- China

- /

- Semiconductors

- /

- SZSE:300940

Shen Zhen Australis Electronic Technology Co.,Ltd.'s (SZSE:300940) 28% Price Boost Is Out Of Tune With Revenues

Shen Zhen Australis Electronic Technology Co.,Ltd. (SZSE:300940) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

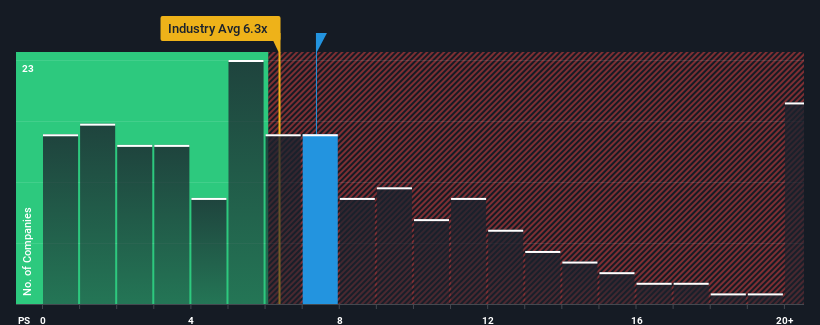

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Shen Zhen Australis Electronic TechnologyLtd's P/S ratio of 7.4x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in China is also close to 6.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shen Zhen Australis Electronic TechnologyLtd

How Shen Zhen Australis Electronic TechnologyLtd Has Been Performing

For example, consider that Shen Zhen Australis Electronic TechnologyLtd's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shen Zhen Australis Electronic TechnologyLtd will help you shine a light on its historical performance.How Is Shen Zhen Australis Electronic TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shen Zhen Australis Electronic TechnologyLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. As a result, revenue from three years ago have also fallen 53% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 37% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Shen Zhen Australis Electronic TechnologyLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Shen Zhen Australis Electronic TechnologyLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Shen Zhen Australis Electronic TechnologyLtd currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 2 warning signs for Shen Zhen Australis Electronic TechnologyLtd (1 doesn't sit too well with us!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300940

Shen Zhen Australis Electronic TechnologyLtd

Shen Zhen Australis Electronic Technology Co.,Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives