Amidst a backdrop of heightened global trade tensions and economic uncertainties, Asian markets have been navigating a complex landscape marked by significant volatility, particularly impacting small-cap stocks. In such an environment, identifying high-growth tech stocks requires careful consideration of factors like resilience to market fluctuations and the ability to capitalize on technological advancements despite broader economic challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.37% | 32.63% | ★★★★★★ |

| Fositek | 31.39% | 36.95% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 22.81% | 27.89% | ★★★★★★ |

| Inspur Digital Enterprise Technology | 29.82% | 29.69% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| PharmaResearch | 20.39% | 27.65% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Everest Medicines (SEHK:1952)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Everest Medicines Limited is a biopharmaceutical company focused on the discovery, licensing, development, and commercialization of therapies and vaccines for unmet medical needs in Greater China and other Asia Pacific regions, with a market cap of approximately HK$18.96 billion.

Operations: Everest Medicines Limited generates revenue primarily from its pharmaceuticals segment, amounting to CN¥706.68 million. The company focuses on addressing critical unmet medical needs in Greater China and other Asia Pacific markets through its biopharmaceutical offerings.

Everest Medicines, amidst a challenging financial landscape with a net loss widening to CNY 1.04 billion from CNY 844.46 million year-over-year, continues to innovate in the biotech sector. The company's commitment to research and development is underscored by its progress with etrasimod, an advanced therapy for ulcerative colitis showing significant efficacy in clinical trials—achieving mucosal healing in 51.9% of treated patients versus 8.8% in the placebo group. Despite current unprofitability, Everest Medicines' revenue surged by over fivefold to CNY 706.68 million last year, reflecting a robust annual growth rate of 31.1%. This performance, coupled with an anticipated earnings growth of 117.42%, positions it as a dynamic entity within Asia's high-growth biotech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Everest Medicines.

Assess Everest Medicines' past performance with our detailed historical performance reports.

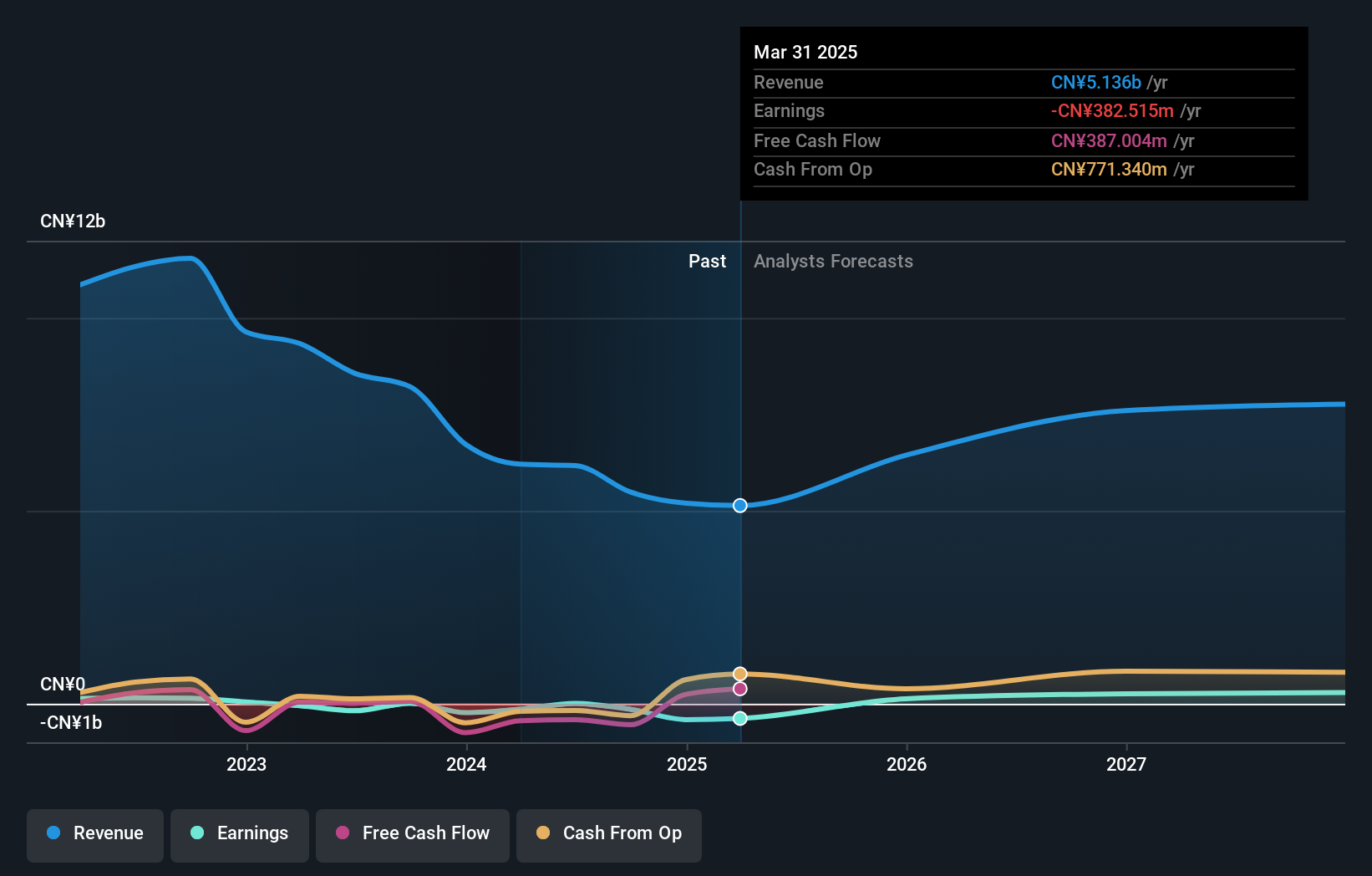

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China National Software & Service Company Limited operates as a software company in China with a market cap of CN¥37.75 billion.

Operations: The company generates revenue primarily from its software service business, which amounts to CN¥5.49 billion.

China National Software & Service is navigating a complex landscape with unprofitability issues, yet it shows promising signs of growth. With earnings projected to surge by 88.5% annually, the company is expected to shift into profitability within three years—an optimistic outlook compared to its current financial status. This trajectory is bolstered by a robust revenue increase forecast at 16.6% per year, outpacing the Chinese market's average of 12.8%. Despite challenges in generating positive free cash flow and a modest forecast return on equity of 8.7%, the firm's commitment to scaling operations and enhancing technological capabilities could position it favorably in Asia's competitive tech sector.

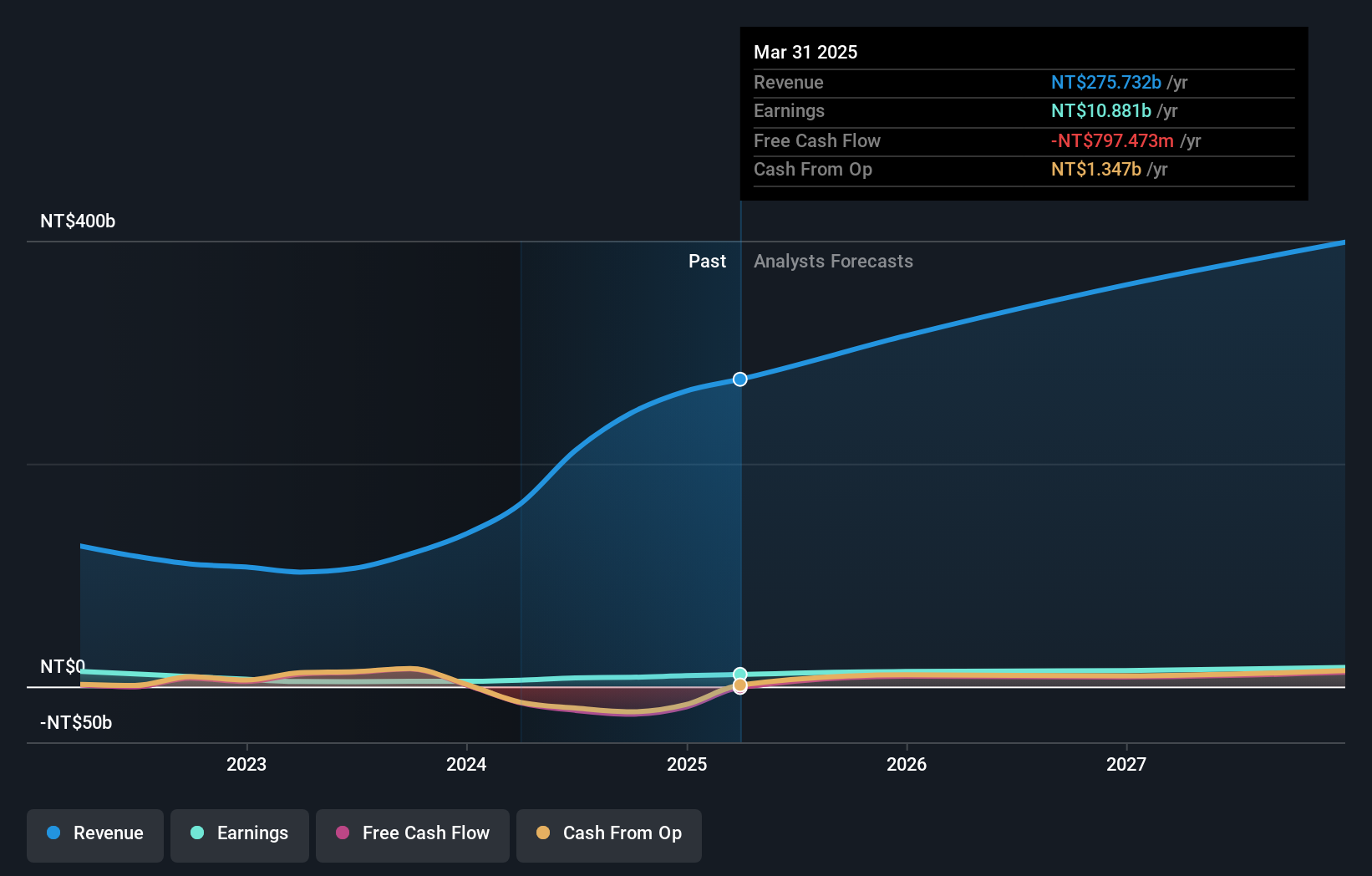

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Giga-Byte Technology Co., Ltd. operates globally in the manufacturing, processing, and trading of computer peripherals and components, with a market cap of NT$165.46 billion.

Operations: The Brand Business Division is the primary revenue driver for Giga-Byte Technology, generating NT$264.28 billion, while the Other Business Group contributes NT$870.64 million. The company's operations span Taiwan, Europe, the United States, Canada, China, and other international markets.

Giga-Byte Technology has demonstrated robust growth with its 2024 full-year sales more than doubling to TWD 265.15 billion from TWD 136.77 billion a year prior, reflecting a dynamic expansion in its tech offerings. The company's net income similarly saw a significant rise, reaching TWD 9.79 billion, up from TWD 4.74 billion, indicating strong profitability alongside revenue growth. Innovations like the MO27U2 QD-OLED monitor underscore Giga-Byte’s commitment to advancing display technology with features such as Tactical Switch 2.0 and Graphene Thermal Film Technology enhancing gaming experiences markedly. These developments not only highlight Giga-Byte's prowess in integrating cutting-edge technology but also position it well within the high-growth tech sector in Asia, suggesting promising prospects if these trends continue.

- Take a closer look at Giga-Byte Technology's potential here in our health report.

Explore historical data to track Giga-Byte Technology's performance over time in our Past section.

Taking Advantage

- Navigate through the entire inventory of 496 Asian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1952

Everest Medicines

A biopharmaceutical company, engages in the discovery, license-in, development, and commercialization of therapies and vaccines to address critical unmet medical needs in Greater China and other Asia Pacific markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives