- China

- /

- Semiconductors

- /

- SHSE:688503

Changzhou Fusion New Material (SHSE:688503) Is Reinvesting At Lower Rates Of Return

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. In light of that, when we looked at Changzhou Fusion New Material (SHSE:688503) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Changzhou Fusion New Material, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = CN¥470m ÷ (CN¥8.6b - CN¥3.9b) (Based on the trailing twelve months to December 2024).

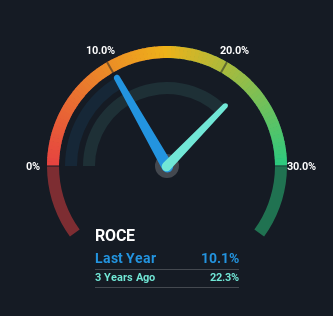

Therefore, Changzhou Fusion New Material has an ROCE of 10%. In absolute terms, that's a satisfactory return, but compared to the Semiconductor industry average of 5.9% it's much better.

See our latest analysis for Changzhou Fusion New Material

Above you can see how the current ROCE for Changzhou Fusion New Material compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Changzhou Fusion New Material .

What Can We Tell From Changzhou Fusion New Material's ROCE Trend?

On the surface, the trend of ROCE at Changzhou Fusion New Material doesn't inspire confidence. To be more specific, ROCE has fallen from 56% over the last five years. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

On a side note, Changzhou Fusion New Material has done well to pay down its current liabilities to 46% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money. Keep in mind 46% is still pretty high, so those risks are still somewhat prevalent.

The Bottom Line

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Changzhou Fusion New Material. These trends are starting to be recognized by investors since the stock has delivered a 4.8% gain to shareholders who've held over the last year. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

If you want to continue researching Changzhou Fusion New Material, you might be interested to know about the 1 warning sign that our analysis has discovered.

While Changzhou Fusion New Material isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688503

Changzhou Fusion New Material

Engages in the research and development, production, and sale of conductive silver paste, electronic component paste, conductive adhesive, and semiconductor materials for photovoltaic industry in China and internationally.

Moderate risk and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026