- China

- /

- Semiconductors

- /

- SZSE:300604

Hangzhou Changchuan Technology Co.,Ltd's (SZSE:300604) Stock Retreats 25% But Revenues Haven't Escaped The Attention Of Investors

Hangzhou Changchuan Technology Co.,Ltd (SZSE:300604) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

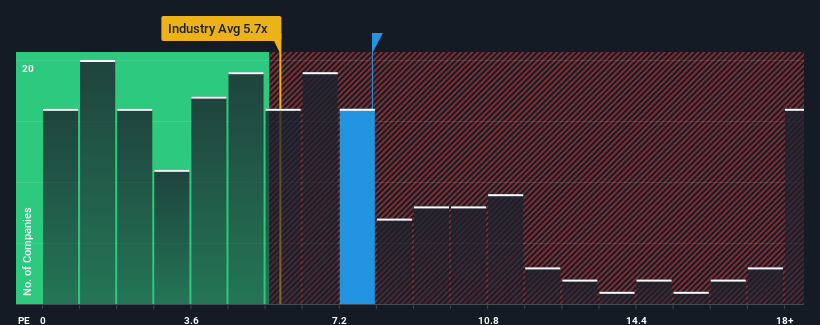

In spite of the heavy fall in price, Hangzhou Changchuan TechnologyLtd may still be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 8x, since almost half of all companies in the Semiconductor in China have P/S ratios under 5.7x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Hangzhou Changchuan TechnologyLtd

How Hangzhou Changchuan TechnologyLtd Has Been Performing

While the industry has experienced revenue growth lately, Hangzhou Changchuan TechnologyLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hangzhou Changchuan TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hangzhou Changchuan TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.5% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 192% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 56% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

In light of this, it's understandable that Hangzhou Changchuan TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

There's still some elevation in Hangzhou Changchuan TechnologyLtd's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hangzhou Changchuan TechnologyLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Hangzhou Changchuan TechnologyLtd (including 1 which can't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Changchuan TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300604

Hangzhou Changchuan TechnologyLtd

Researches and develops, produces, and sells integrated circuit equipment and high-frequency communication materials.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives