- China

- /

- Semiconductors

- /

- SZSE:300812

Shenzhen Etmade Automatic Equipment Co., Ltd.'s (SZSE:300812) Shares Climb 25% But Its Business Is Yet to Catch Up

Shenzhen Etmade Automatic Equipment Co., Ltd. (SZSE:300812) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

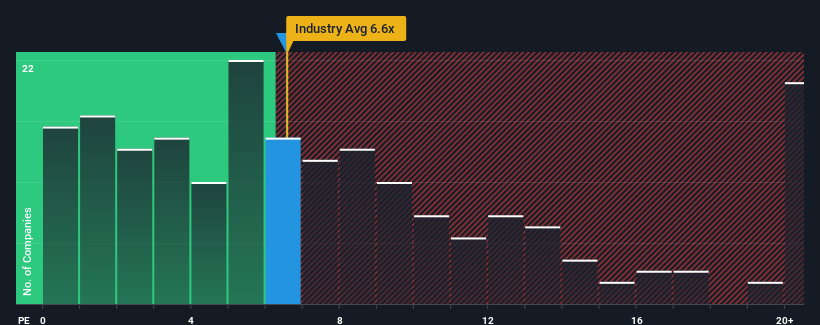

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Shenzhen Etmade Automatic Equipment's P/S ratio of 6.5x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in China is also close to 6.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Shenzhen Etmade Automatic Equipment

How Has Shenzhen Etmade Automatic Equipment Performed Recently?

Revenue has risen at a steady rate over the last year for Shenzhen Etmade Automatic Equipment, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Shenzhen Etmade Automatic Equipment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Shenzhen Etmade Automatic Equipment's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Etmade Automatic Equipment's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.2%. The latest three year period has also seen an excellent 53% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 20,706% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Shenzhen Etmade Automatic Equipment's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Shenzhen Etmade Automatic Equipment's P/S

Shenzhen Etmade Automatic Equipment appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Shenzhen Etmade Automatic Equipment revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It is also worth noting that we have found 4 warning signs for Shenzhen Etmade Automatic Equipment (3 are a bit concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300812

Shenzhen Etmade Automatic Equipment

Shenzhen Etmade Automatic Equipment Co., Ltd.

Excellent balance sheet and good value.

Market Insights

Community Narratives