- China

- /

- Semiconductors

- /

- SHSE:688595

Not Many Are Piling Into Chipsea Technologies (shenzhen) Corp. (SHSE:688595) Just Yet

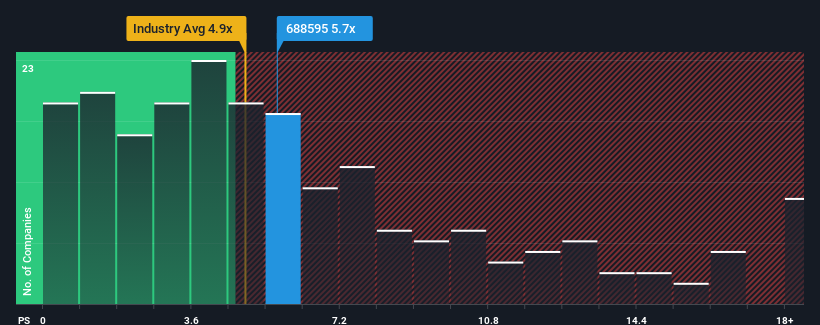

With a median price-to-sales (or "P/S") ratio of close to 4.9x in the Semiconductor industry in China, you could be forgiven for feeling indifferent about Chipsea Technologies (shenzhen) Corp.'s (SHSE:688595) P/S ratio of 5.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Chipsea Technologies (shenzhen)

What Does Chipsea Technologies (shenzhen)'s Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Chipsea Technologies (shenzhen) has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chipsea Technologies (shenzhen).What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Chipsea Technologies (shenzhen) would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 43% gain to the company's top line. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 46% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 36%, which is noticeably less attractive.

With this information, we find it interesting that Chipsea Technologies (shenzhen) is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Chipsea Technologies (shenzhen)'s analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Chipsea Technologies (shenzhen) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688595

Chipsea Technologies (Shenzhen)

A chip design company, focuses on the research and development, design, manufacture, and sale of analog to digital converters (ADCs), microcontroller units (MCUs), measurement algorithms, and one-stop solutions for the Internet of Things in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives