Undiscovered Gems With Potential To Explore This January 2025

Reviewed by Simply Wall St

As January 2025 unfolds, global markets are navigating a complex landscape marked by resilient labor market data and persistent inflation concerns, which have contributed to recent declines in U.S. equities and sent small-cap stocks into correction territory. Amidst this volatility, investors may find opportunities in undiscovered gems—stocks that stand out for their potential resilience and growth prospects despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ha Giang Mineral Mechanics | NA | 23.21% | 43.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Jiangsu Aisen Semiconductor MaterialLtd (SHSE:688720)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Aisen Semiconductor Material Co., Ltd. operates in the semiconductor materials industry and has a market capitalization of CN¥3.55 billion.

Operations: The company generates revenue primarily from its semiconductor materials segment. The net profit margin stands at 15%, indicating the company's ability to convert a portion of its revenue into profit after expenses.

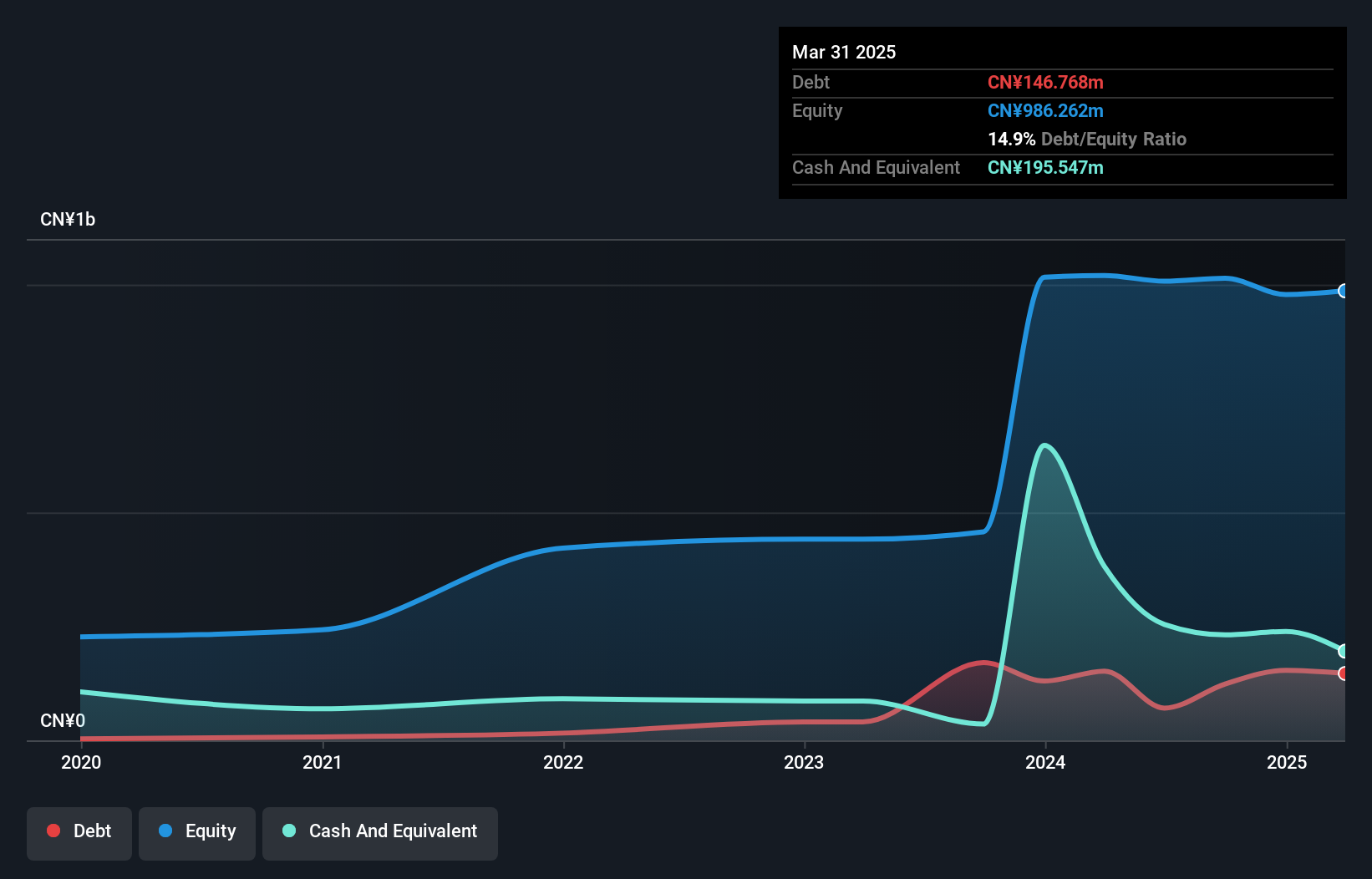

Jiangsu Aisen Semiconductor Material Ltd., a smaller player in the semiconductor space, has shown promising growth with earnings increasing by 14.2% over the past year, outpacing the industry average of 12.9%. Despite its volatile share price recently, the company reported sales of CNY 312.29 million for nine months ending September 2024, up from CNY 247.93 million a year earlier, and net income rose to CNY 23.83 million from CNY 18.54 million. Although free cash flow remains negative and debt reduction data is unclear, their cash holdings exceed total debt, indicating financial resilience amidst its expansion efforts including a recent share buyback program valued at up to CNY 60 million aimed at equity incentives.

DaikokutenbussanLtd (TSE:2791)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daikokutenbussan Co., Ltd. operates discount stores and has a market capitalization of ¥113.01 billion.

Operations: Daikokutenbussan Co., Ltd. generates revenue primarily through its discount store operations. The company has a market capitalization of ¥113.01 billion, reflecting its financial scale in the retail sector.

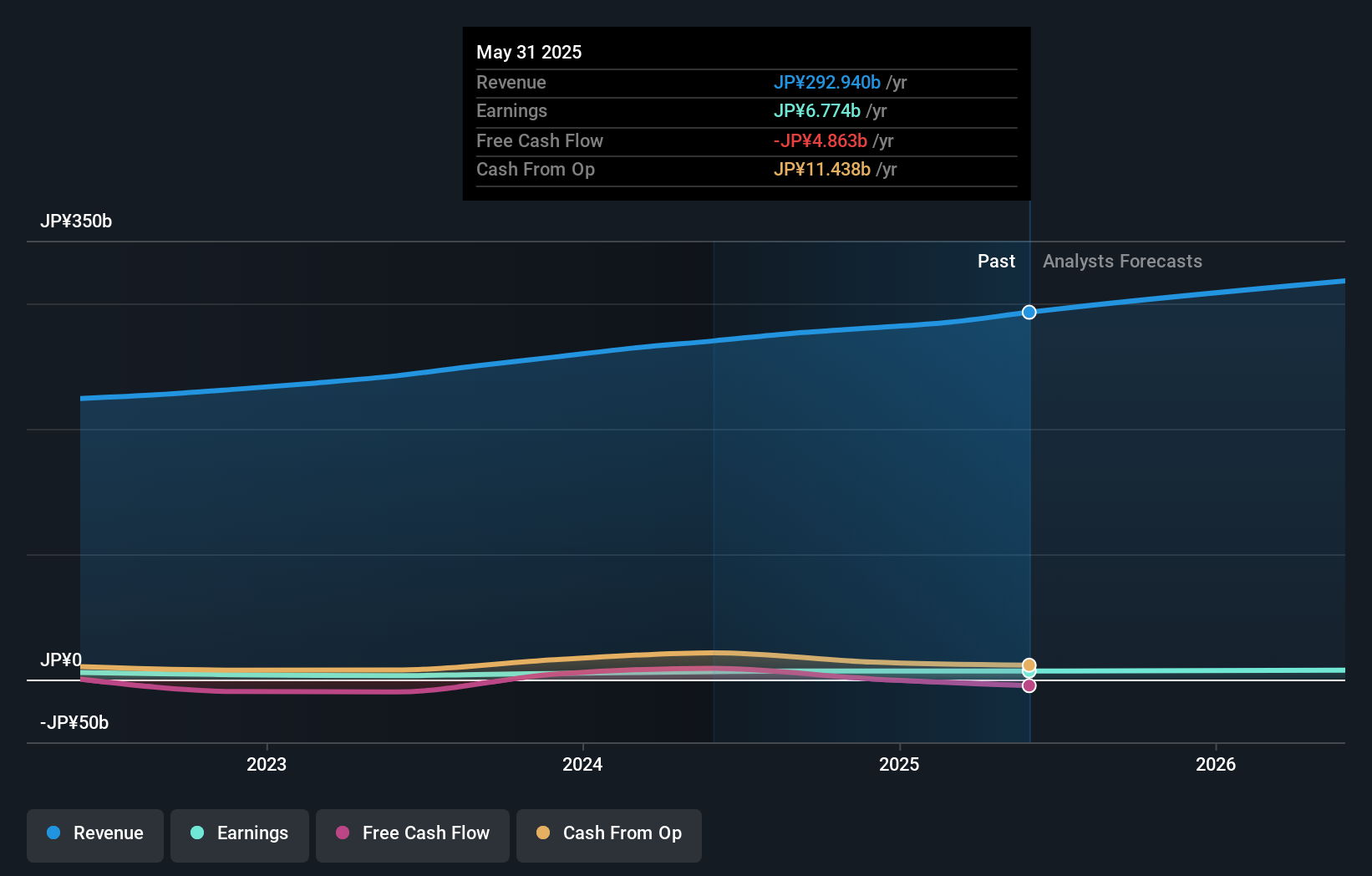

Daikokutenbussan, a nimble player in the retail sector, has shown impressive financial health with its net debt to equity ratio standing at 8.4%, a satisfactory level by industry standards. Over the past five years, this figure has improved from 39.9% to 21.5%, indicating prudent debt management. The company's earnings have surged by 41.7% over the last year, outpacing the broader Consumer Retailing industry's growth of 11.5%. With EBIT covering interest payments an astounding 3353 times over, Daikokutenbussan's profitability and high-quality earnings paint a promising picture for potential investors looking for hidden gems in this space.

- Unlock comprehensive insights into our analysis of DaikokutenbussanLtd stock in this health report.

Evaluate DaikokutenbussanLtd's historical performance by accessing our past performance report.

Morito (TSE:9837)

Simply Wall St Value Rating: ★★★★★★

Overview: Morito Co., Ltd. manufactures and sells apparel-related materials and household goods across Japan, Asia, Europe, and the United States with a market capitalization of ¥42.09 billion.

Operations: The company generates revenue through the manufacture and sale of apparel-related materials and household goods across multiple regions, including Japan, Asia, Europe, and the United States. It operates with a market capitalization of ¥42.09 billion.

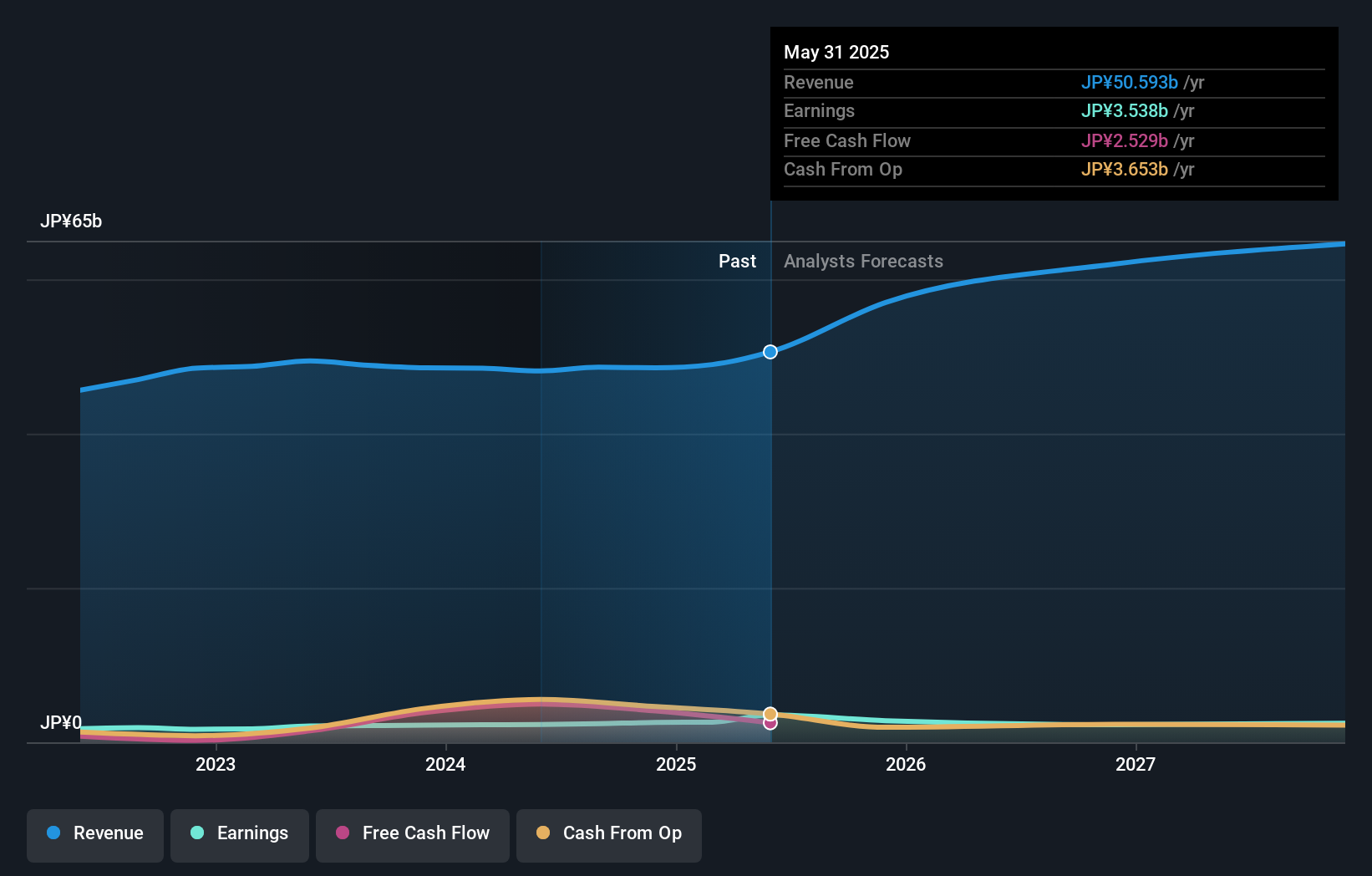

Morito, a smaller player in the market, has shown impressive financial health with earnings growing 16% over the past year, outpacing the Luxury industry’s 9.9%. The company is trading at a significant discount of 46.8% below its estimated fair value, suggesting potential undervaluation. Morito's debt-to-equity ratio has improved dramatically from 11.7% to just 3% over five years, reflecting prudent financial management. Additionally, it holds more cash than total debt and remains free cash flow positive. Recent buyback activity saw ¥728 million spent on repurchasing shares as part of capital policy adjustments and shareholder returns strategies.

- Click here and access our complete health analysis report to understand the dynamics of Morito.

Gain insights into Morito's past trends and performance with our Past report.

Make It Happen

- Discover the full array of 4627 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9837

Morito

Engages in the manufacture and sale of apparel-related materials and household goods and products in Japan, Asia, Europe, and the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives