- China

- /

- Semiconductors

- /

- SZSE:300842

Investors Continue Waiting On Sidelines For Wuxi DK Electronic Materials Co.,Ltd. (SZSE:300842)

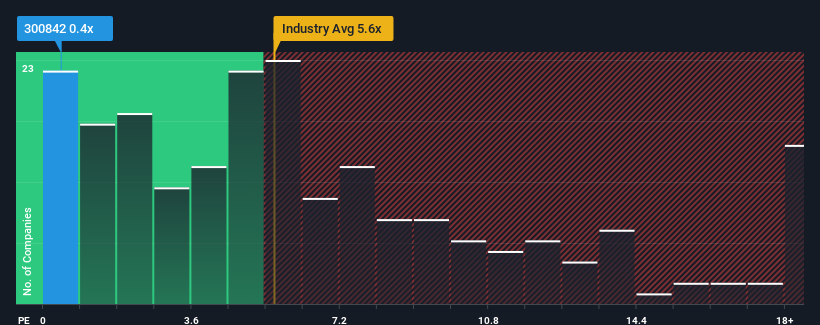

Wuxi DK Electronic Materials Co.,Ltd.'s (SZSE:300842) price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 5.6x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Wuxi DK Electronic MaterialsLtd

What Does Wuxi DK Electronic MaterialsLtd's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Wuxi DK Electronic MaterialsLtd has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wuxi DK Electronic MaterialsLtd will help you uncover what's on the horizon.How Is Wuxi DK Electronic MaterialsLtd's Revenue Growth Trending?

Wuxi DK Electronic MaterialsLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 153%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 32% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 36%, which is not materially different.

With this information, we find it odd that Wuxi DK Electronic MaterialsLtd is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Wuxi DK Electronic MaterialsLtd's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Wuxi DK Electronic MaterialsLtd remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Wuxi DK Electronic MaterialsLtd (2 don't sit too well with us!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Wuxi DK Electronic MaterialsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuxi DK Electronic MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300842

Wuxi DK Electronic MaterialsLtd

A technology company, engages in the research and development, production, and sale of performance electronic materials for solar photovoltaic, display, lighting, and semiconductor in China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives