Global markets have been buoyed by robust stimulus measures from China, driving U.S. stocks to record highs and sparking optimism in the technology sector. As investors navigate these dynamic conditions, identifying high-growth stocks becomes crucial for capitalizing on market opportunities. In this article, we will explore three promising high-growth tech stocks that stand out amid the current economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

Click here to see the full list of 1297 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Yonyou Network TechnologyLtd (SHSE:600588)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yonyou Network Technology Co., Ltd. offers digital intelligence platforms and services to enterprises and public organizations both in China and internationally, with a market cap of CN¥35.71 billion.

Operations: Yonyou Network Technology Co., Ltd. generates revenue primarily from its Cloud Service and Software Business, which accounted for CN¥10.23 billion. The company's digital intelligence solutions cater to both enterprises and public organizations across China and international markets.

Yonyou Network TechnologyLtd's recent strategic moves, including a CNY 100 million share repurchase program, underscore its commitment to enhancing shareholder value and stabilizing its stock price amidst fluctuating market conditions. Despite experiencing a net loss of CNY 793.94 million as of June 2024, the company is poised for recovery with projected earnings growth of 43.3% annually. This optimism is bolstered by an anticipated revenue increase of 14.2% per year, outpacing the Chinese market average of 13.1%. These figures reflect Yonyou's resilience and potential in navigating through its current unprofitable phase towards profitability, leveraging substantial investments in R&D which align with its strategic goals and market demands.

Imeik Technology DevelopmentLtd (SZSE:300896)

Simply Wall St Growth Rating: ★★★★★☆

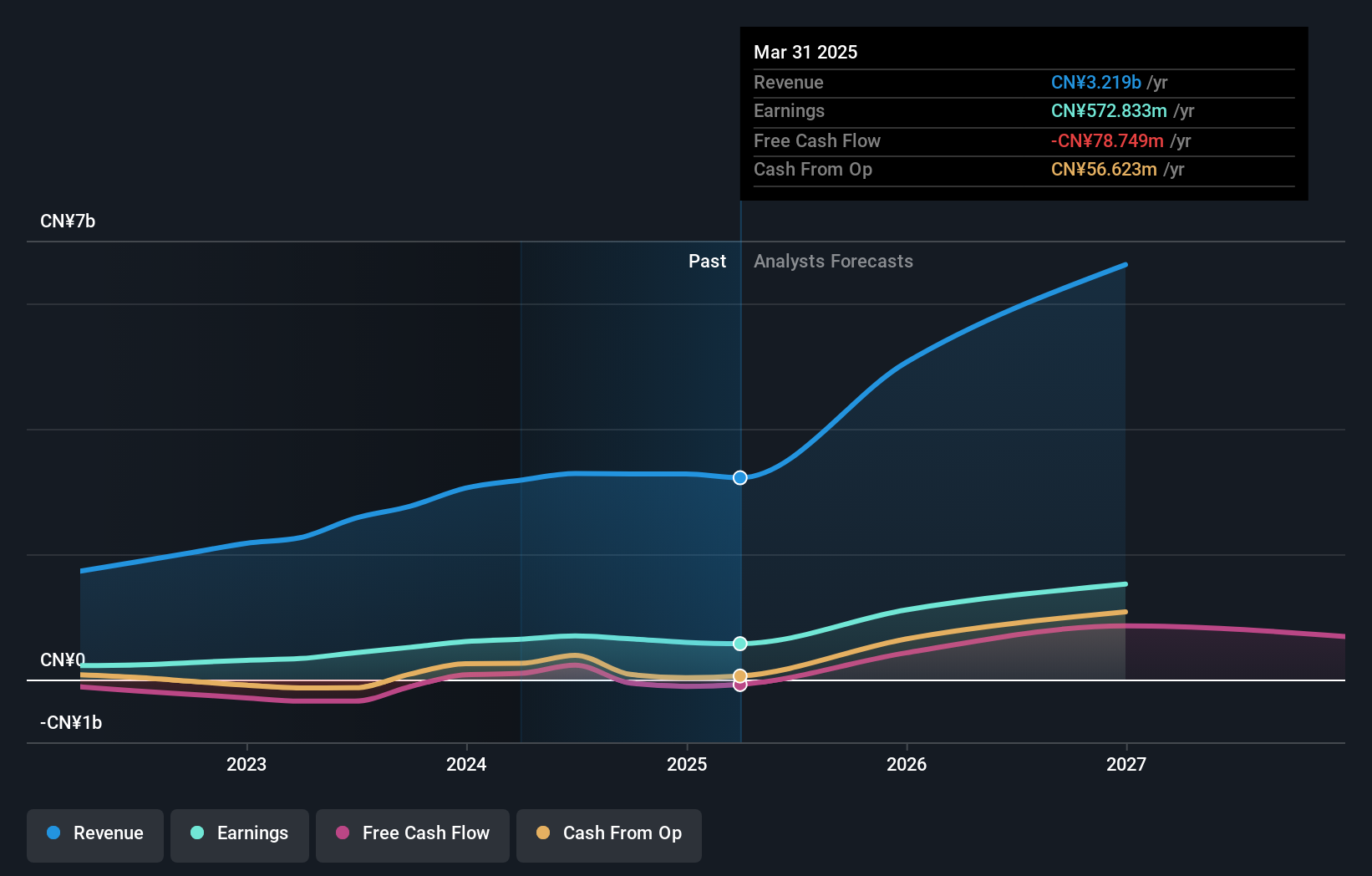

Overview: Imeik Technology Development Co., Ltd. specializes in the research, development, production, and transformation of biomedical soft tissue repair materials in China and has a market cap of CN¥59.15 billion.

Operations: Imeik Technology Development Co., Ltd. generates revenue primarily from its Surgical & Medical Equipment segment, which reported CN¥3.07 billion in revenue. The company focuses on biomedical soft tissue repair materials within the Chinese market.

Imeik Technology Development Co., Ltd. has demonstrated robust financial performance with a notable 23.5% annual revenue growth, outpacing the broader Chinese market's average of 13.1%. This growth is complemented by a significant increase in earnings, up by 22.3% annually, although slightly below the market's 23%. The company has strategically focused on R&D investments which are evident from their recent expenditure trends; these efforts align closely with industry demands and technological advancements, ensuring Imeik remains competitive in its sector. With such solid financial and operational foundations, Imeik is well-positioned to leverage its innovations for future growth despite a highly volatile share price observed over the past three months.

Xi'an NovaStar Tech (SZSE:301589)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an NovaStar Tech Co., Ltd. provides LED display control solutions in China and has a market cap of CN¥17.38 billion.

Operations: NovaStar Tech generates revenue primarily from the sale of electronic components and parts, amounting to CN¥3.29 billion. The company's focus is on providing LED display control solutions within China.

Xi'an NovaStar Tech has shown a robust trajectory with its revenue and earnings growth significantly outpacing the broader Chinese market, recording a 27.9% and 31% annual increase respectively. This performance is underpinned by strategic R&D investments which amounted to substantial figures, aligning closely with evolving industry demands. Recent financial results highlight a surge in net income to CNY 324.41 million from CNY 235.61 million year-over-year, reflecting strong operational efficiency and market adaptation despite ongoing global economic fluctuations. With such momentum, Xi'an NovaStar's focus on technological innovation positions it well for sustained future growth.

- Get an in-depth perspective on Xi'an NovaStar Tech's performance by reading our health report here.

Gain insights into Xi'an NovaStar Tech's past trends and performance with our Past report.

Seize The Opportunity

- Discover the full array of 1297 High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300896

Imeik Technology DevelopmentLtd

Engages in the research and development, production, and transformation of biomedical soft tissue repair materials in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives