- China

- /

- Semiconductors

- /

- SZSE:300671

Shenzhen Fine Made Electronics Group (SZSE:300671) delivers shareholders splendid 20% CAGR over 5 years, surging 6.4% in the last week alone

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of Shenzhen Fine Made Electronics Group Co., Ltd. (SZSE:300671) stock is up an impressive 142% over the last five years. Also pleasing for shareholders was the 60% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 34% in 90 days).

Since it's been a strong week for Shenzhen Fine Made Electronics Group shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Shenzhen Fine Made Electronics Group

Shenzhen Fine Made Electronics Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Shenzhen Fine Made Electronics Group saw its revenue shrink by 1.5% per year. Given that scenario, we wouldn't have expected the share price to rise 19% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

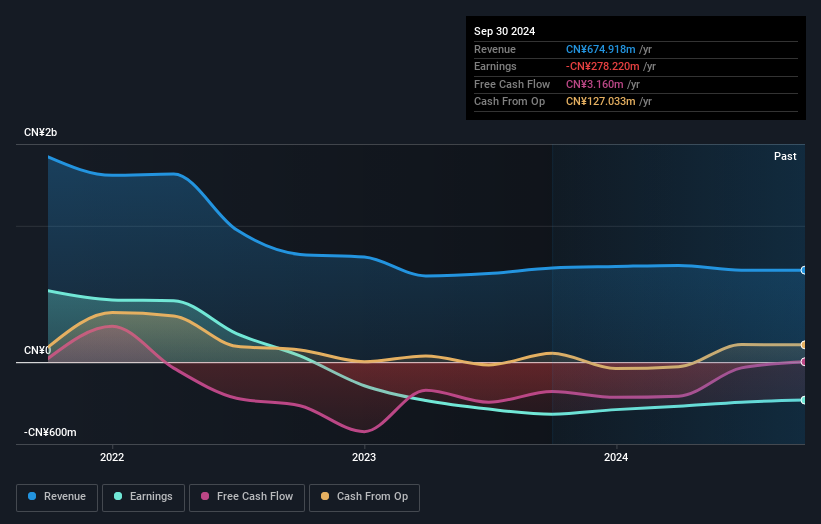

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Shenzhen Fine Made Electronics Group's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Shenzhen Fine Made Electronics Group has rewarded shareholders with a total shareholder return of 26% in the last twelve months. That's better than the annualised return of 20% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Shenzhen Fine Made Electronics Group (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300671

Shenzhen Fine Made Electronics Group

Shenzhen Fine Made Electronics Group Co., Ltd.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives