- China

- /

- Semiconductors

- /

- SHSE:688720

Jiangsu Aisen Semiconductor Material Co.,Ltd.'s (SHSE:688720) 37% Share Price Surge Not Quite Adding Up

Jiangsu Aisen Semiconductor Material Co.,Ltd. (SHSE:688720) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

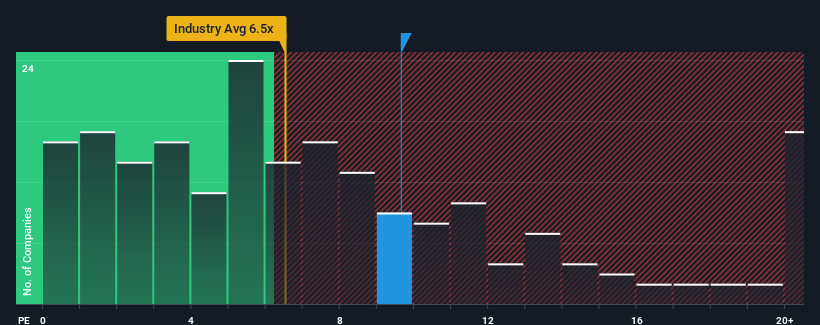

After such a large jump in price, Jiangsu Aisen Semiconductor MaterialLtd's price-to-sales (or "P/S") ratio of 9.6x might make it look like a sell right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios below 6.5x and even P/S below 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Jiangsu Aisen Semiconductor MaterialLtd

How Has Jiangsu Aisen Semiconductor MaterialLtd Performed Recently?

With revenue growth that's inferior to most other companies of late, Jiangsu Aisen Semiconductor MaterialLtd has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Aisen Semiconductor MaterialLtd will help you uncover what's on the horizon.How Is Jiangsu Aisen Semiconductor MaterialLtd's Revenue Growth Trending?

Jiangsu Aisen Semiconductor MaterialLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 72% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 23% over the next year. With the industry predicted to deliver 37% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Jiangsu Aisen Semiconductor MaterialLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Jiangsu Aisen Semiconductor MaterialLtd's P/S?

Jiangsu Aisen Semiconductor MaterialLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Jiangsu Aisen Semiconductor MaterialLtd, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 1 warning sign for Jiangsu Aisen Semiconductor MaterialLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688720

Jiangsu Aisen Semiconductor MaterialLtd

Jiangsu Aisen Semiconductor Material Co.,Ltd.

Adequate balance sheet with poor track record.

Market Insights

Community Narratives