- China

- /

- Semiconductors

- /

- SHSE:688536

3 Chinese Stocks Estimated To Be Up To 45.2% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, Chinese stocks have shown notable resilience, with major indices like the Shanghai Composite and CSI 300 experiencing significant gains. This uptick comes amid optimism surrounding Beijing's comprehensive support measures, despite ongoing challenges in manufacturing and real estate sectors. Identifying undervalued stocks in such a fluctuating market involves assessing intrinsic value relative to current prices, which can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| JinGuan Electric (SHSE:688517) | CN¥14.82 | CN¥28.98 | 48.9% |

| Sinomine Resource Group (SZSE:002738) | CN¥36.54 | CN¥70.67 | 48.3% |

| Zhejiang Huahai Pharmaceutical (SHSE:600521) | CN¥19.59 | CN¥37.02 | 47.1% |

| Neusoft (SHSE:600718) | CN¥10.25 | CN¥19.38 | 47.1% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥24.74 | CN¥47.09 | 47.5% |

| Crystal Growth & Energy EquipmentLtd (SHSE:688478) | CN¥29.28 | CN¥56.32 | 48% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥29.46 | CN¥55.81 | 47.2% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥52.55 | CN¥103.80 | 49.4% |

| Ningbo Jifeng Auto Parts (SHSE:603997) | CN¥13.70 | CN¥25.88 | 47.1% |

Let's review some notable picks from our screened stocks.

Zhejiang China Commodities City Group (SHSE:600415)

Overview: Zhejiang China Commodities City Group Co., Ltd. operates through its subsidiaries to develop, manage, operate, and provide services for an online trading platform in China, with a market cap of CN¥52.92 billion.

Operations: Zhejiang China Commodities City Group Co., Ltd. generates revenue primarily through the development, management, operation, and service of an online trading platform in China.

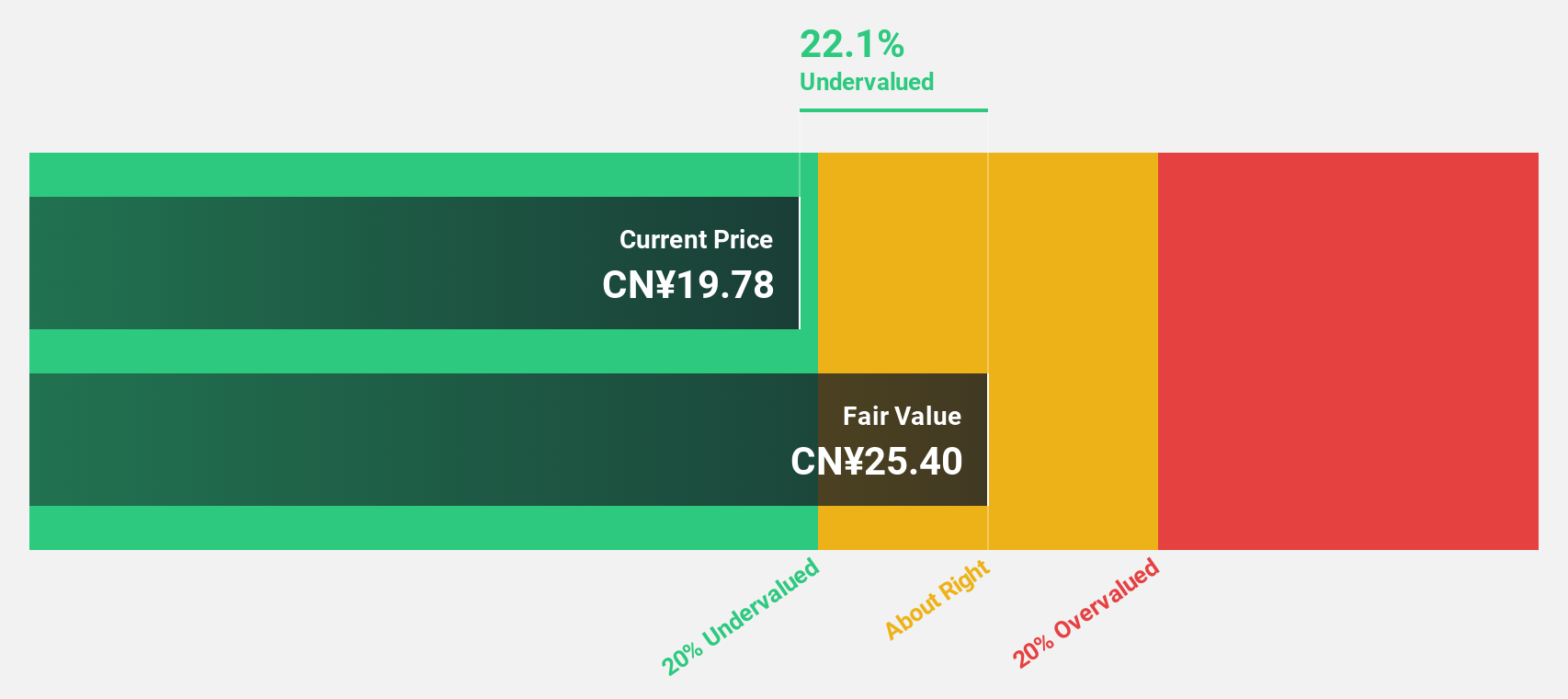

Estimated Discount To Fair Value: 12.2%

Zhejiang China Commodities City Group is trading at a discount, 12.2% below its estimated fair value of CNY 11, despite high debt levels. Revenue and earnings are expected to grow faster than the Chinese market, with significant annual profit growth forecasted at 23.5%. However, net income decreased to CNY 1.45 billion for H1 2024 from CNY 1.99 billion a year ago, and dividends are not well covered by free cash flows.

- The growth report we've compiled suggests that Zhejiang China Commodities City Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Zhejiang China Commodities City Group stock in this financial health report.

Shanghai MicroPort Endovascular MedTech (SHSE:688016)

Overview: Shanghai MicroPort Endovascular MedTech Co., Ltd. operates in the medical technology sector, focusing on developing and manufacturing endovascular devices, with a market cap of approximately CN¥13.93 billion.

Operations: The company's revenue is primarily derived from its medical products segment, totaling CN¥1.35 billion.

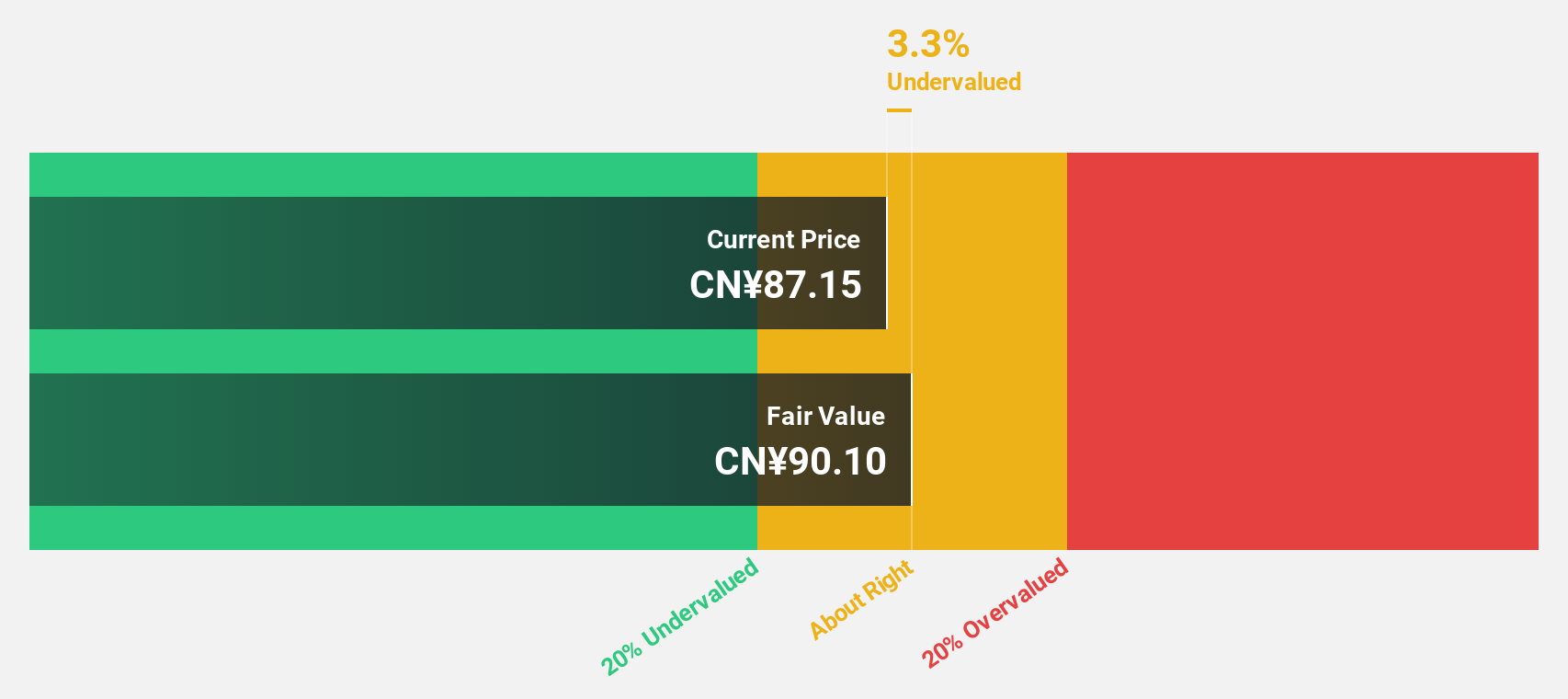

Estimated Discount To Fair Value: 15.9%

Shanghai MicroPort Endovascular MedTech is trading 15.9% below its estimated fair value of CNY 134.31, offering a good relative value compared to peers. The company reported strong earnings growth, with net income rising to CNY 403.52 million for H1 2024 from CNY 279.53 million a year ago, despite recent shareholder dilution and share price volatility. A planned share buyback up to CNY 100 million could support the stock's valuation further, funded by internal resources.

- Our comprehensive growth report raises the possibility that Shanghai MicroPort Endovascular MedTech is poised for substantial financial growth.

- Click here to discover the nuances of Shanghai MicroPort Endovascular MedTech with our detailed financial health report.

3Peak (SHSE:688536)

Overview: 3Peak Incorporated is a fabless semiconductor company specializing in analog products and technologies, with a market cap of CN¥13.27 billion.

Operations: The company generates revenue of CN¥988.19 million from its operations in the Integrated Circuit Industry.

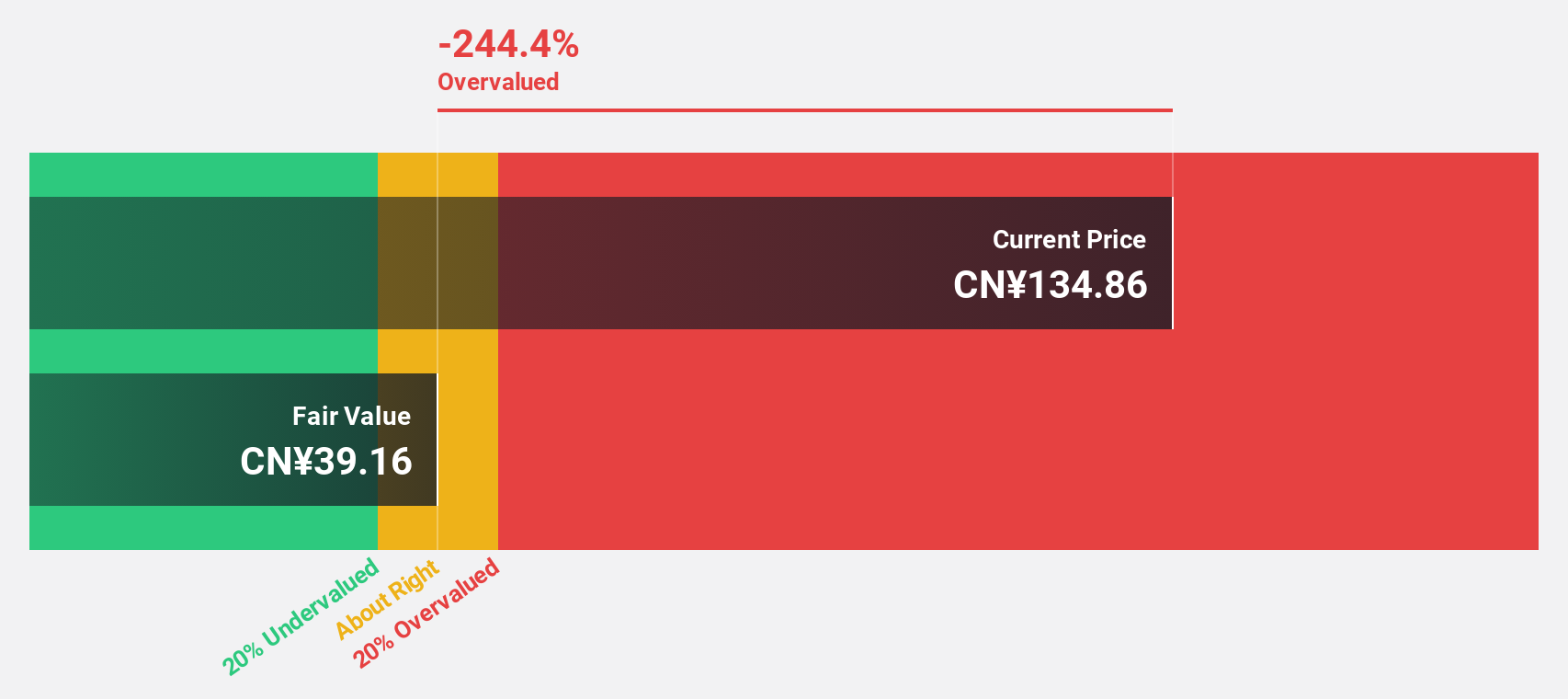

Estimated Discount To Fair Value: 45.2%

3Peak is trading at 45.2% below its estimated fair value of CNY 184.36, despite recent challenges including a net loss of CNY 65.64 million for H1 2024 and volatile share prices. The company completed a share buyback worth CNY 111.79 million, which may stabilize the stock. Analysts forecast significant revenue growth at 37.9% annually, outpacing the market average, with profitability expected within three years despite low future return on equity projections.

- Upon reviewing our latest growth report, 3Peak's projected financial performance appears quite optimistic.

- Navigate through the intricacies of 3Peak with our comprehensive financial health report here.

Taking Advantage

- Dive into all 117 of the Undervalued Chinese Stocks Based On Cash Flows we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3Peak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688536

3Peak

Engages in the research and development, and sale of analog integrated circuit products in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives