- China

- /

- Semiconductors

- /

- SHSE:688719

Xi'an Actionpower Electric Co., Ltd.'s (SHSE:688719) P/E Is Still On The Mark Following 34% Share Price Bounce

The Xi'an Actionpower Electric Co., Ltd. (SHSE:688719) share price has done very well over the last month, posting an excellent gain of 34%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.1% over the last year.

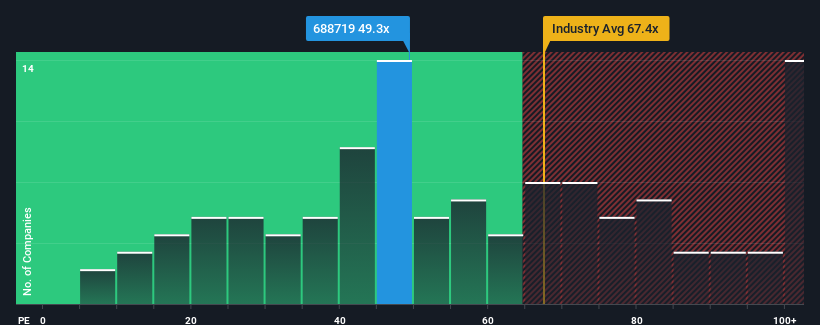

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 37x, you may consider Xi'an Actionpower Electric as a stock to potentially avoid with its 49.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times haven't been advantageous for Xi'an Actionpower Electric as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Xi'an Actionpower Electric

Does Growth Match The High P/E?

In order to justify its P/E ratio, Xi'an Actionpower Electric would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 56% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 81% as estimated by the dual analysts watching the company. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Xi'an Actionpower Electric's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Xi'an Actionpower Electric's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Xi'an Actionpower Electric maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Xi'an Actionpower Electric (1 is potentially serious!) that you should be aware of before investing here.

You might be able to find a better investment than Xi'an Actionpower Electric. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688719

Xi'an Actionpower Electric

Engages in the research and development, production, and sale of power supply and quality control equipment in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives