- China

- /

- Semiconductors

- /

- SZSE:300458

Allwinnertech TechnologyLtd (SZSE:300458) Is Doing The Right Things To Multiply Its Share Price

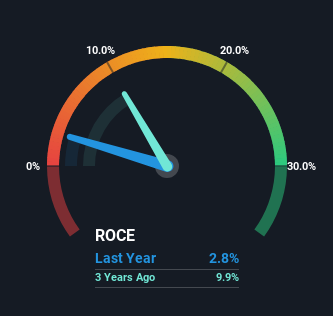

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So when we looked at Allwinnertech TechnologyLtd (SZSE:300458) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Allwinnertech TechnologyLtd is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.028 = CN¥85m ÷ (CN¥3.7b - CN¥647m) (Based on the trailing twelve months to September 2024).

Thus, Allwinnertech TechnologyLtd has an ROCE of 2.8%. In absolute terms, that's a low return and it also under-performs the Semiconductor industry average of 4.8%.

See our latest analysis for Allwinnertech TechnologyLtd

In the above chart we have measured Allwinnertech TechnologyLtd's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Allwinnertech TechnologyLtd .

What Does the ROCE Trend For Allwinnertech TechnologyLtd Tell Us?

Even though ROCE is still low in absolute terms, it's good to see it's heading in the right direction. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 2.8%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 36%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

In Conclusion...

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Allwinnertech TechnologyLtd has. And a remarkable 167% total return over the last five years tells us that investors are expecting more good things to come in the future. In light of that, we think it's worth looking further into this stock because if Allwinnertech TechnologyLtd can keep these trends up, it could have a bright future ahead.

One more thing to note, we've identified 2 warning signs with Allwinnertech TechnologyLtd and understanding them should be part of your investment process.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300458

Allwinner TechnologyLtd

Researches, develops, designs, manufactures, and sells intelligent application SoC, analog components, and wireless interconnect chips in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives