- China

- /

- Semiconductors

- /

- SHSE:688595

Chipsea Technologies (shenzhen) Corp.'s (SHSE:688595) 28% Price Boost Is Out Of Tune With Revenues

Those holding Chipsea Technologies (shenzhen) Corp. (SHSE:688595) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

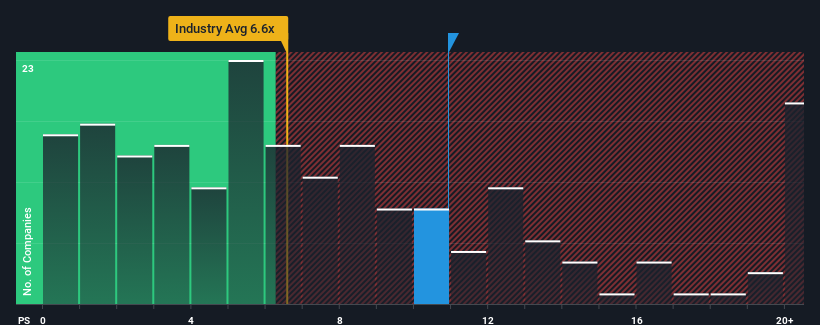

Since its price has surged higher, Chipsea Technologies (shenzhen) may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 10.9x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.6x and even P/S lower than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Chipsea Technologies (shenzhen)

What Does Chipsea Technologies (shenzhen)'s P/S Mean For Shareholders?

Chipsea Technologies (shenzhen) could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chipsea Technologies (shenzhen).Do Revenue Forecasts Match The High P/S Ratio?

Chipsea Technologies (shenzhen)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 30%. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 87% over the next year. Meanwhile, the rest of the industry is forecast to expand by 20,706%, which is noticeably more attractive.

In light of this, it's alarming that Chipsea Technologies (shenzhen)'s P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Chipsea Technologies (shenzhen)'s P/S?

The strong share price surge has lead to Chipsea Technologies (shenzhen)'s P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Chipsea Technologies (shenzhen) currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Chipsea Technologies (shenzhen) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688595

Chipsea Technologies (Shenzhen)

A chip design company, focuses on the research and development, design, manufacture, and sale of analog to digital converters (ADCs), microcontroller units (MCUs), measurement algorithms, and one-stop solutions for the Internet of Things in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives