Beijing Teamsun Technology Co.,Ltd.'s (SHSE:600410) Low P/S No Reason For Excitement

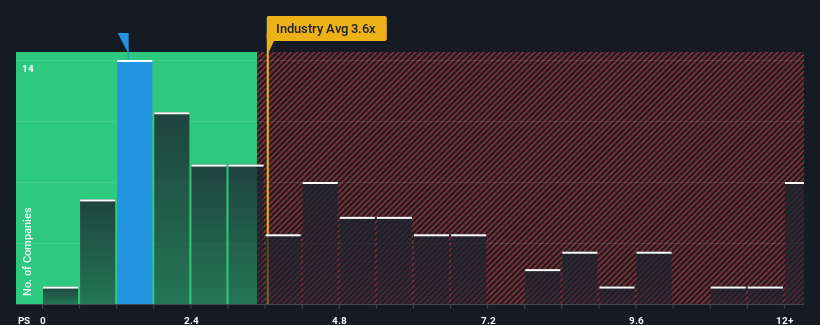

You may think that with a price-to-sales (or "P/S") ratio of 1.4x Beijing Teamsun Technology Co.,Ltd. (SHSE:600410) is definitely a stock worth checking out, seeing as almost half of all the IT companies in China have P/S ratios greater than 3.6x and even P/S above 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Beijing Teamsun TechnologyLtd

How Has Beijing Teamsun TechnologyLtd Performed Recently?

Revenue has risen firmly for Beijing Teamsun TechnologyLtd recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Beijing Teamsun TechnologyLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Beijing Teamsun TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Beijing Teamsun TechnologyLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Revenue has also lifted 16% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 42% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Beijing Teamsun TechnologyLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Beijing Teamsun TechnologyLtd's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Beijing Teamsun TechnologyLtd revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You should always think about risks. Case in point, we've spotted 1 warning sign for Beijing Teamsun TechnologyLtd you should be aware of.

If you're unsure about the strength of Beijing Teamsun TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Teamsun TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600410

Beijing Teamsun TechnologyLtd

Engages in the IT system solutions, digital infrastructure, digital applications, and other businesses.

Flawless balance sheet and good value.

Market Insights

Community Narratives