- China

- /

- Semiconductors

- /

- SZSE:300604

Hangzhou Changchuan Technology Co.,Ltd's (SZSE:300604) 30% Share Price Surge Not Quite Adding Up

Hangzhou Changchuan Technology Co.,Ltd (SZSE:300604) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

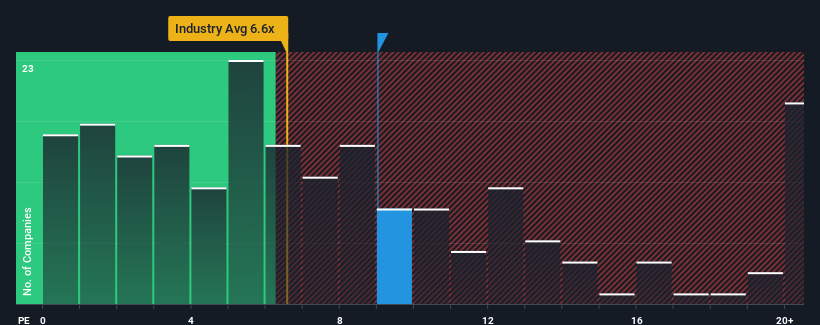

Following the firm bounce in price, Hangzhou Changchuan TechnologyLtd may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 9x, since almost half of all companies in the Semiconductor in China have P/S ratios under 6.6x and even P/S lower than 3x are not unusual. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hangzhou Changchuan TechnologyLtd

How Hangzhou Changchuan TechnologyLtd Has Been Performing

While the industry has experienced revenue growth lately, Hangzhou Changchuan TechnologyLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hangzhou Changchuan TechnologyLtd.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hangzhou Changchuan TechnologyLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.5%. Still, the latest three year period has seen an excellent 192% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 61% over the next year. Meanwhile, the rest of the industry is forecast to expand by 20,706%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Hangzhou Changchuan TechnologyLtd's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Hangzhou Changchuan TechnologyLtd's P/S

Hangzhou Changchuan TechnologyLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Hangzhou Changchuan TechnologyLtd trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Hangzhou Changchuan TechnologyLtd (1 can't be ignored!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Hangzhou Changchuan TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hangzhou Changchuan TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300604

Hangzhou Changchuan TechnologyLtd

Researches and develops, produces, and sells integrated circuit equipment and high-frequency communication materials.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives