- China

- /

- Semiconductors

- /

- SZSE:300323

Investors in BOE HC SemiTek (SZSE:300323) from three years ago are still down 48%, even after 10% gain this past week

It is a pleasure to report that the BOE HC SemiTek Corporation (SZSE:300323) is up 65% in the last quarter. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 48% in the last three years, falling well short of the market return.

On a more encouraging note the company has added CN¥1.0b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for BOE HC SemiTek

Given that BOE HC SemiTek didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, BOE HC SemiTek saw its revenue grow by 5.6% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 14% during that time. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

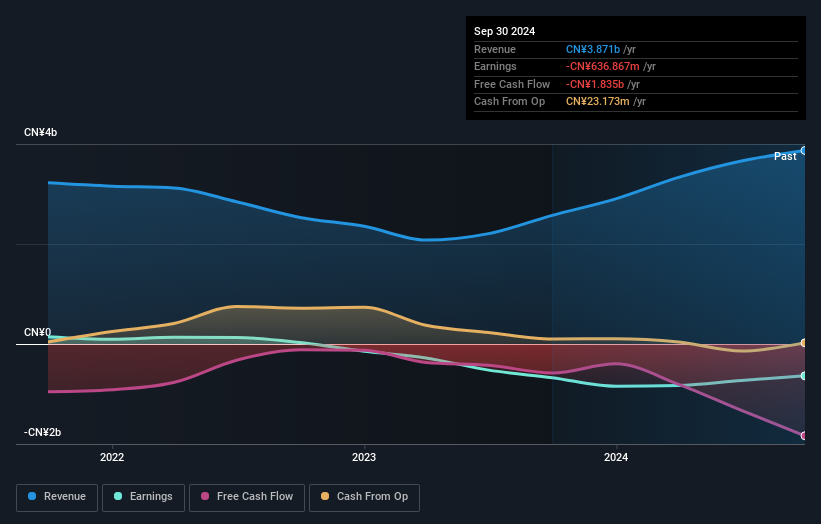

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

BOE HC SemiTek shareholders gained a total return of 2.1% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 2% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with BOE HC SemiTek (including 2 which make us uncomfortable) .

Of course BOE HC SemiTek may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BOE HC SemiTek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300323

BOE HC SemiTek

Researches, develops, produces, and sells light emitting diode epitaxial wafers and chips in China.

Adequate balance sheet low.