- China

- /

- Semiconductors

- /

- SHSE:688595

Subdued Growth No Barrier To Chipsea Technologies (Shenzhen) Corp., Ltd. (SHSE:688595) With Shares Advancing 27%

Chipsea Technologies (Shenzhen) Corp., Ltd. (SHSE:688595) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 32%.

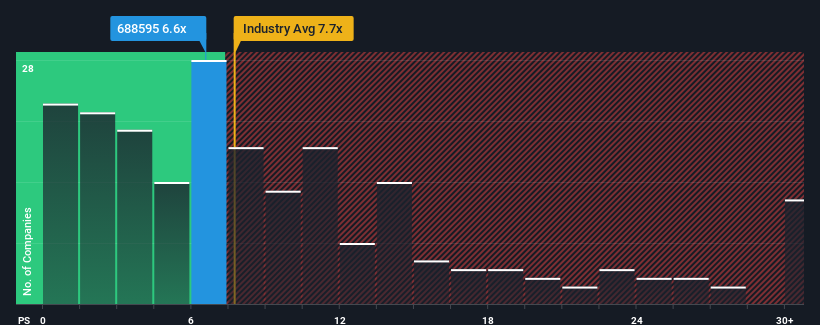

Even after such a large jump in price, there still wouldn't be many who think Chipsea Technologies (Shenzhen)'s price-to-sales (or "P/S") ratio of 6.6x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 7.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Chipsea Technologies (Shenzhen)

How Has Chipsea Technologies (Shenzhen) Performed Recently?

Chipsea Technologies (Shenzhen) certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Chipsea Technologies (Shenzhen) will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Chipsea Technologies (Shenzhen)'s is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 60% gain to the company's top line. The latest three year period has also seen a 16% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 41% over the next year. That's shaping up to be materially lower than the 51% growth forecast for the broader industry.

In light of this, it's curious that Chipsea Technologies (Shenzhen)'s P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Chipsea Technologies (Shenzhen)'s P/S

Chipsea Technologies (Shenzhen) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Chipsea Technologies (Shenzhen)'s revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Chipsea Technologies (Shenzhen) with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688595

Chipsea Technologies (Shenzhen)

A chip design company, focuses on the research and development, design, manufacture, and sale of analog to digital converters (ADCs), microcontroller units (MCUs), measurement algorithms, and one-stop solutions for the Internet of Things in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives