- China

- /

- Semiconductors

- /

- SHSE:688589

Market Might Still Lack Some Conviction On Leaguer (Shenzhen) Microelectronics Corp. (SHSE:688589) Even After 26% Share Price Boost

Leaguer (Shenzhen) Microelectronics Corp. (SHSE:688589) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

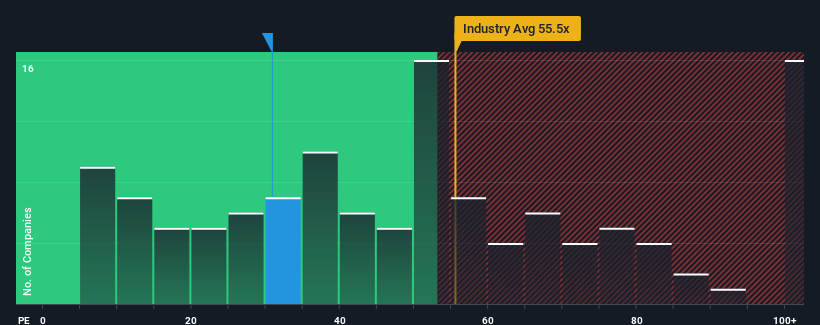

Even after such a large jump in price, it's still not a stretch to say that Leaguer (Shenzhen) Microelectronics' price-to-earnings (or "P/E") ratio of 30.8x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for Leaguer (Shenzhen) Microelectronics as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Leaguer (Shenzhen) Microelectronics

Is There Some Growth For Leaguer (Shenzhen) Microelectronics?

There's an inherent assumption that a company should be matching the market for P/E ratios like Leaguer (Shenzhen) Microelectronics' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 43%. The strong recent performance means it was also able to grow EPS by 222% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 66% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's curious that Leaguer (Shenzhen) Microelectronics' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Leaguer (Shenzhen) Microelectronics' P/E?

Its shares have lifted substantially and now Leaguer (Shenzhen) Microelectronics' P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Leaguer (Shenzhen) Microelectronics currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 2 warning signs for Leaguer (Shenzhen) Microelectronics that you need to take into consideration.

You might be able to find a better investment than Leaguer (Shenzhen) Microelectronics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688589

Leaguer (Shenzhen) Microelectronics

A fabless chip design company, engages in the designs, develops, and sells integrated circuits, computer software, and electronic information products.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives