- China

- /

- Semiconductors

- /

- SZSE:300724

Shenzhen S.C New Energy Technology's (SZSE:300724) Strong Earnings Are Of Good Quality

The subdued stock price reaction suggests that Shenzhen S.C New Energy Technology Corporation's (SZSE:300724) strong earnings didn't offer any surprises. Our analysis suggests that investors might be missing some promising details.

Check out our latest analysis for Shenzhen S.C New Energy Technology

A Closer Look At Shenzhen S.C New Energy Technology's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

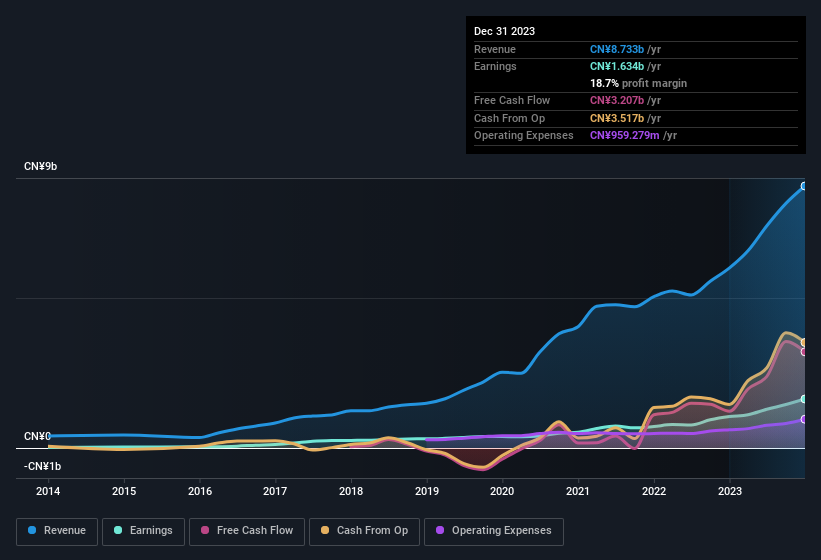

Shenzhen S.C New Energy Technology has an accrual ratio of -1.36 for the year to December 2023. Therefore, its statutory earnings were very significantly less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of CN¥3.2b, well over the CN¥1.63b it reported in profit. Shenzhen S.C New Energy Technology shareholders are no doubt pleased that free cash flow improved over the last twelve months.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Shenzhen S.C New Energy Technology's Profit Performance

Happily for shareholders, Shenzhen S.C New Energy Technology produced plenty of free cash flow to back up its statutory profit numbers. Because of this, we think Shenzhen S.C New Energy Technology's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! Better yet, its EPS are growing strongly, which is nice to see. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example - Shenzhen S.C New Energy Technology has 1 warning sign we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Shenzhen S.C New Energy Technology's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300724

Shenzhen S.C New Energy Technology

Provides crystalline silicon production equipment in China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success