- China

- /

- Semiconductors

- /

- SZSE:301321

Highbroad Advanced Material (Hefei)'s (SZSE:301321) Solid Profits Have Weak Fundamentals

Highbroad Advanced Material (Hefei) Co., Ltd.'s (SZSE:301321) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

See our latest analysis for Highbroad Advanced Material (Hefei)

Examining Cashflow Against Highbroad Advanced Material (Hefei)'s Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

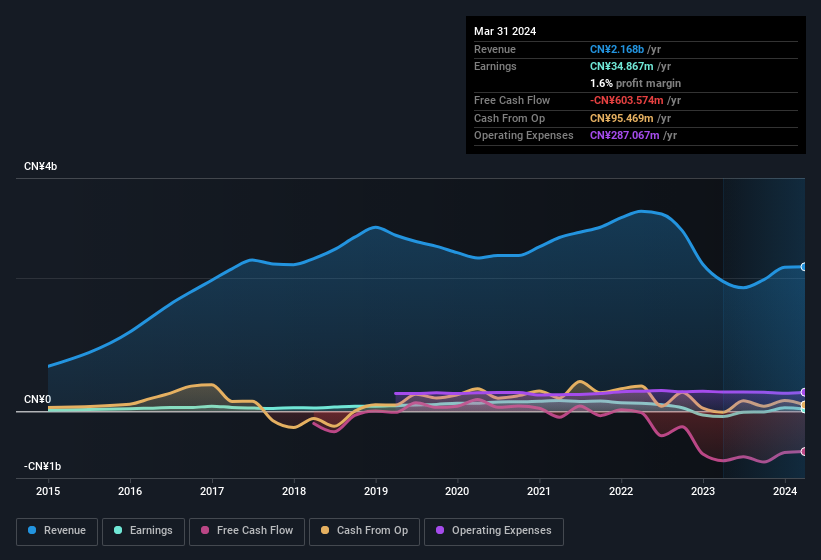

Highbroad Advanced Material (Hefei) has an accrual ratio of 0.32 for the year to March 2024. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, raising questions about how useful that profit figure really is. Even though it reported a profit of CN¥34.9m, a look at free cash flow indicates it actually burnt through CN¥604m in the last year. We also note that Highbroad Advanced Material (Hefei)'s free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥604m. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Highbroad Advanced Material (Hefei).

The Impact Of Unusual Items On Profit

Highbroad Advanced Material (Hefei)'s profit suffered from unusual items, which reduced profit by CN¥55m in the last twelve months. If this was a non-cash charge, it would have made the accrual ratio better, if cashflow had stayed strong, so it's not great to see in combination with an uninspiring accrual ratio. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Highbroad Advanced Material (Hefei) took a rather significant hit from unusual items in the year to March 2024. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Highbroad Advanced Material (Hefei) received a tax benefit of CN¥5.5m. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Highbroad Advanced Material (Hefei)'s Profit Performance

Summing up, Highbroad Advanced Material (Hefei)'s unusual items suggest that its statutory earnings were temporarily depressed, while its tax benefit is having the opposite effect, and its accrual ratio indicates a lack of free cash flow relative to profit. Based on these factors, we think it's very unlikely that Highbroad Advanced Material (Hefei)'s statutory profits make it seem much weaker than it is. If you want to do dive deeper into Highbroad Advanced Material (Hefei), you'd also look into what risks it is currently facing. For example, we've discovered 5 warning signs that you should run your eye over to get a better picture of Highbroad Advanced Material (Hefei).

Our examination of Highbroad Advanced Material (Hefei) has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Highbroad Advanced Material (Hefei) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301321

Highbroad Advanced Material (Hefei)

Highbroad Advanced Material (Hefei) Co., Ltd.

Low risk and slightly overvalued.

Market Insights

Community Narratives