- China

- /

- Semiconductors

- /

- SZSE:300776

Many Still Looking Away From Wuhan DR Laser Technology Corp.,Ltd (SZSE:300776)

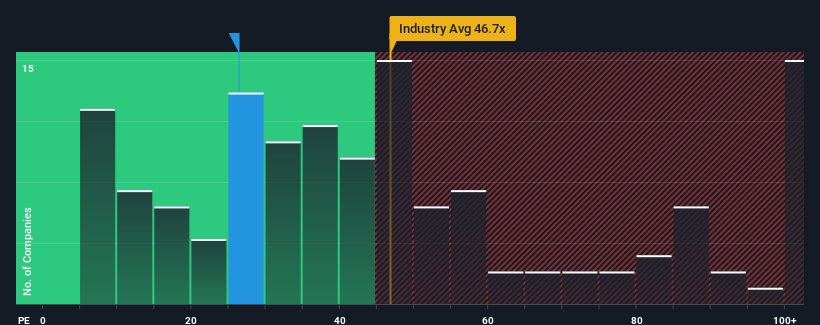

With a median price-to-earnings (or "P/E") ratio of close to 29x in China, you could be forgiven for feeling indifferent about Wuhan DR Laser Technology Corp.,Ltd's (SZSE:300776) P/E ratio of 26.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Wuhan DR Laser TechnologyLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Wuhan DR Laser TechnologyLtd

How Is Wuhan DR Laser TechnologyLtd's Growth Trending?

Wuhan DR Laser TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.9%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 17% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 65% over the next year. That's shaping up to be materially higher than the 36% growth forecast for the broader market.

With this information, we find it interesting that Wuhan DR Laser TechnologyLtd is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Wuhan DR Laser TechnologyLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Wuhan DR Laser TechnologyLtd, and understanding should be part of your investment process.

You might be able to find a better investment than Wuhan DR Laser TechnologyLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Wuhan DR Laser TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuhan DR Laser TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300776

Wuhan DR Laser TechnologyLtd

Engages in the manufacture and sale of laser equipment for solar cell applications in China and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives