- China

- /

- Life Sciences

- /

- SHSE:688755

Green Tea Group And 2 Other Undiscovered Asian Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by trade negotiations and evolving economic policies, small- and mid-cap indexes have shown resilience, posting gains for the fifth consecutive week. In this environment, identifying stocks with robust fundamentals and strategic positioning in emerging sectors can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| GakkyushaLtd | 18.84% | 4.73% | 16.81% | ★★★★★★ |

| Kanda HoldingsLtd | 27.19% | 4.45% | 15.53% | ★★★★★★ |

| Jih Lin Technology | 54.08% | 1.96% | 1.22% | ★★★★★★ |

| Shenzhen iN-Cube Automation | NA | 1.75% | -15.44% | ★★★★★★ |

| Kondotec | 11.26% | 7.01% | 7.06% | ★★★★★☆ |

| Qingdao CHOHO IndustrialLtd | 39.70% | 14.43% | 7.86% | ★★★★★☆ |

| Shenzhen Farben Information TechnologyLtd | 13.86% | 20.51% | 3.44% | ★★★★★☆ |

| Suzhou Chunqiu Electronic Technology | 46.46% | 3.33% | -19.72% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 19.19% | -5.24% | -9.23% | ★★★★★☆ |

| Suzhou Sepax Technologies | 4.44% | 21.44% | 34.83% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Green Tea Group (SEHK:6831)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Green Tea Group Limited operates casual Chinese restaurants in Mainland China with a market capitalization of approximately HK$3.83 billion.

Operations: Green Tea Group generates revenue primarily through its restaurant operations, amounting to CN¥3.84 billion. The company's net profit margin has shown variability over recent periods.

Green Tea Group recently completed an IPO, raising HKD 1.21 billion by offering shares at HKD 7.19 each, with a slight discount of HKD 0.22 per share. This debt-free company has shown impressive earnings growth of 18% over the past year, outpacing the Hospitality industry's average growth of 5%. Trading at approximately 15% below its estimated fair value suggests potential undervaluation for investors seeking opportunities in Asia's emerging markets. Despite its illiquid shares, Green Tea Group remains profitable with high-quality earnings and positive free cash flow, indicating robust financial health and promising future prospects.

- Click to explore a detailed breakdown of our findings in Green Tea Group's health report.

Assess Green Tea Group's past performance with our detailed historical performance reports.

Jiangsu Hanbon Science and Technology (SHSE:688755)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Hanbon Science and Technology Co., Ltd. (SHSE:688755) is a company with a market cap of CN¥2 billion, focusing on the development and production of medical products.

Operations: Hanbon generates revenue primarily from its medical products segment, amounting to CN¥690.88 million. The company's market cap stands at CN¥2 billion.

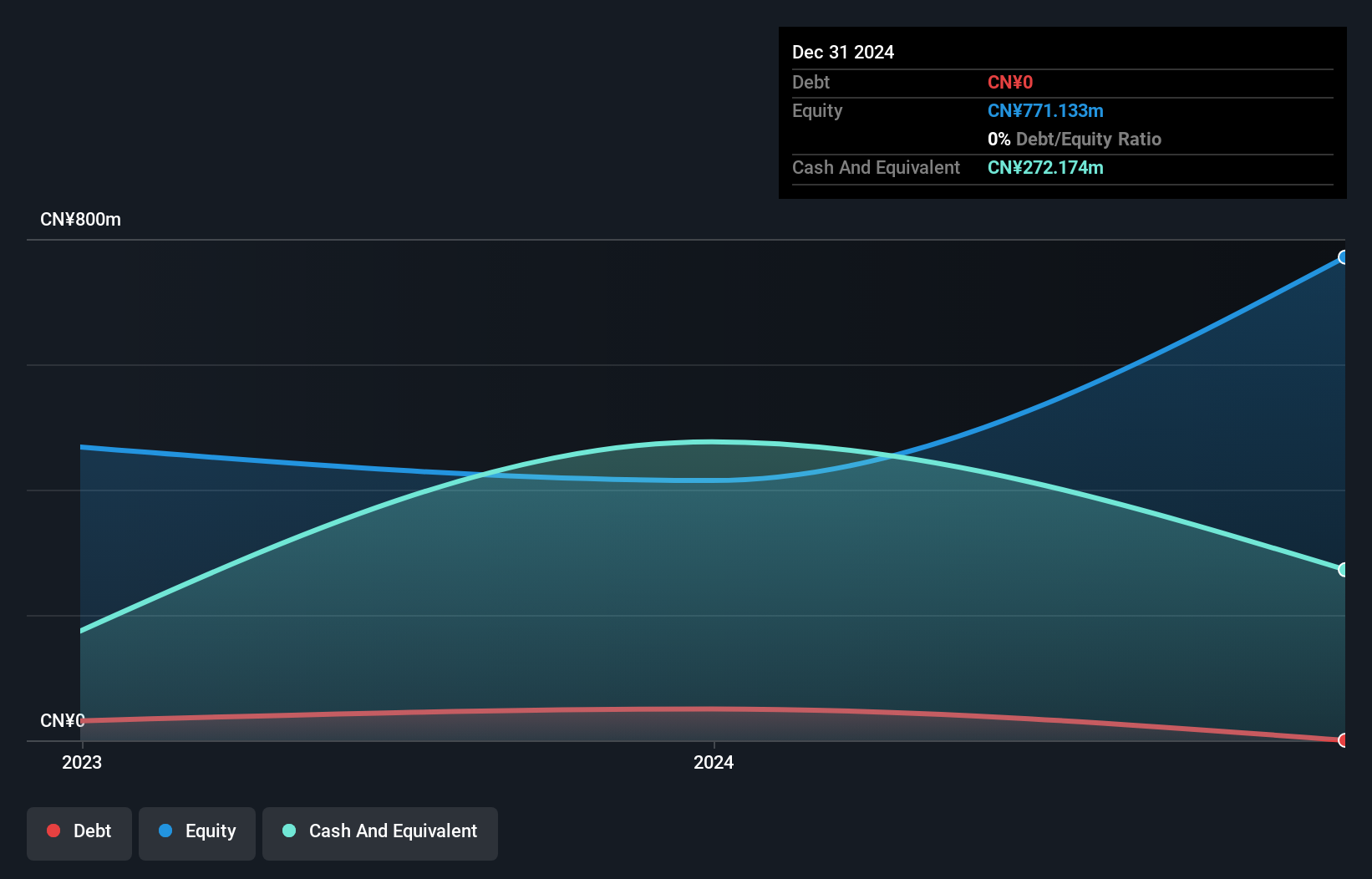

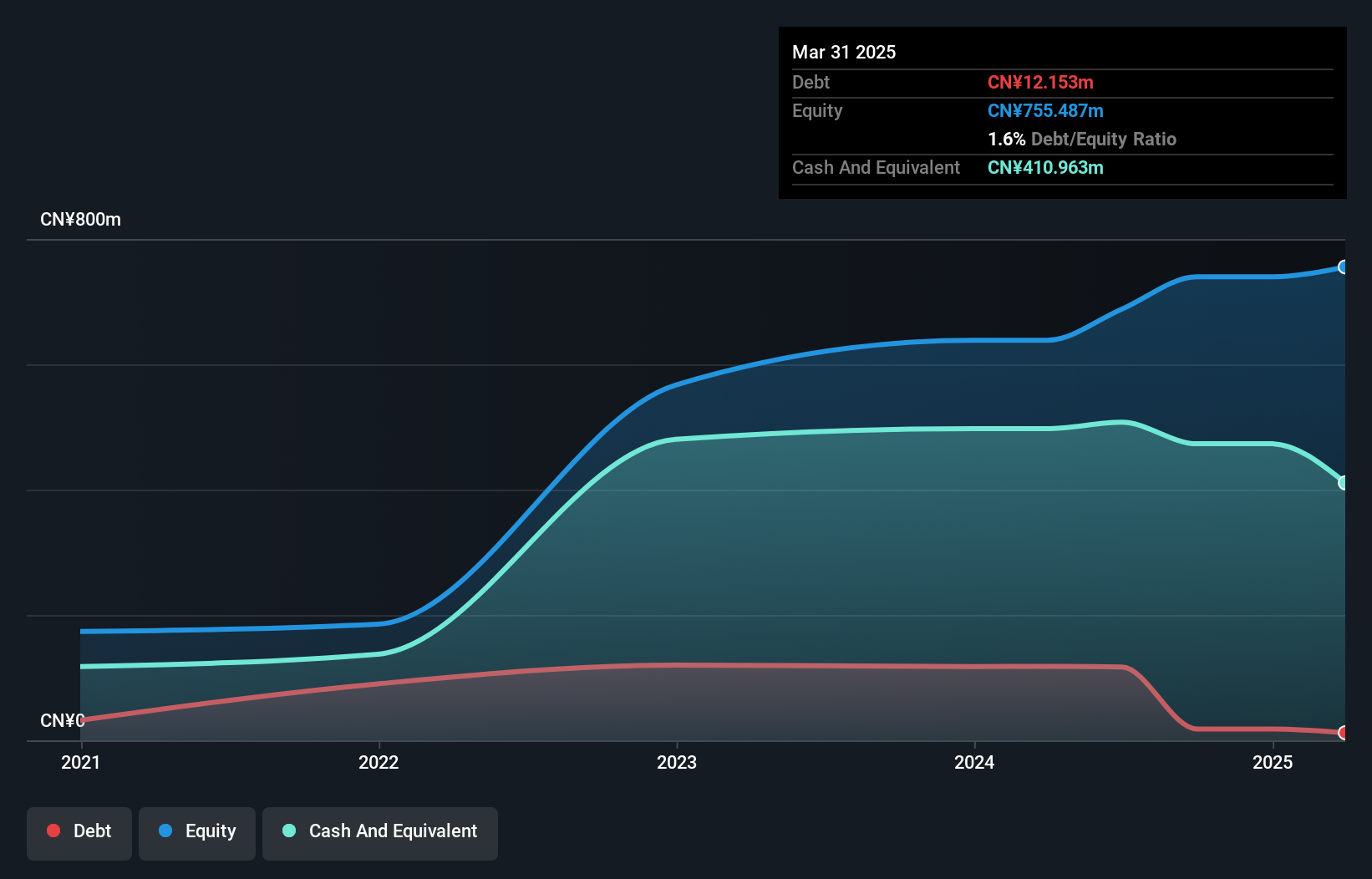

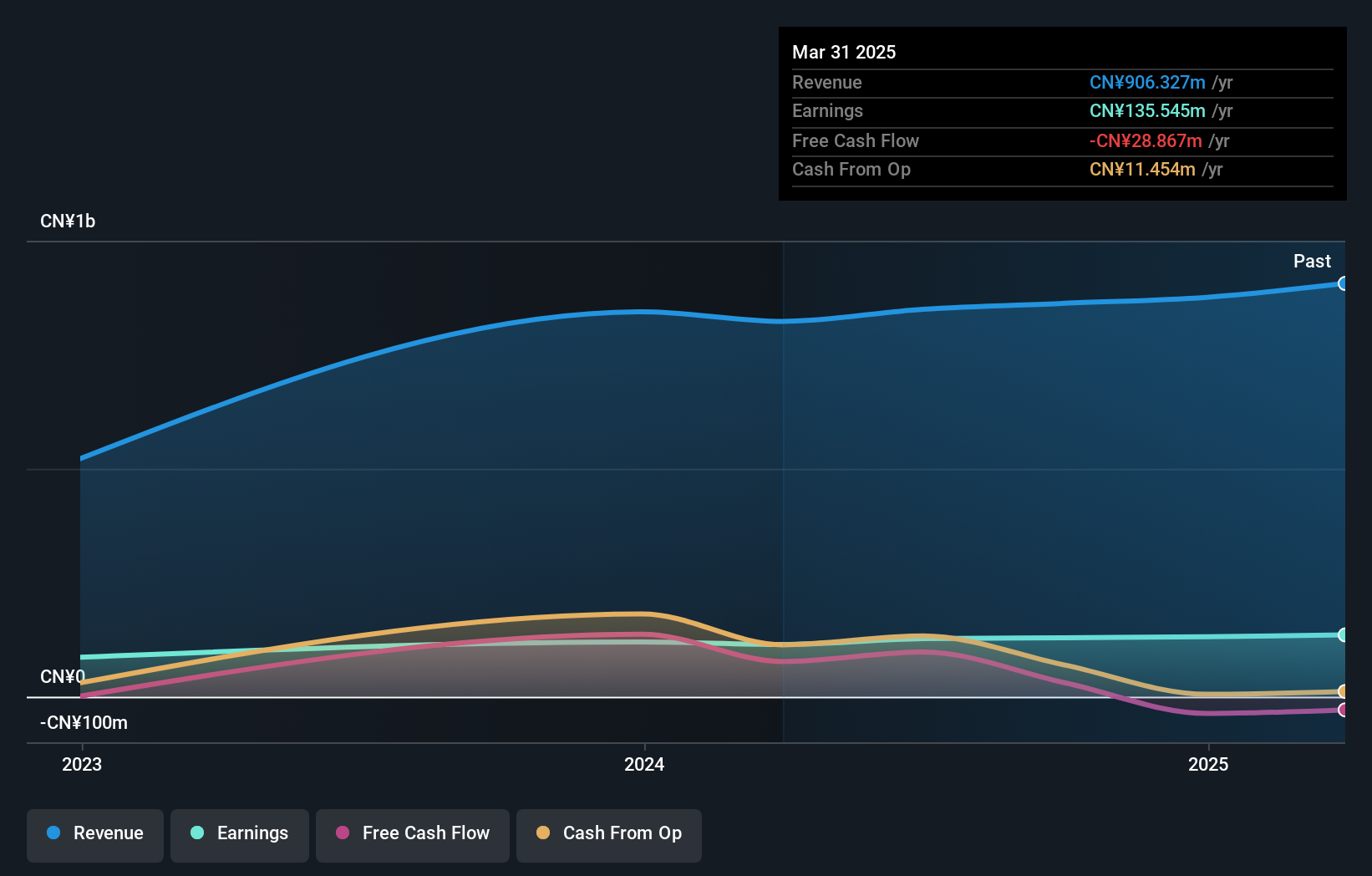

Jiangsu Hanbon Science and Technology recently completed an IPO, raising CNY 500.94 million, highlighting its small cap potential in the market. With earnings growth of 54% over the past year, it outpaced the Medical Equipment industry average of -3.5%. The company reported net income of CNY 79.34 million for 2024 compared to CNY 51.5 million in the previous year, showcasing robust financial health with more cash than total debt and a P/E ratio of 25x below the CN market average of 38x. Despite high illiquidity in shares, profitability remains strong with positive free cash flow trends observed recently.

- Get an in-depth perspective on Jiangsu Hanbon Science and Technology's performance by reading our health report here.

Understand Jiangsu Hanbon Science and Technology's track record by examining our Past report.

Zerun (SZSE:301636)

Simply Wall St Value Rating: ★★★★★☆

Overview: ZERUN CO., LTD specializes in manufacturing junction boxes, PV connectors, and PV cable assemblies for markets across China, the Asia-Pacific region, Europe, the United States, and Australia with a market capitalization of CN¥2.11 billion.

Operations: The company's primary revenue stream is from photovoltaic module junction boxes, generating CN¥795.12 million, while software and other segments contribute CN¥32.21 million.

Zerun recently completed an IPO, raising CNY 527.87 million, which underscores its potential in the market. The company shows robust financial health with earnings growth of 39.1% over the past year, significantly outpacing the Semiconductor industry's 7.2%. Despite being highly illiquid, Zerun trades at a substantial discount of 83.9% below its estimated fair value, suggesting room for appreciation. Additionally, it has more cash than total debt and earns more interest than it pays, indicating solid financial management and stability in covering interest obligations without stress on resources.

- Click here and access our complete health analysis report to understand the dynamics of Zerun.

Examine Zerun's past performance report to understand how it has performed in the past.

Summing It All Up

- Unlock our comprehensive list of 2626 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688755

Jiangsu Hanbon Science and Technology

Jiangsu Hanbon Science and Technology Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives