- China

- /

- Semiconductors

- /

- SZSE:300672

Market Might Still Lack Some Conviction On Hunan Goke Microelectronics Co.,Ltd. (SZSE:300672) Even After 26% Share Price Boost

Those holding Hunan Goke Microelectronics Co.,Ltd. (SZSE:300672) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 34% in the last twelve months.

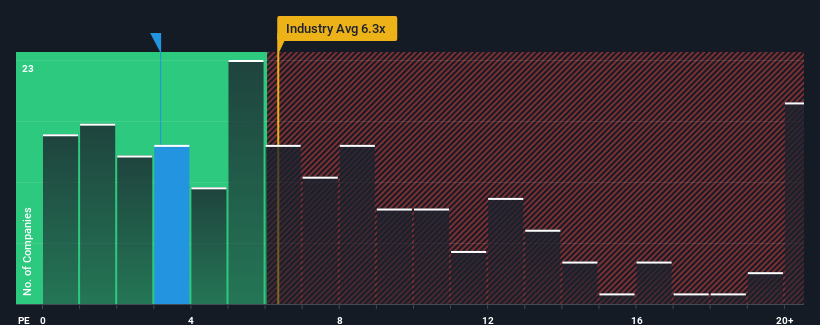

In spite of the firm bounce in price, Hunan Goke MicroelectronicsLtd's price-to-sales (or "P/S") ratio of 3.2x might still make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 6.3x and even P/S above 12x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hunan Goke MicroelectronicsLtd

What Does Hunan Goke MicroelectronicsLtd's P/S Mean For Shareholders?

Recent times haven't been great for Hunan Goke MicroelectronicsLtd as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Hunan Goke MicroelectronicsLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Hunan Goke MicroelectronicsLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 53% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 38% growth forecast for the broader industry.

In light of this, it's peculiar that Hunan Goke MicroelectronicsLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Hunan Goke MicroelectronicsLtd's P/S

Hunan Goke MicroelectronicsLtd's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Hunan Goke MicroelectronicsLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Hunan Goke MicroelectronicsLtd.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Goke MicroelectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300672

Hunan Goke MicroelectronicsLtd

Engages in the research and development of integrated circuit chip related products in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.