China National Software & Service Company Limited (SHSE:600536) Stocks Shoot Up 30% But Its P/S Still Looks Reasonable

Despite an already strong run, China National Software & Service Company Limited (SHSE:600536) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days bring the annual gain to a very sharp 52%.

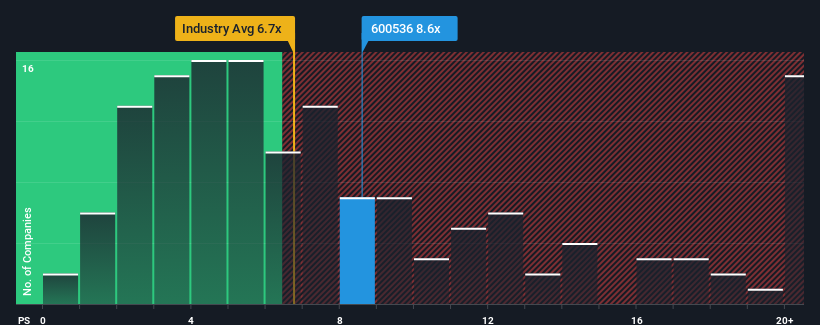

Following the firm bounce in price, given close to half the companies operating in China's Software industry have price-to-sales ratios (or "P/S") below 6.7x, you may consider China National Software & Service as a stock to potentially avoid with its 8.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for China National Software & Service

What Does China National Software & Service's Recent Performance Look Like?

While the industry has experienced revenue growth lately, China National Software & Service's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China National Software & Service.How Is China National Software & Service's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as China National Software & Service's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. This means it has also seen a slide in revenue over the longer-term as revenue is down 43% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 45% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 32%, which is noticeably less attractive.

With this in mind, it's not hard to understand why China National Software & Service's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

China National Software & Service shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into China National Software & Service shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for China National Software & Service with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600536

China National Software & Service

Provides independent software products and industry solutions in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives