- China

- /

- Semiconductors

- /

- SHSE:688516

Here's Why We Think Wuxi Autowell TechnologyLtd (SHSE:688516) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Wuxi Autowell TechnologyLtd (SHSE:688516). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Wuxi Autowell TechnologyLtd

Wuxi Autowell TechnologyLtd's Improving Profits

Over the last three years, Wuxi Autowell TechnologyLtd has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Wuxi Autowell TechnologyLtd's EPS shot up from CN¥3.84 to CN¥6.11; a result that's bound to keep shareholders happy. That's a commendable gain of 59%.

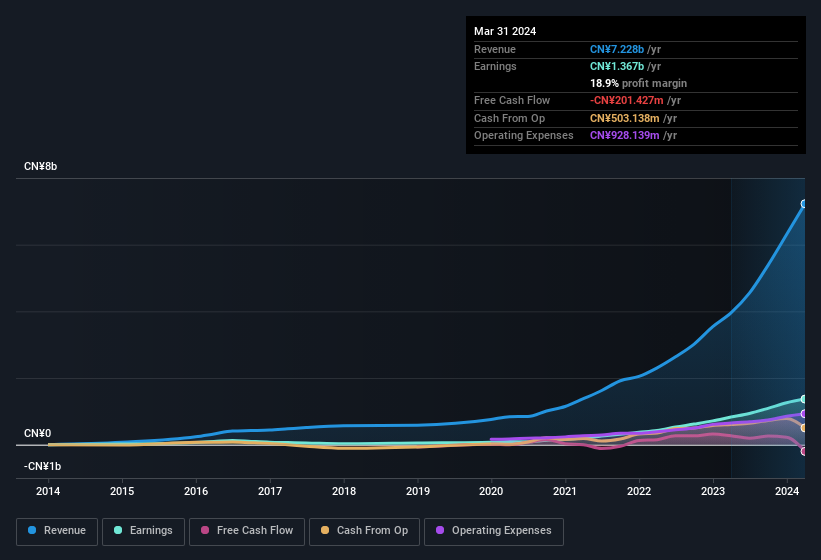

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Wuxi Autowell TechnologyLtd maintained stable EBIT margins over the last year, all while growing revenue 83% to CN¥7.2b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Wuxi Autowell TechnologyLtd's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Wuxi Autowell TechnologyLtd Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Wuxi Autowell TechnologyLtd will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 47% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. That level of investment from insiders is nothing to sneeze at.

Does Wuxi Autowell TechnologyLtd Deserve A Spot On Your Watchlist?

You can't deny that Wuxi Autowell TechnologyLtd has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. You still need to take note of risks, for example - Wuxi Autowell TechnologyLtd has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Although Wuxi Autowell TechnologyLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Autowell TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688516

Wuxi Autowell TechnologyLtd

Manufactures and sells automation equipment for photovoltaic equipment, lithium battery equipment, and semiconductor industries in China.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives