- China

- /

- Semiconductors

- /

- SZSE:001309

3 Asian Stocks That May Be Trading Below Their Estimated Value In May 2025

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by trade tensions and economic uncertainties, investors are keenly observing opportunities for stocks that may be trading below their estimated value. In this context, identifying undervalued stocks requires a careful evaluation of fundamentals and market conditions to uncover potential gems that could offer significant value in the current environment.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shibaura Mechatronics (TSE:6590) | ¥6760.00 | ¥13261.80 | 49% |

| Fujikura (TSE:5803) | ¥5529.00 | ¥10816.05 | 48.9% |

| Sany Renewable EnergyLtd (SHSE:688349) | CN¥22.70 | CN¥44.89 | 49.4% |

| Newborn Town (SEHK:9911) | HK$8.18 | HK$16.33 | 49.9% |

| Renesas Electronics (TSE:6723) | ¥1733.00 | ¥3424.35 | 49.4% |

| Rakus (TSE:3923) | ¥2184.00 | ¥4319.36 | 49.4% |

| UTour Group (SZSE:002707) | CN¥7.92 | CN¥15.53 | 49% |

| Seegene (KOSDAQ:A096530) | ₩26550.00 | ₩52687.75 | 49.6% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.50 | CN¥20.69 | 49.2% |

| Innovent Biologics (SEHK:1801) | HK$54.90 | HK$107.73 | 49% |

Let's dive into some prime choices out of the screener.

Shenzhen Techwinsemi Technology (SZSE:001309)

Overview: Shenzhen Techwinsemi Technology Co., Ltd. develops, manufactures, and sells storage control chips and modules both in China and internationally, with a market cap of CN¥20.63 billion.

Operations: The company's revenue primarily comes from the storage industry, amounting to CN¥4.77 billion.

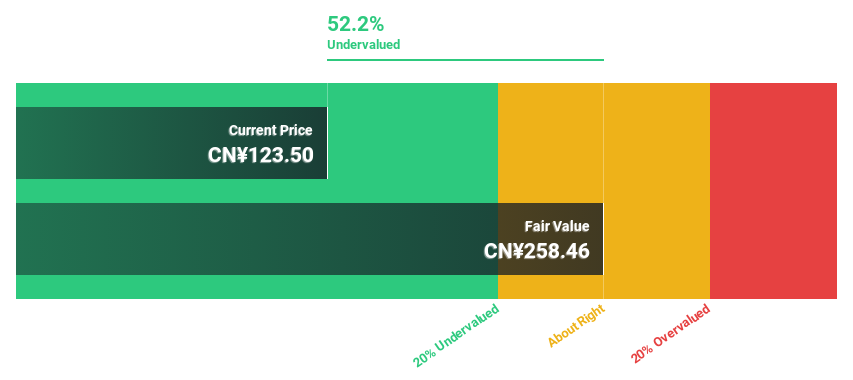

Estimated Discount To Fair Value: 45.6%

Shenzhen Techwinsemi Technology is trading at CN¥127.5, significantly below its estimated fair value of CN¥234.42, indicating undervaluation based on discounted cash flow analysis. Despite recent quarterly net losses of CN¥69.09 million, the company shows robust annual revenue growth from CN¥1.78 billion to CN¥4.77 billion and a substantial increase in net income to CN¥350.55 million in 2024, suggesting strong underlying cash flows and potential for future earnings growth above market expectations.

- Our expertly prepared growth report on Shenzhen Techwinsemi Technology implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Shenzhen Techwinsemi Technology with our detailed financial health report.

Zhejiang Wanfeng Auto Wheel (SZSE:002085)

Overview: Zhejiang Wanfeng Auto Wheel Co., Ltd. and its subsidiaries manufacture and sell automotive parts and aircraft in China, with a market cap of CN¥35.48 billion.

Operations: The company generates revenue from its automotive parts and aircraft manufacturing operations in China.

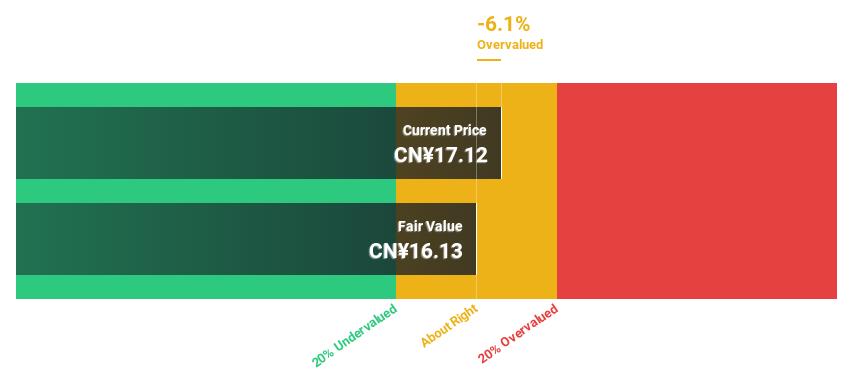

Estimated Discount To Fair Value: 23.1%

Zhejiang Wanfeng Auto Wheel is trading at CN¥16.71, below its fair value estimate of CN¥21.72, highlighting potential undervaluation based on cash flows. The company reported Q1 2025 net income of CNY 275.07 million, an increase from CNY 226.79 million a year ago, with earnings per share rising to CNY 0.13 from CNY 0.11. Despite a decreased dividend proposal, projected annual profit growth exceeds the market average significantly at over 32%.

- Our growth report here indicates Zhejiang Wanfeng Auto Wheel may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Zhejiang Wanfeng Auto Wheel's balance sheet health report.

Renesas Electronics (TSE:6723)

Overview: Renesas Electronics Corporation engages in the research, development, design, manufacture, sale, and servicing of semiconductors across Japan, China, the rest of Asia, Europe, North America, and internationally with a market cap of ¥3.11 trillion.

Operations: Renesas Electronics generates revenue from its Automotive segment with ¥679.96 billion and its Industrial/Infrastructure/IoT segment with ¥615.96 billion.

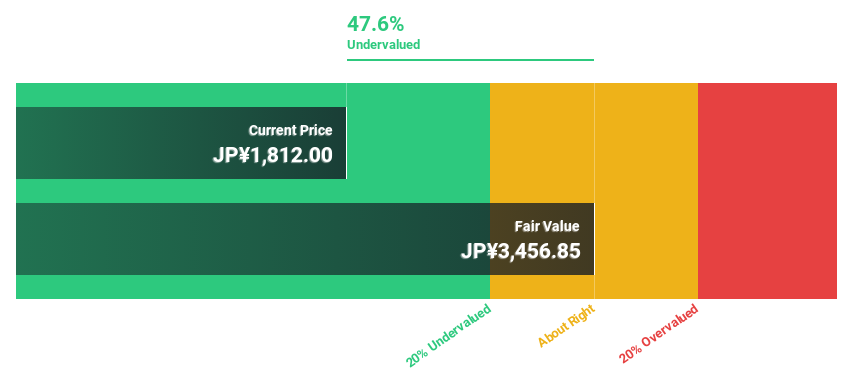

Estimated Discount To Fair Value: 49.4%

Renesas Electronics, trading at ¥1733, is significantly below its estimated fair value of ¥3424.35, suggesting it may be undervalued based on cash flows. Despite high debt levels and recent profit margin declines from 21.3% to 12.7%, the company's earnings are projected to grow at a robust 20.1% annually, outpacing the Japanese market's average growth rate of 7.6%. Recent strategic agreements and product innovations bolster its position in key markets like automotive and industrial systems.

- Our earnings growth report unveils the potential for significant increases in Renesas Electronics' future results.

- Navigate through the intricacies of Renesas Electronics with our comprehensive financial health report here.

Key Takeaways

- Explore the 273 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001309

Shenzhen Techwinsemi Technology

Develops, manufactures, and sells storage control chips and modules in China and internationally.

Exceptional growth potential and good value.

Market Insights

Community Narratives