- China

- /

- Semiconductors

- /

- SHSE:688601

Wuxi ETEK Microelectronics Co.,Ltd. (SHSE:688601) Soars 40% But It's A Story Of Risk Vs Reward

Wuxi ETEK Microelectronics Co.,Ltd. (SHSE:688601) shares have had a really impressive month, gaining 40% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.8% over the last year.

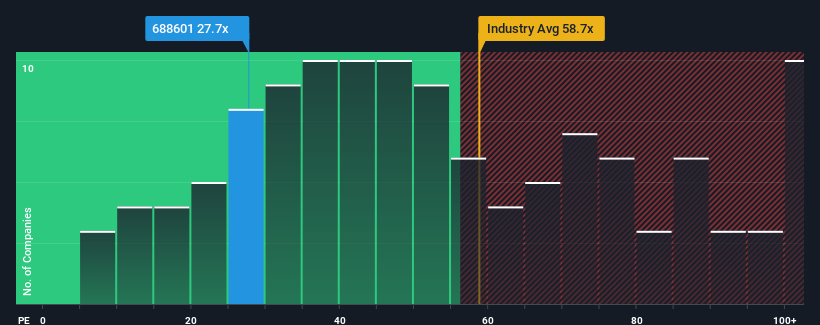

Although its price has surged higher, Wuxi ETEK MicroelectronicsLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 27.7x, since almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 64x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Wuxi ETEK MicroelectronicsLtd has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Wuxi ETEK MicroelectronicsLtd

Is There Any Growth For Wuxi ETEK MicroelectronicsLtd?

In order to justify its P/E ratio, Wuxi ETEK MicroelectronicsLtd would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 143% last year. The strong recent performance means it was also able to grow EPS by 60% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 22% each year as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 19% each year, which is noticeably less attractive.

With this information, we find it odd that Wuxi ETEK MicroelectronicsLtd is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Wuxi ETEK MicroelectronicsLtd's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Wuxi ETEK MicroelectronicsLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Wuxi ETEK MicroelectronicsLtd that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi ETEK MicroelectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688601

Wuxi ETEK MicroelectronicsLtd

Engages in the research and development, manufacture, and sale of analog integrated circuits (ICs) in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026