.

Explore historical data to track Innovent Biologics' performance over time in our Past section.

Shanghai Baosight SoftwareLtd (SHSE:600845)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China and has a market capitalization of CN¥68.42 billion.

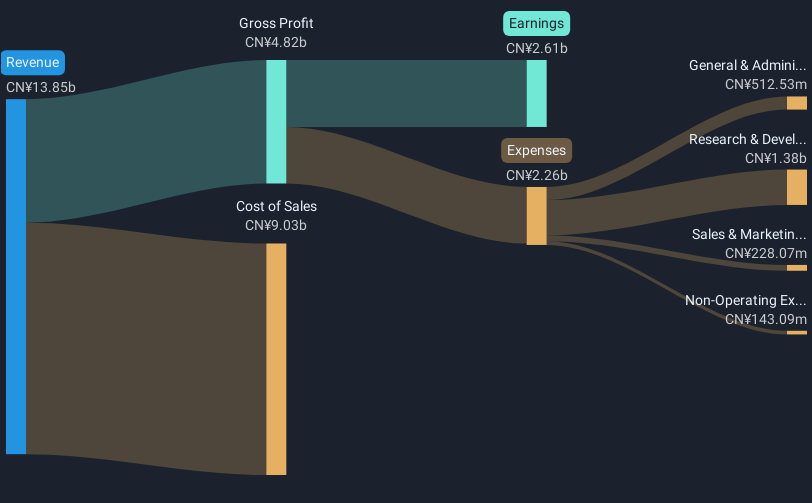

Operations: Baosight Software focuses on delivering industrial solutions within China. The company generates revenue primarily through its software services and technology products, contributing significantly to its financial performance.

Shanghai Baosight Software Co., Ltd. is distinguishing itself in the tech sector with a notable annual revenue growth of 21.8% and earnings expected to surge by 25.2% annually. Recent strategic index inclusions reflect growing market recognition, enhancing its visibility and potential investor interest. The company's robust investment in R&D, amounting to significant yearly expenditures, underpins its commitment to innovation, particularly in software solutions for industrial applications. This focus not only fuels its financial growth but also positions Baosight adeptly within an increasingly competitive landscape where technological advancements are pivotal.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★☆

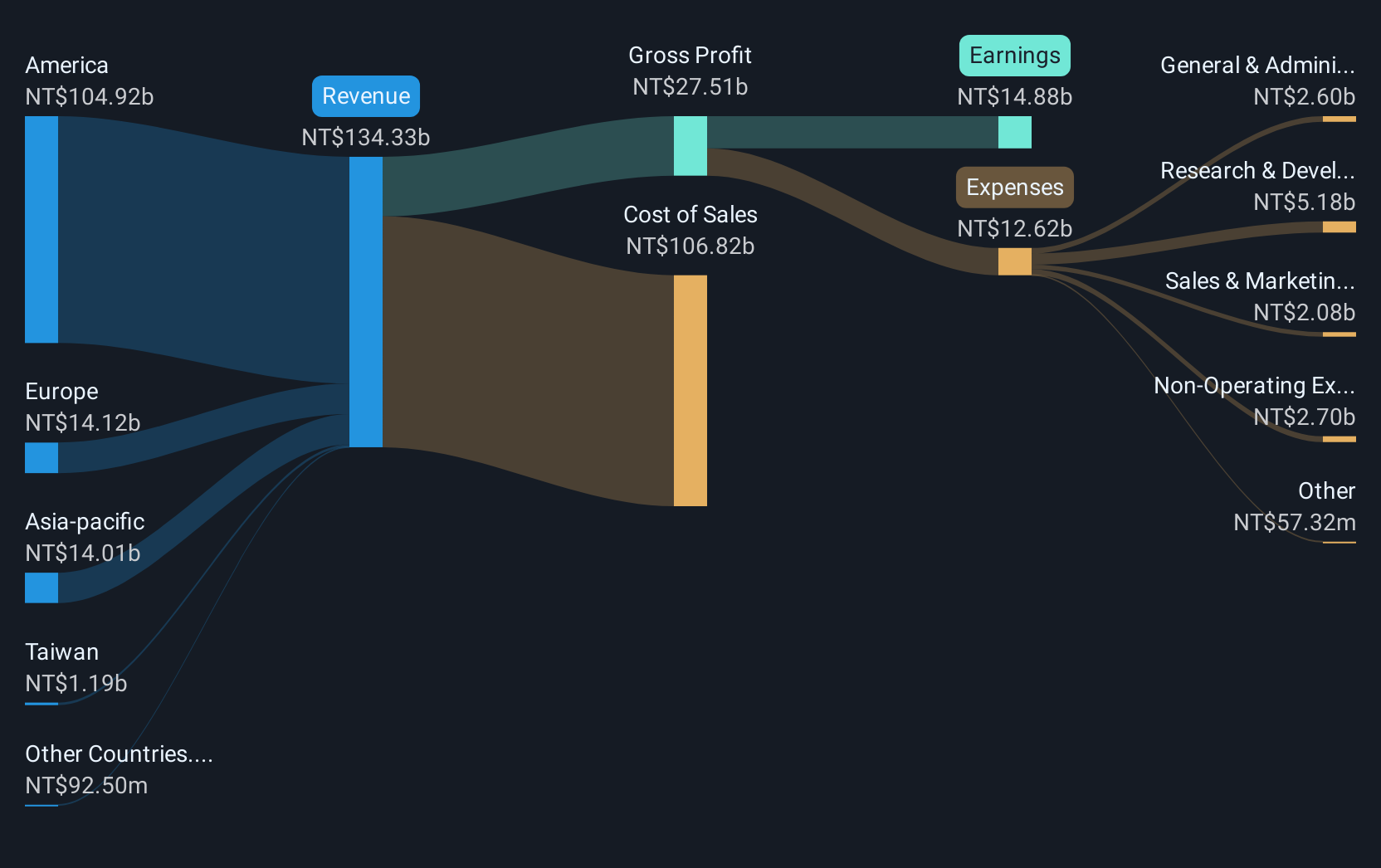

Overview: Accton Technology Corporation is engaged in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and internationally with a market cap of NT$428.12 billion.

Operations: Accton Technology generates revenue primarily from its computer networks segment, amounting to NT$93.41 billion. The company focuses on developing and selling network communication equipment across various international markets.

Accton Technology is making significant strides in the tech landscape, evidenced by a robust 25.1% projected annual earnings growth and a revenue increase of 19.6% per year, outpacing the broader Taiwanese market. The company's commitment to innovation is highlighted by its substantial R&D investments, which have fueled advancements in hyperscale data center technologies and AI networking solutions. Recent expansions like the $25 million injection into its Vietnam factory underscore Accton's strategic growth initiatives, while new product launches with DriveNets illustrate its competitive edge in addressing the exponential demands of AI and ML applications.

- Click here to discover the nuances of Accton Technology with our detailed analytical health report.

Gain insights into Accton Technology's past trends and performance with our Past report.

Taking Advantage

- Click here to access our complete index of 1254 High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2345

Accton Technology

Researches and develops, manufactures, and sells network communication equipment in Taiwan, America, rest of Asia, Europe, and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives