- China

- /

- Semiconductors

- /

- SHSE:688503

Take Care Before Jumping Onto Changzhou Fusion New Material Co., Ltd. (SHSE:688503) Even Though It's 26% Cheaper

Changzhou Fusion New Material Co., Ltd. (SHSE:688503) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

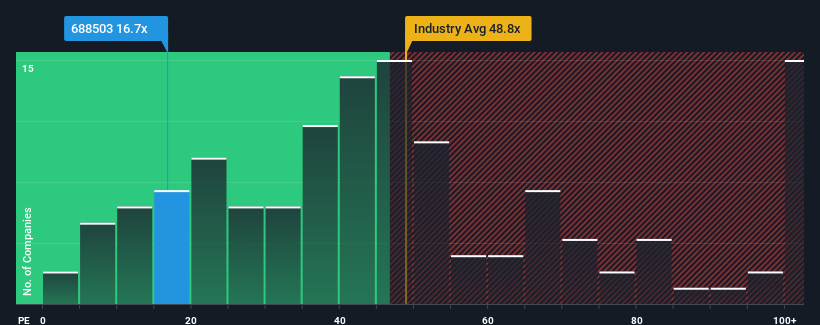

Following the heavy fall in price, Changzhou Fusion New Material's price-to-earnings (or "P/E") ratio of 16.7x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 29x and even P/E's above 54x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Changzhou Fusion New Material could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Changzhou Fusion New Material

How Is Changzhou Fusion New Material's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Changzhou Fusion New Material's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. Even so, admirably EPS has lifted 95% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 38% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 25% each year, which is noticeably less attractive.

In light of this, it's peculiar that Changzhou Fusion New Material's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Changzhou Fusion New Material's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Changzhou Fusion New Material currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Changzhou Fusion New Material (1 is potentially serious!) that you should be aware of.

If you're unsure about the strength of Changzhou Fusion New Material's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688503

Changzhou Fusion New Material

Engages in the research and development, production, and sale of conductive silver paste, electronic component paste, conductive adhesive, and semiconductor materials for photovoltaic industry in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives